Currency pairs.

Choosing the right trading instrument directly impacts your trading results, but it's also important to remember that each currency pair has its own unique characteristics that require careful consideration. The "Currency Pairs" section is dedicated to describing these characteristics.

Currency pairs for swap profits using the Carry Trade strategy

Most Forex beginners perceive the overnight fee as just an additional expense.

However, a swap can be either negative or positive, which can lead to profit. It all depends on the difference in interest rates between the currencies in the currency pair and the direction of the trade.

If we recall the principle of calculating swap, we can say that when making a purchase transaction, you acquire the base currency and borrow the quoted currency.

That is, in the case when you buy a currency with a higher interest rate and a positive swap value appears.

USDMXN Currency Pair: Peculiarities of Trading the Mexican Peso

Forex trading isn't limited to the five most liquid currency pairs; if you're looking, you can also make money on exotic assets.

For example, on the same USDMXN pair, which is formed by currencies such as the US dollar and the Mexican peso.

The base currency for this asset is the US dollar, so one lot will be equal to 100,000 US dollars, and the quote currency will be the Mexican peso.

The USDMXN pair has quite high volatility, which is due to the instability of the Mexican peso exchange rate and the fact that both currencies belong to the same trading session.

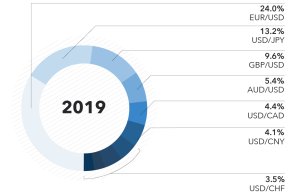

Liquid currency pairs on Forex: advantages of trading them

The term "liquid asset" is often used when discussing financial market trading.

In Forex, it applies to currency pairs and characterizes how popular and in-demand a pair is among traders.

Liquidity, in the classic sense, is the speed with which you sell your asset at market price, how much demand it has, how quickly a buyer is found, and what it costs you.

Based on this, liquid currency pairs on Forex should sell at record speeds, but in reality, things are a bit different.

The order execution speed in a trader's trading platform is roughly the same regardless of the pair you select, but the commission spread for opening trades varies significantly.

USDCNH Trading Features

Your future success directly depends on the choice of trading instrument, namely the currency pair.

The world's top currencies by turnover combine to form the most popular Forex currency pairs, which offer low commissions and are in high demand in the foreign exchange market.

Naturally, novice traders tend to resort to instruments they've only heard of, even if only vaguely.

While these assets are certainly among the leaders for good reason, that doesn't mean they're the easiest to analyze or trade.

Unfortunately, the huge demand for the main instruments creates a multitude of influencing factors, making them difficult to predict.

USD/HKD Trading Pair: Trading Features

It's no secret that traders typically categorize currency pairs into majors, crosses, and outright exotics. Major currency pairs on Forex are the most sought-after on the global market, which is why they offer the highest liquidity.

Traders typically prefer to trade them due to their high volatility, and sometimes even cross rates to hedge risks .

However, you'll rarely find recommendations for trading exotic instruments in any textbook.

This is unfortunate, as exotic currency pairs in the Forex market can also generate substantial profits and are especially attractive to investors who prefer to create low-risk, hedging-based strategies to generate profits from swaps.

Characteristics of EURCAD

Many traders avoid cross rates due to their relatively low volatility and the high commission charged by the broker in the form of a spread.

However, not all forex currency pairs, traditionally referred to as exotic, have low liquidity and high commission requirements.

For example, EURCAD combines the interaction of highly developed countries such as Germany, France, and other members of the European Union with equally developed Canada and its advanced industrial complex.

The economic relationship between the developed European Union and industrialized Canada generates increased interest in this currency pair, and consequently, the volatility and spread size for this cross rate are practically on par with those of the most popular assets.

Currency pair GBPAUD

A trader's performance directly depends on the choice of Forex currency pair. The subtleties of the instrument's movements, the factors that influence both currencies individually, and the factors that determine the exchange rate are the foundation for making sound trading decisions.

the instrument's movements, the factors that influence both currencies individually, and the factors that determine the exchange rate are the foundation for making sound trading decisions.

