Liquid currency pairs on Forex: advantages of trading them

The term "liquid asset" is often used when discussing financial market trading.

In Forex, it applies to currency pairs and characterizes how popular and in-demand a pair is among traders.

Liquidity, in the classic sense, is the speed with which you sell your asset at market price, how much demand it has, how quickly a buyer is found, and what it costs you.

Based on this, liquid currency pairs on Forex should sell at record speeds, but in reality, things are a bit different.

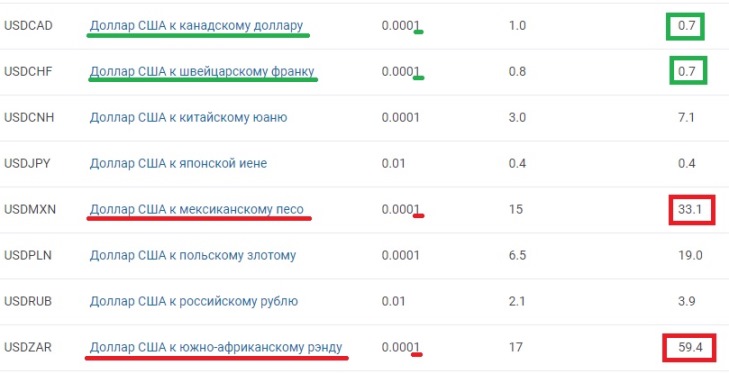

The order execution speed in a trader's trading platform is roughly the same regardless of the pair you select, but the commission spread for opening trades varies significantly.

It's important to compare not only the commission rate itself, but also the pip value for different currencies for the same transaction value. These values almost always differ.

It's important to compare not only the commission rate itself, but also the pip value for different currencies for the same transaction value. These values almost always differ.

In our particular case, you sell your commodity (currency) at the same speed, but pay a higher commission for selling less liquid assets.

It's the spread size that best characterizes which pair is currently enjoying the greatest popularity. This is confirmed by the unprecedented widening of the spread on days when liquidity drops to near zero, usually before holidays.

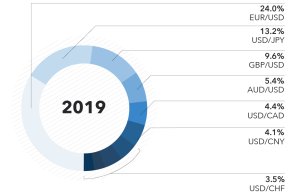

The most liquid currency pairs on Forex

There are currently quite a few, as Forex trading is growing in popularity every day:

EURUSD (Euro vs. US Dollar) is the most popular and, consequently, the most liquid pair. The spread for this currency pair often drops to 0, with the average spread being around 2 pips.

AUDUSD (Australian Dollar vs. US Dollar) is also a rather interesting trading instrument, with its highest trading volumes recorded during the Australian Forex session.

EURGBP (Euro vs. British Pound) – these two currencies are constantly vying for supremacy after Britain refused to join the Eurozone. Volatility is highest during the European trading session.

GBPUSD ( British Pound vs. US Dollar) is a traditional pairing. The currencies of two countries with the strongest economies will always trend.

USDJPY ( Dollar vs. Japanese Yen) is traditionally used by many traders to profit during Bank of Japan interventions.

EURJPY (Euro vs. Japanese Yen) – this pair has also gained considerable popularity in the forex market over the past few years.

USDCHF (US Dollar vs. Swiss Franc) – the Swiss currency is traditionally considered a safe haven for investors, so EURCHF is always in high demand.

These are the most liquid currency pairs found in the trading terminal, but other pairs include USDCAD, USDCNH, and EURCNY.

You can read about all currency pairs in the section - http://time-forex.com/pary