What is a web terminal? An overview using NPBFX as an example

It's impossible to make money on Forex without a trading terminal, just as it is impossible to make money without a reliable broker—these are the two main keys to success in the market.

Traders who prefer day trading should always be online, with the ability to check the markets at any time.

This isn't always possible if you don't have a platform at hand. A web terminal was developed for such cases.

Today, in collaboration with multi-market broker NPBFX, we'll explain what it is, its pros and cons, and how it differs from the traditional full-size version.

Netting or hedging account: what is the difference between these two types of accounts?

Hedging and netting accounts are the two main types of accounts used in forex or stock market trading.

A hedging account is a type of trading account that allows traders to simultaneously open positions in different directions on a single currency pair.

The main feature of this type of account is the ability to hed or lock positions , which allows you to reduce exchange rate risks when using certain strategies.

With this type of account, you can simultaneously open multiple buy and sell orders for one currency pair.

A netting account is a type of Forex trading account that allows traders to open only one position per currency pair at a time.

What is Flash Crash, what are the causes and consequences of this phenomenon?

A flash crash is a sell-off in a stock or other exchange-traded asset that causes the price to drop by hundreds of points in a very short time.

Often, during a Flash Crash, the price drop occurs so quickly and unexpectedly that many traders perceive this event as an error on the trading platform.

And they begin to search for the reason for such an event on the Internet or contact their broker's customer support.

In fact, their assumptions often turn out to be not so far from the true reasons that cause Flash Crash.

What causes Flash Crash?

Human error - The US Securities and Exchange Commission (SEC) has named humans as the main cause of periodic crashes in the stock and currency markets.

The pros and cons of using Forex trading advisors

Expert Advisors (EAs), also known as automated trading advisors, are becoming increasingly popular among traders every year.

These programs not only help you automatically earn money on Forex, but also free traders from the need to constantly sit in front of a computer monitor, thereby saving time and stress.

However, there are still many skeptics who doubt the effectiveness of this tool, claiming that advisors often become the cause of deposit losses.

But the reason for the failures lies not so much in the scripts themselves, but in the wrong approach to their use.

Risk and Reward Ratio: A Simple Approach to Calculating the Loss/Profit Ratio in Stock Trading

Traders just starting out on the stock exchange generally think only about the size of the profit they will receive and rarely plan for potential losses.

At the same time, the ratio of acceptable loss to planned profit plays a key role in planning successful transactions.

Often, such a ratio is expressed through the following formula – risk/reward ratio, which allows you to evaluate the prospects of a transaction.

Typically, both parameters involved in the formula are set using stop orders, so you can imagine that:

Risk is the amount of loss you set before opening a trade using the stop loss order parameter.

What type of account is best for stock trading?

Once you have registered with one of the stock brokers, you will need to open a trading account.

This is a very important point, because the right choice can help not only increase trading efficiency, but also save money.

However, choosing an account type can sometimes be confusing for beginning traders, so let's try to figure out which option is best suited to your situation.

Today, most brokers offer up to five different account options, each with its own advantages and disadvantages.

Principles of price formation in the Forex currency market

When starting to trade Forex, many traders completely ignore the theoretical foundations of the currency market, relying solely on indicator signals.

Moreover, they do this completely in vain, because knowledge of the principles of price formation allows you to understand what is currently happening on the exchange and can serve as an excellent filter for false signals when making the right decision.

The essence of the process is that each indicator signal in the trading platform must be based on a specific event.

That is, if the script signals a trend reversal, and there are no strong events in the news feed, you need to think carefully before opening a trade.

What is a VPS server for trading?

Any trader who decides to achieve results in Forex will eventually encounter certain difficulties.

Only beginners naively believe that a personal computer and a little luck are enough for success.

Having mastered the basics of market operations and gained experience, traders inevitably begin to consider the help of trading robots and scripts, as keeping track of a dynamic market on their own throughout the day is quite challenging.

Using trading experts in trading has several advantages:

• 24/7 monitoring of the market situation even when the trader is not at the terminal;

• the speed with which transactions are carried out is incomparable with human capabilities;

• strict adherence to a trading strategy, when under the influence of emotions, the trader’s intervention is excluded.

