Как прогнозировать курс криптовалюты на основе капитализации

Наиболее интересными вложениями являются долгосрочные инвестиции в новые криптовалюты, именно таким способом можно увеличить свой капитал в сто, или даже в тысячу раз.

Все помнят историю с Биткоином когда первая криптовалюта с 0,03 долларов за несколько лет подорожала до десятков тысяч американских долларов.

Казалось бы, покупай сейчас любую не дорогую криптовалюту и через несколько лет её цена так же выростит до тысяч долларов.

Но все уже убедились, что далеко не каждая новая монета повторяет судьбу Биткоина, некоторые криптовалюты наоборот падают в цене до нуля и даже подвергаются делистингу.

Поэтому, нужно немного постараться для того, что бы выбрать правильный актив с перспективой принести тысячи процентов прибыли в ближайшие годы.

- Функция криптовалюты,

- Известность разработчиков,

- Наличие инвесторов,

- Количество монет в обороте,

- Общая капитализация.

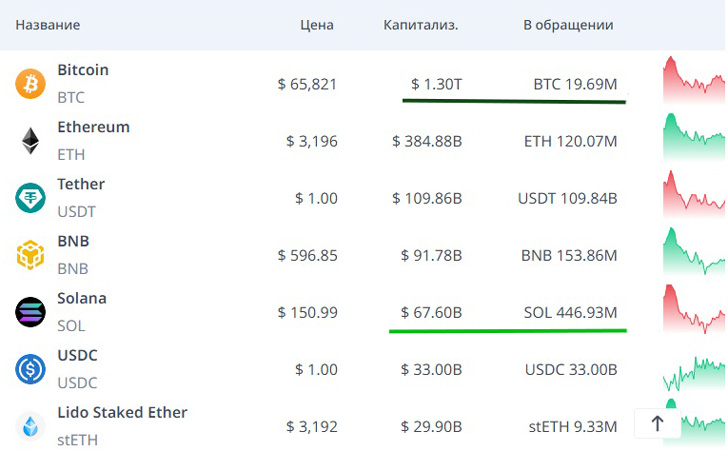

Особенно интересными параметрами являются количество монет в обороте и капитализация, на них и следует обратить внимание, если вы хотите сделать прогноз максимально возможной цены токена.

Как капитализация и количество монет в обороте ограничивает максимальную стоимость

При расчете вероятной цены существует некоторая закономерность между количеством выпущенных монет и максимальной ценой криптовалюты:

Как видите, четко отслеживается некая закономерность, чем меньше монет в обращении, тем выше цена за монету.

Самая дорогая монета Биткоин, на данный момент в обороте находится меньше 20 миллионов монет, а капитализация составляет 1,3 триллиона долларов.

Теперь возьмем, к примеру, Solana сможет ли она достичь такой же цены как биткоин, ведь сейчас она стоит всего лишь 151 доллар США?

Капитализация Solana на данный момент составляет 67 миллиардов, а в обороте находится 446 миллионов монет, предположим, что криптовалюта подорожала в сто раз и теперь стоит 15 000 долларов.

Тогда капитализация Solana достигнет 67х100 = 6700 мил. или 6,7 триллиона долларов.

На сегодня общая стоимость всех криптовалют в обращении составляет 2,56 триллиона долларов, то есть Solana ни при каком сценарии не может подорожать до 15 000 долларов. Так как на криптовалютным рынке просто нет такого количества денег.

Для такого соотношения капитализации и количества монет вполне вероятно, что Solana может подорожать в несколько раз, но не как не в 50 или 100.

Аналогичная ситуация и с другими монетами количество которых насчитывает миллиарды, если монета на Премаркете уже стоит пару долларов, а в оборот сразу планируется ввести миллиард монет, то сразу можно предположить, что данная криптовалюты вряд ли повторит судьбу биткоина.

Поэтому принимая решение о покупке той или иной монеты, обращаем внимание не только на отзывы в сети интернет и высказывания разработчиков, но и на реальные перспективы с учетом количества монет в обращении и текущей капитализации.

Понятно, что небольшое количество монет не является гарантией высокой цены, поэтому не скидываем со счетов и другие факторы, влияющие на цену криптовалюты.