Locking in Forex

A competent approach to loss management and money management is perhaps one of the most important components, without which even the most profitable trading strategy will sooner or later become unprofitable.

A competent approach to loss management and money management is perhaps one of the most important components, without which even the most profitable trading strategy will sooner or later become unprofitable.

Essentially, this is a special approach to fixing losses, which is delayed in time, although it requires large financial expenses on the part of the trader.

Unlike a standard stop order, where a loss is immediately fixed, a lock allows you to delay the closure of unprofitable positions and, with the right approach, turn the situation around to your advantage.

What is Forex locking?

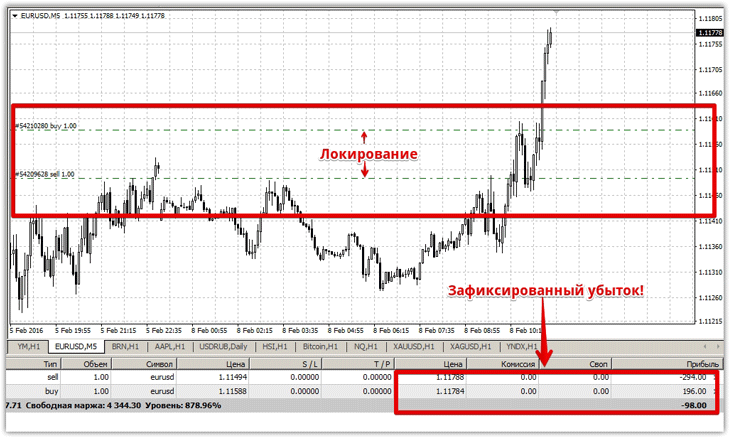

Locking in a loss is the practice of locking in a loss without closing the position itself. This is accomplished by opening two opposing orders with the same lot size. Simply put, when a trader needs to close a losing position, they open a trade in the opposite direction with the same lot size, and the distance in points between the orders is the locked-in loss.

The image above clearly shows a situation where a loss is locked in by two orders. After such a lock-in, there's virtually no difference in the price's direction, since as the sell loss increases, the buy profit also increases, while the loss itself, represented by the distance between these two opposing orders, remains the same.

The image above clearly shows a situation where a loss is locked in by two orders. After such a lock-in, there's virtually no difference in the price's direction, since as the sell loss increases, the buy profit also increases, while the loss itself, represented by the distance between these two opposing orders, remains the same.

However, it is precisely because of the delay in fixing the loss that this approach is unique, since it provides an opportunity to decide on the correct exit tactics in order to exit both positions in the plus or with minimal losses.

How to exit the lock

While creating a fixed loss and a lock is straightforward, almost everyone faces enormous challenges when it comes to turning this situation around. So, let's look at a couple of options for breaking the lock and the alternative consequences that could unfold if the situation doesn't change in our favor.

1) Closing a profitable position and waiting for a rollback to a losing position

This approach is one of the most popular and easiest. The entire process of closing the lock boils down to waiting for one of the orders to hit a support or resistance zone. When this happens, we close the profitable order and wait for the price to roll back to the opening point of the losing order, after which we close the second trade.

Ideally, we'd have a small loss on one order and a profit on the other, which would more than offset all our losses. However, this method has a drawback: the price could move further after the profitable order closes and not roll back, leading to an increased lock-in size or a huge loss on the second trade.

2) Adding a second order following the trend

Unlike the previous approach to closing a lock, we must clearly determine the trend direction and open an additional trade in the same direction as the main trend with the same lot size as the previous orders. Essentially, we're averaging in the direction of the global trend in the hope that the combined profit on both positions will offset the loss on one trade.

The danger of this approach is that we may misjudge the direction of the trend and in addition to one losing position, we may end up with another, which will further widen the lock and increase the risk.

In general, there are various approaches to locking, and the second method doesn't necessarily rely solely on the trend, as news is also suitable. However, you should understand that locking in Forex isn't a panacea for stopping orders, but rather a grueling approach that only experienced market participants can handle.

In general, there are various approaches to locking, and the second method doesn't necessarily rely solely on the trend, as news is also suitable. However, you should understand that locking in Forex isn't a panacea for stopping orders, but rather a grueling approach that only experienced market participants can handle.