The best traders.

This section is devoted to describing the success stories of famous traders and the strategies they used. Is it so difficult to succeed in trading? What is needed for this? The main secrets of profitable trading on the stock exchange.

Ed Seykota - one of the fathers of mechanized trading strategies

Ed Seykota is one of the first traders who was able to realize the idea of automatic trading strategies in reality, despite the fact that personal computers had not yet been invented in that era.

reality, despite the fact that personal computers had not yet been invented in that era.

His innovative views allowed him to go down in history as the most innovative trader, providing himself and his clients with stunning returns with virtually minimal intervention in the trading process.

Edward was born back in 1946 in the Netherlands. He spent the first years of his life in the town of Voorburg, but after another move he had to graduate from Den Haage school.

Difficult family circumstances forced the Seykota family to immigrate to the United States. A very young Edward had a passion for trading on the stock exchange from an early age, as his father was a broker and repeatedly taught the basic principles of trading futures and stocks.

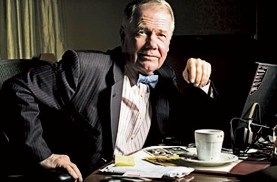

Michael Marcus

Do you know the taste of defeat? Do you know what it's like to repeatedly fall to your knees and get up from them? What does the phrase go ahead and achieve your success mean?

Do you know what it's like to repeatedly fall to your knees and get up from them? What does the phrase go ahead and achieve your success mean?

Perhaps you can imagine what it would be like for a trader to lose tens of thousands of dollars?

Everyone is familiar with these phrases, but for some reason the vast majority, having at least once found themselves at the bottom or received their first serious losses, begin to forget about the dream of becoming a trader.

Moreover, it doesn’t matter whether it’s trading or business, in any field of activity there are ups and downs, and only strong people are able to achieve their own goals.

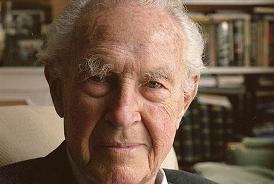

John Templeton is a crazy optimist!

John Templeton is the greatest investor and optimist who, thanks to his faith in people and a promising future, was able to earn billions of dollars. The most interesting thing is that John Templeton is not only the greatest trader and investor, but also a philanthropist, as well as one of the most influential people in the world.

was able to earn billions of dollars. The most interesting thing is that John Templeton is not only the greatest trader and investor, but also a philanthropist, as well as one of the most influential people in the world.

John Templeton's success story is one of the most fascinating, so after reading his biography, perhaps you will see yourself and never stop on your path.

John Templeton was born in 1912 in the town of Winchester, Tennessee. John is familiar with poverty firsthand, because he grew up in a large family with four more children, namely three sisters and one brother.

The father worked as an ordinary shoemaker, and the mother was a housewife and raised children.

10 Commandments by Lewis Borsellino

Lewis Borsellino is a phenomenal personality who left a huge mark in the history of the development of stock trading.

His phenomenal successes became possible thanks to strict adherence to the rules that he set for himself as a trader.

We all understand perfectly well that only strict adherence to the rules and strict control over risks will allow us to maintain stable growth, and unprofitable trades will become part of everyday life, which simply cannot unsettle us.

For all novice traders who decide to take this path, Lewis Borsellino in his book outlines 10 commandments, following which becomes mandatory if you want to achieve real success.

All these commandments are very simple and banal, but even professionals in their field cannot challenge them, so I suggest you get acquainted with each of them and hope that you will be able to comply with them.

Lewis Borsellino

Reading books about the stock exchange and watching films on this topic, you notice the unimaginable progress of the stock exchange as such. Previously, no one could imagine that years later it would be possible to conduct trade in a cozy office or home via a computer.

progress of the stock exchange as such. Previously, no one could imagine that years later it would be possible to conduct trade in a cozy office or home via a computer.

Previously, there were so-called “Pits”, where a large number of traders gathered and, in great noise and crowded conditions, carried out active trading, where in order to execute your deal you had to have not only a loud and strong voice, but also physical abilities to push through this crowd and reach their set goals.

Not everyone liked this kind of fuss, so, as a rule, no one could stay in “Yama” for more than two years.

James Beeland Rogers

Considering the success stories of various odious figures in the world of trading, we forget about those people who helped them rise to the top of Olympus.

people who helped them rise to the top of Olympus.

James Beeland Rogers is a major financier, international investor and co-founder of the famous international investment fund Quantum.