GBPAUD is a trading instrument that combines two national currencies, the British Pound and the Australian Dollar.

To understand how the chart is constructed, you should clearly understand when you see this symbol that the chart displays the number of Australian dollars that need to be paid for 1 British pound.

Both of these currencies are slightly inferior in terms of money supply turnover to such giants as the dollar and the euro, but they confidently occupy fourth and fifth place in the world in terms of global volume.

Gold – XAUUSD currency pair

Gold is one of the most attractive stock market instruments for investors. Until recently, gold was considered a quiet investor's instrument, as its price has been rapidly rising over many years.

gold was considered a quiet investor's instrument, as its price has been rapidly rising over many years.

However, since the second half of 2012, the instrument has begun its active downward dive and has become one of the most volatile and unpredictable on the Forex currency market.

XAUUSD consists of two elements, namely gold (XAU) and the dollar (USD), which is used to purchase this precious metal.

The XAUUSD currency pair is considered one of the most dangerous due to the poor predictability of its movements and very high volatility, which reaches from 2500 to 3000 points per day.

USDDKK currency pair

It's widely believed that volatility in major Forex currency pairs has decreased dramatically in recent years. It's rare to see a 250-pip daily move in the EUR/USD these days, and it's usually triggered by a major news storm, making such swings very unpredictable.

It's rare to see a 250-pip daily move in the EUR/USD these days, and it's usually triggered by a major news storm, making such swings very unpredictable.

As you can imagine, a decrease in volatility and liquidity always leads to a decrease in the profitability of trading strategies.

Of course, you can overestimate the lot and achieve very high results by increasing the risks, but you can also go the route of using exotic currency pairs in your trading arsenal.

The USD/DKK currency pair is one of the most popular exotic currency pairs, with daily volatility exceeding 1,500 pips.

During calm and strong market conditions, the price of this instrument can move 300-500 points, allowing traders to achieve increased profitability by using the same trend-following trading strategy as they do for other major market instruments.

USDDKK is an asset formed by the US dollar and the Danish krone.

Dollar currency pairs and trading them.

Every asset has its own characteristics and behavior patterns, so before you begin trading using any trading strategy, you should triple-check whether your tactics are suitable for potential price changes, volatility, and chart behavior during different trading sessions.

using any trading strategy, you should triple-check whether your tactics are suitable for potential price changes, volatility, and chart behavior during different trading sessions.

Before we begin our review of various dollar instruments, we would like to remind you of the three main groups of quotes against the dollar: direct, inverse, and cross rates.

A typical example of a direct quote is USD/JPY due to its widespread use, but to make sure you understand, in a direct quote the USD symbol always comes first, followed by the symbol of the other currency.

A direct quote shows how much of a certain currency must be given for one dollar.

In an inverse quote, the USD symbol is placed after another currency, for example GBP/USD, and shows us how many dollars we need to pay for 1 unit of currency, or in our case, for 1 pound.

USDSGD

Choosing easily predictable trading instruments is the shortest path to success. Many trade the euro/dollar for years without learning how to make any meaningful forecasts, let alone make real money.

trade the euro/dollar for years without learning how to make any meaningful forecasts, let alone make real money.

The banality and stupidity of the situation is that the overwhelming majority do not even try to get acquainted with other possibilities, and when exotic instruments are mentioned, they erect a wall of rumors and speculation in front of themselves.

Lack of confidence and a plethora of myths about exotic currency pairs being more difficult to trade because they are unpredictable deprive you of a second chance to master the profession of a trader.

Today's article will discuss the so-called exotic currency pair USDSGD. It consists of two currencies: the US dollar (USD) and the Singapore dollar (SGD).

NZD/USD

NZD/USD is considered the most attractive instrument for investors and traders who prefer long-term trading.

The pair includes two of the most common currency pairs, the New Zealand dollar and the US dollar.