Stock market participants or those who can influence the price of shares

To trade successfully on the stock market, it's important to have at least a basic understanding of who determines the price of securities.

How their decisions can affect share prices, and how to use this information when forecasting prices and making plans.

Stock market participants are all those who issue, regulate, and influence the supply or demand of securities.

Currently, these include issuers issuing securities, investors financing the issue, governments regulating the circulation of these securities, organizations protecting the interests of investors, and professional participants profiting from this process.

Each of these groups influences the securities market in its own way, pursuing specific goals.

Free stock trading training

In any endeavor, the most important step is learning the basics; without it, it's simply impossible to achieve anything.

And the quality of your training directly determines whether you'll become a professional in your chosen field.

Most traders, having failed in the forex market, switch to the stock market, and to some extent, this is entirely appropriate, as securities behave more logically.

The key is finding quality stock trading training, as modern internet resources are largely focused on providing information about the forex market.

There are few stock traders in our country, so it's difficult to find blogs dedicated to working in this market segment.

How to Learn to Forecast the Forex Market

Those new to the exchange often think that the main thing is to trade with the trend, that is, open orders in the direction of the existing trend.

In reality, it's not the current trend that matters, but what it will be in a minute, an hour, or a day.

This means predicting future price movements and then deciding on the direction of a future trade based on that forecast.

Therefore, before starting Forex trading, it's crucial to learn how to forecast exchange rates; this is the key to successful trading.

A novice trader should at least know the basics of this science; without it, most trades will be unprofitable.

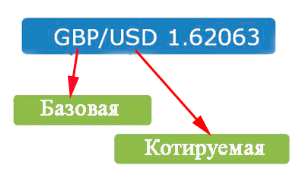

Quoted and base currencies and their role in the quote

When trading Forex, you encounter a host of different concepts that are tied to the calculation of various important trading parameters.

One such concept is the quote and everything related to it, as this knowledge is used to calculate the lot price, the pip value, and the swap.

The quote is formed by two currencies, the first of which is the base currency and the second the quote currency. It would seem that nothing could be simpler, but...

Base currency

This is the currency in which transactions are conducted; it is the currency in which the transaction volume is calculated, which is why it is called the base currency.

For example, in the GBPUSD currency pair (British pound/US dollar), the British pound is the base currency, and volumes are calculated in it.

Types of Forex trading positions

In financial market terminology, the word "order" is often used to denote a trading order.

Experienced traders often substitute this term for "position."

Depending on the direction of the transaction, positions are divided into long (purchase of an asset) and short (sale of an asset); by duration, transactions can be short-term or long-term; by opening time, they can be urgent or deferred.

Orders that can be opened in the trader's trading terminal are based on this classification.

What can you learn from a broker's specifications?.

One of the most important steps in Forex trading is choosing a broker, but to make the best choice, you need to compare trading conditions from different brokerage companies.

The easiest way to do this is to obtain information directly from the broker's website by analyzing the specifications of assets available for trading.

To find these specifications, go to the website of the company you're interested in - http://time-forex.com/spisok-brokerov - and click the "Trading" tab.

Next, select the "Contract Specifications" tab. Sometimes this information can be hidden under another menu item.

After clicking, you'll see a table containing all the necessary information on currency pairs or other assets, such as cryptocurrencies, stocks, metals, or futures:

Basics of Forex trading.

Trading on the currency exchange requires some practical and theoretical knowledge of forex trading principles. Without this knowledge, you simply won't be able to trade and will quickly lose your funds. Therefore, spending a few minutes reading this article will be well worth it and will save you from some mistakes.

of forex trading principles. Without this knowledge, you simply won't be able to trade and will quickly lose your funds. Therefore, spending a few minutes reading this article will be well worth it and will save you from some mistakes.

The basics of forex trading include general concepts, technical aspects of transactions, fundamental and technical analysis, and basic strategies used for trading.

In the classic sense, Forex is currency trading, but thanks to the expanded capabilities of the trading terminal, it can now also trade precious metals, stocks, contracts, and other instruments.

Currency pair correlation, table and indicator for calculating the indicator

Many people often hear the assertion that exchange rates are strongly correlated. However, there are virtually no clear practical recommendations on how to apply this knowledge in practice.

To understand this, it's important to consider the concept of a correction coefficient.

