Trusted brokers for scalping and pipsing

The most profitable trading strategy at the moment is considered to be short-term trading, which involves opening a large number of trades during a single session.

This type of operation places additional demands on the quality of services provided, servers, and communication lines, which is why not all data centers allow short-term transactions.

This article presents a list of brokerage firms that allow scalping. Trading is permitted without any specific time or profit limits, allowing for virtually any trading strategy.

Scalping brokers are listed based on the attractiveness of their trading conditions and ease of use. They also have excellent customer support, which has confirmed the absence of restrictions.

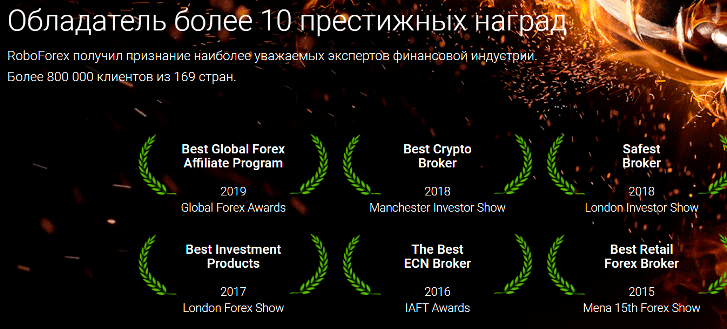

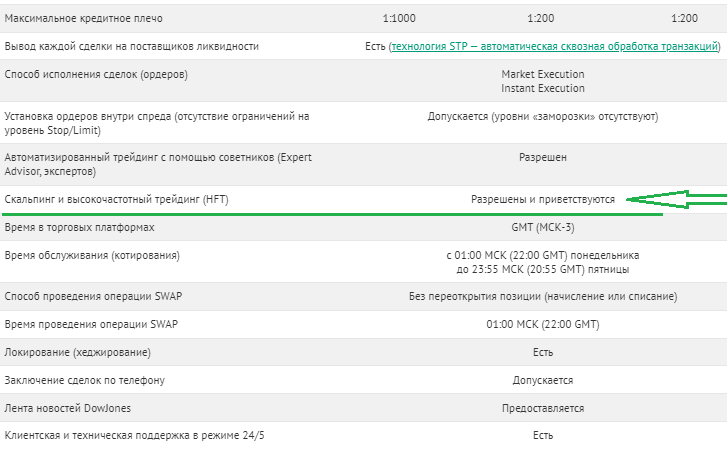

RoboForex is one of the most stable companies, supporting all types of strategies. Traders can choose from three account types: cent, standard, and VIP, depending on their financial capabilities and trading volumes. The offerings are simply enormous: scripts, terminals, analytics, and the ability to trade cryptocurrencies.

The minimum deposit starts from $1.

Spreads start from 0 pips depending on the account type.

Instant or Market execution options are available.

Bonuses up to +110%

, leverage up to 1:2000, and leverage for cryptocurrencies up to 1:50

. Quotes are available in four or five digits.

AMarkets – this company's advertising claims that this broker is suitable for scalping. They also hold a scalping contest of the same name.

Deposits start from $100.

start from 0.2 pips.

Choice of instant or market execution.

Bonus up to 30%.

Leverage up to 1:3000.

Quotes are five-digit.

Alpari – this company doesn't need much introduction; it's known to traders worldwide. Its client base has long since surpassed three million, so if you're looking for scalping and large-volume trading, this is the perfect choice. In addition to the standard options, you can deposit 50 cryptocurrencies.

The minimum deposit is $1.

Spreads start from 0 pips.

Orders are executed using Instant Execution or Market Execution.

Leverage is record-breaking – up to 1:3000

. Five-digit quotes are

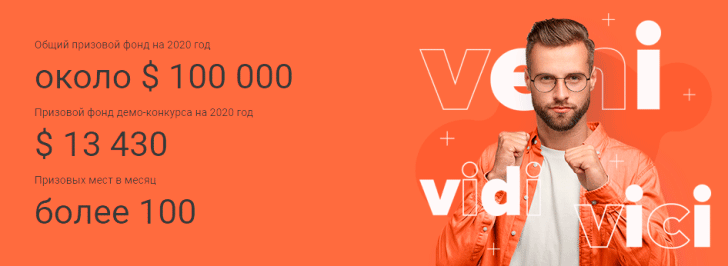

Really low spreads allow you to reduce costs while increasing your deposit. There are demo account contests for scalpers with good prizes. Alpari is currently the best broker for scalping.