If the US dollar is the world's leading currency, then the New Zealand dollar is among the top ten currencies that occupy the world's financial turnover.

The NZD/USD is characterized by long-term trends and relatively low volatility, so due to its predictability, almost all beginners are recommended to start with it.

I suggest taking a closer look at each currency to identify the general factors that influence the NZD/USD chart movement.

CADJPY

CADJPY is one of the most popular trading instruments among traders who actively use fundamental analysis . Due to its unique characteristics, CADJPY is considered the least predictable instrument for traders who use technical analysis.

unique characteristics, CADJPY is considered the least predictable instrument for traders who use technical analysis.

Sudden daily price fluctuations of 150-250 pips are considered normal for this instrument, as it reacts strongly to economic indicators, foreign policy activities, and key news releases from strategic partner countries.

CADJPY is considered an exotic currency pair because the high commissions for trading this instrument simply weed out traders who take short positions, as well as scalpers and pipsers.

The average spread for CADJPY ranges from 7 to 15 pips across various brokers, so if you decide to trade CADJPY, I recommend carefully selecting your broker.

EURCHF

The EURCHF currency pair consists of two monetary units, namely the Swiss franc and the euro, which is the main currency of the European Union countries.

which is the main currency of the European Union countries.

Looking at the currency pair's configuration, we can see that the chart shows how many Swiss francs are worth one euro.

Until recently, EURCHF was considered one of the most stable assets, as it only moved 20-50 pips daily, sometimes as little as ten pips.

Therefore, this instrument wasn't particularly popular among speculators, as its extremely low volatility and small daily price movements simply prevented traders from making money.

EURGBP

The EURGBP currency pair consists of two monetary units, namely the euro and the British pound.

with the EURGBP, the main one being that it has calm trends without any significant sharp jumps.

the EURGBP, the main one being that it has calm trends without any significant sharp jumps.

Some site owners recommend it for beginners, claiming that it is easily predictable and does not have high volatility.

These are all myths and misconceptions, and I will try to explain to you why.

First, let's look at both currencies separately to understand what actually influences price movement.

USDZAR

The USDZAR currency pair is considered an exotic Forex trading instrument, so it is rarely used by traders.

rarely used by traders.

The downside of working with exotic instruments is the presence of a large spread, and if we talk about USDZAR, its value usually fluctuates between 15 and 30 pips depending on the broker at four-digit quotes.

USDZAR consists of two independent currencies, namely the US dollar and the South African rand.

Moreover, judging by the configuration, we are buying dollars for rands, and not the other way around, as is the case with the main currency pairs.

Volatile currency pairs

One indicator that determines the profitability of trades is Volatility. This indicator characterizes the distance between the minimum and maximum price values over a day or trading session.

characterizes the distance between the minimum and maximum price values over a day or trading session.

Volatile Forex currency pairs allow you to earn the maximum number of pips from a single trade, thereby reducing the size of the consolidated spread.

A good profit can be achieved even with a single trade, allowing for trading even pairs with wide spreads.

This indicator should be considered by traders who trade on medium-term timeframes; it plays little role when using scalping or pipsing.

Currently, the following exchange-traded assets have the greatest range of movement:

AUDCHF

The AUDCHF consists of two monetary units, namely the Australian dollar and the Swiss franc.

This instrument has significantly lower liquidity than popular instruments such as GBP/USD and EUR/USD.

lower liquidity than popular instruments such as GBP/USD and EUR/USD.

The main drawback is that almost all brokers set a large spread, making it unprofitable for scalpers and traders who prefer short positions.

For example, the broker InstaForex sets a spread of 10 pips. As you can imagine, seeing a negative balance immediately after opening a position is extremely stressful. A spread of 10 pips carries a significant psychological burden.

Before talking about forecasting the exchange rate for this instrument, let's look at each currency separately.

USDNOK currency pair on Forex

Until recently, USDNOK was considered to be in the second group of interest for traders after such instruments as GBP/USD and EUR/USD.

EUR/USD.