The correlation of currency pairs is a ratio or interrelationship. For traders and investors, this concept refers to the coefficient of interdependence of financial assets.

This indicator is very often used in many trading strategies, and it should be noted that there is a connection not only between exchange rates, but also a stable correlation between assets included in different groups.

The most striking example of correlation at the moment is the dependence of cryptocurrency rates: when the price of Bitcoin changes, the rates of other cryptocurrencies begin to change almost immediately.

Long-Term Forex Trading: The Secret to Consistent Profits

Many traders, having gained enough experience and learned their lesson in day trading, sooner or later begin to think about long-term or medium-term trading.

In reality, scalping and day trading have become a huge myth about the profitability of this approach.

Most beginners mistakenly believe that by devoting more time to trading, they will somehow magically earn more.

Unfortunately, this approach is fundamentally flawed and has been ingrained in us since the Soviet era.

For example, in the past, people who exceeded their production quotas were heavily rewarded, rewarded, and featured in newspapers.

MetaTrader 4 Trading Terminal Review

It's hard to imagine how trading would have developed today without the advent of trading terminals. Indeed, anyone who's read many of the classics of stock trading might have noticed that traders used to sit outside brokerage firms with a newspaper in hand, trying to conduct this or that currency transaction.

read many of the classics of stock trading might have noticed that traders used to sit outside brokerage firms with a newspaper in hand, trying to conduct this or that currency transaction.

The same thing happened with technical analysis, which forced traders to spend days sitting in front of large drawing boards, calculating formulas for simple indicators and plotting them on pre-drawn charts.

It's worth reading a book about the Ichimoku indicator, where you would learn that Goichi Hosoda (who invented this indicator) spent days with his students drawing his indicator to predict the Japanese index.

How to Use Pending Orders to Make a Profit

Exchange trading allows you to open not only urgent trades but also pending ones, which will open after a certain period of time and only if certain conditions are met.

after a certain period of time and only if certain conditions are met.

This means you can order to buy a currency if its rate drops below a specified level, thereby executing the transaction on the most favorable terms possible without even having to be present at the trading terminal.

Such orders are executed using pending orders, which, thanks to their functionality, significantly expand your trading capabilities.

Internet brokers.

Recently, the concept of online trading has become a common part of every Internet user's life. Now, there's no need to search for a company that provides access to trading, go to an office, sign contracts, and place orders over the phone.

to search for a company that provides access to trading, go to an office, sign contracts, and place orders over the phone.

All you need is a computer, laptop, or even a smartphone, and you're already a participant in online trading, allowing you to trade currencies, buy and sell gold, or stocks. The main source of income for this type of trading is online brokers.

Internet brokers are companies that provide access to financial markets exclusively online, offering the opportunity to conduct exchange transactions using software or web terminals on their own websites.

The importance of fundamental analysis in Forex.

Recently, the number of opponents of fundamental analysis has increased significantly; many traders don't even consider it important when trading Forex.

don't even consider it important when trading Forex.

Why analyze the economic situation or monitor news if the price reflects everything?

The unfortunate result of such reasoning is triggered stop losses, and if the trader neglected to use stop orders, lost deposits.

While it's not always possible to predict how a currency will perform after a particular news release, it's better to be prepared for it and factor it into your trading.

The best time to trade forex.

The advantage of trading forex is that you can set your own schedule, as the forex market operates 24/7, excluding weekends and holidays.

as the forex market operates 24/7, excluding weekends and holidays.

This means trading begins early Monday morning and ends late Friday night. You can trade during regular business hours, as well as late in the evening or early in the morning. So,

when is the best time to trade forex—morning, afternoon, evening, or even night?

History of Forex.

Currency exchange has been around since the advent of currencies and the development of trade relations between various countries. This function was performed by money changers in markets, who essentially set the exchange rate based on the purchasing power of a given currency.

was performed by money changers in markets, who essentially set the exchange rate based on the purchasing power of a given currency.

The metal from which the currency was made played a significant role: gold and silver coins were valued by weight, while others were valued by the same purchasing power and their equivalent in gold.

A more civilized form of exchange began in the 19th century, while the history of forex itself only began in the second half of the 20th century.

The history of forex actually began with the emergence of the Jamaican Monetary System, the key feature of which was the liberalization of gold prices, which led to the concept of a floating exchange rate.