NPBFX broker offers trading without hidden fees, while also offering incredible leverage of up to 1000. Operating since 1996,

the minimum deposit starts at $10.

Spreads start at 0.4 pips.

Instant execution and market execution.

Leverage up to 1:1000

. Five-digit quotes.

InstaForex – rounds out our short list. The company has recently lost significant ground among traders due to high fees for withdrawing funds to electronic payment systems. Therefore, if you prefer working with WebMoney or Yumani, you're better off choosing another broker.

InstaForex – rounds out our short list. The company has recently lost significant ground among traders due to high fees for withdrawing funds to electronic payment systems. Therefore, if you prefer working with WebMoney or Yumani, you're better off choosing another broker.

Initial deposit – from $1.

Spread – floating or fixed from 0.2 pips.

Quote – four digits

Leverage – 1:1000.

Bonus up to 55%.

This company can be conditionally classified as a broker for scalping, as there is a limitation - the minimum duration of a transaction is 5 minutes .

In conclusion, I would like to note that using brokers for scalping does not guarantee profitable trading, but only makes it a little more convenient and less risky.

What conditions should a broker meet for scalping?

Scalping is trading on the shortest timeframes, with trades typically lasting no more than a few minutes, sometimes even seconds. However, there are several key parameters that the best scalping broker should meet:

1. Spread – or the difference between the buy and sell price of a currency pair. The smaller it is, the better the financial result. With this strategy, this metric is crucial, as sometimes a trade yields only a few pips. However, with a high order opening fee, it's simply impossible to make a profit. This metric can be either fixed or floating.

Fixed – its value is immediately specified in the trading conditions and remains constant regardless of the forex market situation.

Floating – the commission value is constantly changing based on the instrument's liquidity and market volatility. For example, for the EUR/USD currency pair, this value can fluctuate from 0.5 to 3 within a single session; for other instruments, even greater fluctuations are sometimes observed.

Short-term scalping brokers offering this option typically specify an average spread, so you'll need to monitor its current value when opening trades.

2. Currency pair – the higher its liquidity, the smaller the spread; these two parameters are closely related. Volatility is also worth noting: pairs with high volatility can generate higher returns, but trading with them carries the highest risk.

Avoid scalping currencies like Bitcoin; the cryptocurrency's price moves so rapidly that, using leverage, you could lose your deposit almost instantly in the event of a sharp trend reversal.

3. Leverage – scalping requires high leverage; this will allow you to place substantial trades. However, this doesn't mean you should margin trade at a ratio of 1:1000; the ratio between your deposit and position size should be reasonable and not exceed 1:300.

4. Bonuses upon deposit – the larger the bonus, the larger the trade volume you can open, so it's a good idea to take full advantage of this offer.

This is especially true considering that earned funds can be withdrawn without any additional conditions or restrictions.

5. Minimum amount to start trading – if you only have $100, a dealing center that requires a minimum deposit of $1,000 is unlikely to suit you. However, using scalping, even with this amount, you can start earning money by gradually increasing your deposit.

A good option is to attract borrowed funds from investors through a PAMM account. PAMM accounts of managers who trade using scalping are usually quite convincing, allowing you to quickly attract additional capital.

6. Order execution – brokers for scalping must offer instant order execution. A request to open a position must be executed exactly at your price; otherwise, slippage will wipe out any potential profit.

7. No restrictions – some dealing service providers impose restrictions such as Min Trade Time, minimum profit with which an order is closed, and the maximum number of open trades during the day.

These companies aren't on the list provided, but before opening an account, double-check the trading conditions, as they can change at any time.

These are the key parameters you should pay attention to when choosing a scalping broker; only then will you achieve your intended profit and avoid any potential problems.