This was due to the fact that USDNOK had low liquidity compared to the currency pairs listed above, so it was of greater interest to investors rather than traders.

USDNOK is composed of two currencies: the US dollar and the Norwegian krone .

When it comes to the dollar, almost everyone knows the factors that influence its movement, but few of you have considered what drives the price of the Norwegian krone.

Norway is the fifth-largest producer and exporter of black gold.

Oil is the foundation of the country's economy, and the ability to supply raw materials to various countries has always significantly filled the state budget.

The most profitable currency pair

There are a great many discussions on the topic of "What can you earn the most on?", and any beginning trader asks the question  -

-

Which currency pairs are the most profitable on Forex?

This is a fascinating question that requires careful study, as any trading instrument can offer high profitability at certain times.

Let's examine the current situation for the most popular instruments, focusing not only on the forex market.

The trading platform allows you to use virtually any exchange-traded asset, including futures and precious metals.

Forex cross pairs

The US dollar remains the primary instrument on the currency exchange, serving as the second currency in most transactions. Such currency pairs on Forex are called direct and typically have the smallest spreads.

most transactions. Such currency pairs on Forex are called direct and typically have the smallest spreads.

However, the US dollar isn't always involved in a transaction. For example, if you want to buy euros with Swiss francs (EUR/CHF), the quote will no longer be direct.

This type of transaction is called a cross pair, and essentially refers to all transactions that don't involve the US dollar.

That is, such pairs include AUDCAD, AUDCHF, AUDJPY, AUDNZD, CADCHF, CADJPY, CHFJPY, EURAUD, EURCAD, EURCHF, EURCZK, EURGBP, EURHUF, EURJPY, EURNOK, EURNZD, EURPLN, EURSEK, GBPAUD, GBPCAD, GBPCHF, GBPCZK, GBPJPY, GBPNOK, GBPNZD, GBPSEK, GBPZAR, NZDCHF, NZDJPY, etc.

Currency pair for beginners

A beginner who decides to trade Forex first faces the question of choosing a trading asset. Brokers typically offer several dozen currency pairs, so which one should you choose for profitable trading?

offer several dozen currency pairs, so which one should you choose for profitable trading?

It might seem like the most popular, but the answer isn't always so obvious, and many experts advise against taking a less formal approach.

Yes, EUR/USD offers the most favorable trading conditions, and there are a huge number of tools, such as expert advisors and indicators, written specifically for this currency pair. However, along with its advantages, it also has certain disadvantages.

First and foremost, euro news is released during Moscow business hours, which causes sharp fluctuations while you're trading Forex. Furthermore, the asset is influenced by a host of secondary factors, making it difficult to objectively assess price movement.

Pair CHFJPY

Most traders prefer to trade only the most popular currency pairs on Forex, while other, equally interesting, trading instruments remain unnoticed.

trading instruments remain unnoticed.

The CHFJPY pair falls into this category, consisting of the Swiss franc as the base currency and the Japanese yen as the quote currency.

This interesting combination allows for profitable trading during the Asian Forex session, as this is when the price is most susceptible to change.

This makes the instrument more suitable for traders who prefer to trade at night or in the morning. This is because the main yen events occur during the Asian session, while the Swiss franc is a more stable currency.

How to choose a currency pair

As with any market, the choice of trading instrument in Forex is highly dependent. Unlike real trading, a multitude of other factors are taken into account, not just supply and demand.

As with any market, the choice of trading instrument in Forex is highly dependent. Unlike real trading, a multitude of other factors are taken into account, not just supply and demand.

The approach to selection should also take into account the trader's chosen trading strategy, not just the characteristics of the trading instrument.

Taking into account a Forex strategy allows you to select the right pair, offering the best chance of success in exchange trading.

In addition, many advisors are created for a specific exchange asset, which is also important when making the right choice.

USDCNH pair

The Chinese currency is increasingly gaining ground on global markets, and this phenomenon has not bypassed Forex trading.