Yes, precisely that “Quantum” thanks to which the whole world learned about such a person as George Soros.

James is also known for his world records and wonderful books that motivate motivated people to invest and provide instructive advice to avoid mistakes that the author himself encountered.

Steven Cohen: how a card player became a financier

In many ways, our success depends on an ordinary chance or opportunity that appears once in a lifetime, and, as a rule, at such a moment we have to risk almost everything and possibly our future.

once in a lifetime, and, as a rule, at such a moment we have to risk almost everything and possibly our future.

The success story of Steven Cohen successfully shows us how an ordinary student, putting his future career on the line, simply amazed the whole world with his success and for some time eclipsed George Soros himself and his foundation.

Steven Cohen was born and grew up in an ordinary middle-income family, where his father was a clothing manufacturer, and his mother worked as an ordinary music teacher and taught piano lessons.

Born and lived in New York State in a town called Great Neck. The future millionaire grew up in a fairly large family, so from a very young age he clearly understood that it was necessary to be able to concentrate on a specific task in order to achieve success.

GEORGE LANE

Many traders can only dream of stable work in the financial markets for many years. Everyone understands perfectly well that sooner or later a trading strategy becomes obsolete and begins to bring only losses, and it is very difficult to understand at what stage this happened, which leads to large losses.

Everyone understands perfectly well that sooner or later a trading strategy becomes obsolete and begins to bring only losses, and it is very difficult to understand at what stage this happened, which leads to large losses.

Having read many stories of successful people, you understand that every trader must have a certain ace up his sleeve, namely such a universal approach that years later you can remain in the saddle.

The story of George Lane is very similar to the stories of many successful people, namely, an unnoticed young man who did not even know about the existence of the stock exchange went from rags, as people say, to riches.

Ingeborg Mootz – age is not a hindrance, but a great moment

The success story of the famous old woman Ingeberga Mootz is not just a historical fact, but another confirmation that to achieve success on the stock exchange, age and even experience do not matter, and the main thing is to set a goal and go towards it with leaps and bounds.

confirmation that to achieve success on the stock exchange, age and even experience do not matter, and the main thing is to set a goal and go towards it with leaps and bounds.

Today she is called the most honest investor in Germany, and these are not just laurels.

Just imagine, she managed to make money where everyone else was losing money, and she doesn’t have any insider information, but watches reports from regular newspapers and makes all her purchases through an old phone.

If you think about it, most pensioners at her age give up and live out their lives modestly, but Ingeborg Mootz managed to make money where people with specialized education, young and ambitious people lose.

George Soros Strategy

George Soros is a famous billionaire who made his fortune through speculative operations. His fortune is estimated at over $7 billion, and legends about how he earned his money continue to this day.

operations. His fortune is estimated at over $7 billion, and legends about how he earned his money continue to this day.

In some countries, the emergence of George Soros is heralded with the onset of a crisis, since he skillfully buys shares of strategic companies for almost nothing.

For example, in Russia they treat George’s appearance with such distrust that if he visited an investment forum of some country, then all the news broadcasts that something is going to happen soon.

It gets to the point that some politicians directly accuse him of deliberately stirring up conflicts in order to quickly profit from depreciated assets.

However, George is not only a global investor, but also an excellent speculator, and he prefers the foreign exchange market.

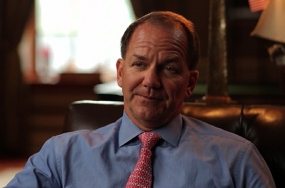

Paul Tudor Jones - Kings are not born, but made.

Paul Tudor Jones is one of the most secretive personalities in the stock exchange world. However, the size of his fortune, which exceeds the three billion dollar mark, says more about Paul than any soap story from a TV channel.

However, the size of his fortune, which exceeds the three billion dollar mark, says more about Paul than any soap story from a TV channel.

Paul has been repeatedly recognized as the best futures trader in the world by the most authoritative magazine Financial World, and his fund has branches in many countries around the world. Today, the assets of his fund are estimated at more than six billion.

However, Paul was not born into a billionaire right away, and he had to go through a difficult path of becoming from an ordinary beginner to the king of the futures markets.

The famous trader was born in 1954 in the USA in the state of Tennessee in the small town of Memphis. He received his higher education at the University of Memphis, and later received a scientific degree at the University of Virginia. A very young Paul in 1976 first encountered the world of finance, getting a job as a clerk in a brokerage company.