The essence of the Forex market.

An investor planning to trade on the foreign exchange market for profit must have a clear understanding of the essence of forex. First and foremost, they need to know that forex (from FOReign EXchange) is a global currency market that emerged in the early 1970s, immediately following the abandonment of fixed exchange rates and the transition to floating exchange rates.

have a clear understanding of the essence of forex. First and foremost, they need to know that forex (from FOReign EXchange) is a global currency market that emerged in the early 1970s, immediately following the abandonment of fixed exchange rates and the transition to floating exchange rates.

The history of this transition is quite dramatic and is directly linked to the collapse of the Bretton Woods international financial system, which was based on the United States' commitment to exchange its national currency (the US dollar) for physical gold to anyone at a strictly fixed rate (at the time, 35 North American dollars per ounce).

When the US unilaterally abandoned this commitment, the need arose for trading platforms that facilitated the exchange of one currency for another at free rates. This is how the foreign exchange market emerged, without which international trade in goods and services could not function properly. So, at its core, Forex is a global-scale exchange market, with daily turnover amounting to billions of dollars.

Three components of success in Forex.

You've probably heard many sad stories about Forex trading, where traders lost their money due to circumstances beyond their control.

circumstances beyond their control.

Most of these stories are completely untrue; people tend to shift blame. Try to remember the last time someone you knew said, "I did the wrong thing."

It's almost always the boss, coworker, wife (husband), and so on who's to blame. Forex is no exception; you can only make money in it with strict discipline and self-control.

There are three key components without which you simply won't achieve success in trading:

Register for a Forex demo or real account in just a few minutes

To start trading on a currency exchange, you first need to register. Many beginners think they need to register directly on the exchange to trade, but this isn't entirely true.

they need to register directly on the exchange to trade, but this isn't entirely true.

Becoming a participant in the market independently is practically impossible; it requires not only large sums of money but also expensive licenses.

Therefore, all trading is conducted through intermediaries—dealing centers (brokers), who provide the average trader with access to the currency market, charging their own commission (spread and swap).

Registering for Forex and opening a demo account takes just a few minutes, after which you'll have access to the full functionality of the trader's trading account.

It will also be possible to download the programs necessary for work.

Forex registration follows the following procedure:

What is the essence of trading on the stock exchange?

You could talk about trading for hours and still not understand the essence of this type of trading.

Therefore, in this article, I will try to outline the main points of trading as briefly as possible, so that even someone with no financial background can understand them.

The essence of trading is primarily speculative trading on the stock exchange for profit, with no other goal than making money.

Trading is accessible to virtually anyone with money and a computer with internet access, regardless of profession, education, and sometimes even age.

Furthermore, the following key points should be noted:

Exchange instruments.

The first question anyone who decides to become a trader faces is: what to trade on the exchange? A modern trader's terminal offers a wide selection.

offers a wide selection.

In total, about 100 exchange trading instruments are available, and choosing the most suitable one isn't easy.

A trader's career success and earnings often depend on this choice. Let's explore the main groups of assets available for trading.

Exchange-traded instruments include shares of large companies, indices, precious metals, commodity and currency futures, and currency pairs.

Features to consider when starting to trade on Forex.

Any business related to making money has its own unique characteristics, and without taking these into account, you can make a multitude of unfortunate mistakes that will ultimately result in lost money.

result in lost money.

Forex trading almost always involves large sums of money, so losses can be far more than just a dent in your budget, and you can even lose money in places you wouldn't expect.

Let's move on to the main issues that should be considered before starting exchange trading.

1. Losses – it's much easier to lose on Forex than to make money, especially for beginning traders. Therefore, it's not recommended to trade with other people's money, borrowed money, or credit.

Education for working on Forex.

Most of my friends, upon learning that I make money on Forex, ask, "What kind of education do I need to do that?"

Yes, I'll be honest: I graduated from university with a degree in finance, so I can say with certainty what I learned from my five years of study.

Practically nothing. Everything I've used in stock trading can be learned in a week; it's mostly general knowledge about fundamental analysis and currencies.

So, what kind of education do you need to trade Forex?

Page 1 of 2

- To the beginning

- Back

- 1

- 2

- Forward

- To the end