Gradually, the Chinese yuan began to appear in traders' terminals.

the Chinese yuan began to appear in traders' terminals.

USDCNH is the main currency pair you can use to trade the Chinese currency. It's currently the most liquid trading instrument involving the yuan.

What makes this type of trading so appealing?

• Outlook - China is the second largest economy in the world, meaning its currency is growing in popularity.

Silver trading on Forex

Silver was once considered a leading commodity in exchange trading, actively traded on most global exchanges.

most global exchanges.

Trading silver remains attractive, especially since it's accessible to virtually anyone with the necessary funds.

The technical instruments used for trading are the XAG/USD or XAG/EUR currency pairs.

In the first case, silver is purchased for US dollars, in the second for euros. The choice of instrument depends on which currency you are more familiar with and which one you are more comfortable working with.

Oil on Forex

It would seem that the article title is a typo, since Forex is a currency market, and therefore only currencies can be traded there.

only currencies can be traded there.

However, the well-known MetaTrader trading terminal allows trading not only on the currency market, so assets such as gas, oil, and precious metals can also be used as trading instruments.

Oil can be bought or sold on Forex just like any other currency. Technically, this operation is no different from trading currency pairs, but there are still some differences.

• Oil quote - displays the price for 1 barrel, that is, how many dollars will need to be paid for 1 barrel of oil, at the moment the price is around 100 dollars.

Currency pairs with small spreads

The spread size on Forex currency pairs is important when using high leverage. A difference of a fraction of a pip can add up to a significant amount, and if a trader makes a large number of trades, this amount increases even more proportionally.

amount, and if a trader makes a large number of trades, this amount increases even more proportionally.

Therefore, it's crucial to choose a currency pair with the smallest spread.

Typically, such pairs include those involving the European currency or the US dollar, but small spreads can also be found on other trading instruments.

It should also be noted that the size of the floating spread can change dynamically depending on the liquidity of the asset on the market.

Depending on various factors, liquidity for the same asset may fall or rise.

EURUSD

The most popular forex trading instrument is the EUR/USD, with trades between these two currencies accounting for over 60% of all forex transactions.

two currencies accounting for over 60% of all forex transactions.

This is not surprising, as the pair is formed by two of the most popular currencies—the US dollar and the euro. These currencies offer a wealth of useful information, from news to analysis and exchange rate forecasts.

The EUR/USD is a rather interesting instrument with its own trading characteristics, which we'll discuss below.

Structure and general points.

In EURUSD, the euro is the base currency and the dollar is the quote currency, so the price of the base currency rises as the euro rises and falls as the dollar declines. When the US dollar strengthens, the opposite occurs.

EURRUB pair

EURRUB is a rather unusual, but still popular, forex trading tool; more and more brokers are including it in their trading terminals.

trading terminals.

EURRUB consists of the euro base currency and the ruble quote currency. This means the currency pair's price is directly linked to the euro exchange rate; if the euro appreciates, the pair will also appreciate, and vice versa.

The ruble exchange rate is inversely linked: as the ruble appreciates, the currency pair's price falls. Consequently, if the ruble depreciates, the EURRUB exchange rate will resume its upward trend.

Despite their somewhat exotic nature, ruble currency pairs are becoming increasingly popular on Forex, as they allow you to follow the news practically during a single Forex session.

Gold trading on Forex.

Despite being a precious metal, gold is also a subject of active forex speculation.

Gold trading on forex is conducted in the trader's terminal using the XAUUSD currency pair and is technically no different from other instruments.

You can also place urgent and pending orders and use any available technical analysis tools .

The XAUUSD currency pair consists of two assets: gold, of course, as the base currency, and the US dollar as the counter currency. This means you'll be trading gold against US dollars, regardless of your deposit currency. You can also use the XAUEUR currency pair for trading, which is ideal if you trade during the European trading session and rely on current news.

Page 1 of 2

- To the beginning

- Back

- 1

- 2

- Forward

- To the end