Buying company shares before the cutoff date or before the dividend announcement

Buying company shares is a rather complicated process; it is not enough to simply choose a company you like and purchase its securities.

There are things to look out for when buying a stock, and one of those things is the cutoff date.

Cut-off date - A cut-off date is a fixed date on which the list of persons entitled to receive a particular right or payment (e.g., dividends) is fixed.

If the asset is owned by you on that date, the right is retained; if acquired later, the right does not arise.

This moment is often also referred to as the register closing date.

What to choose for investment: gold or gold mining stocks

Gold's record rise has made it the number one asset in 2025, with demand for the precious metal rising not only among large buyers but also among smaller investors.

Today, there are many options for buying gold – bars and coins, cryptocurrencies tied to the price of gold, spot transactions.

But there is another option for investing in precious metals: shares of gold mining companies, and many professional investors choose this path.

In order to maximize diversification , the NYSE Arca Gold Miners Index (GDM) is purchased.

Gold or Stocks: Which to Choose for Long-Term Investments?

With the price of gold skyrocketing, do you ever wonder, "Shouldn't I have invested in gold instead of stocks?"

This is a completely logical concern, especially in the context of instability in financial markets, an economic crisis and potential risks to securities.

To understand which asset will generate more profit in the long term—gold or stocks—let's consider how much you can earn over 10 years by investing the same amount in each of these instruments.

For the sake of clarity, we will compare the results using the S&P 500 index , which includes shares of the 500 largest American companies.

Why You Shouldn't Blindly Copy Investment Portfolios

Building your own investment portfolio is quite challenging—it requires careful study of each asset and an assessment of its current prospects.

Therefore, there is a common belief that it is easiest to buy the same stocks that are in the portfolios of people like Warren Buffett or Carl Icahn.

To track such portfolios, special services have even been created that allow you to find out which shares a particular financier has purchased — https://ru.investing.com/

Overall, it's a good idea, but it's not always possible to copy everything. The market is constantly changing, and what was once a profitable purchase becomes more expensive over time and loses investment appeal.

Buy just one share and earn 30% per annum

Building an investment portfolio is one of the most challenging aspects of investing, making it a challenging task for a beginning investor.

But what would you say if I offered you to buy just one share and earn an average of 30% per year on your initial investment?

It turns out that such a stock actually exists, and it's called the SPDR® S&P 500® ETF Trust (SPY).

The SPDR S&P 500 ETF Trust (ticker: SPY) is the oldest and one of the largest exchange-traded funds (ETFs) in the world, in existence since 1993.

Its primary investment objective is to closely replicate the performance of the S&P 500 index , which includes the 500 largest publicly traded companies in the United States by market capitalization.

Stock Market Crash: Should We Fear It?

Warnings of an impending stock market crash have been increasingly common lately. News reports are abuzz with speculation about a possible recession and a global economic slowdown.

Against this backdrop, the recent actions of legendary investors are also remembered: Warren Buffett reduced his holdings of certain assets before retirement, locking in profits after years of growth.

It's no wonder that private investors are worried: are we on the brink of another collapse?

But is a stock market crash really that scary if you're investing for the long term and are confident you won't need the money you invest for the next 5-10 years?

Let's try to understand how the market behaves in practice, taking as a basis one of the most famous and representative stock indexes - the S&P 500 , which reflects the dynamics of the 500 largest US companies.

Do I need to pay taxes when investing in gold? A quick overview by country

Investing in gold is traditionally considered a reliable way to preserve capital, but selling a bar or coin can trigger unexpected tax liabilities.

The widespread belief that gold is completely exempt from taxation is not true everywhere—each country applies its own rules.

How it works in different European countries

The European Union primarily regulates VAT: investment gold—bars and coins of established quality—is exempt from VAT in all EU countries.

However, income taxes on sales are determined by national laws and vary widely.

My stock portfolio and how much it will earn in 2025

When building a securities portfolio, it's important not just to select companies with big names, but to build a system.

Diversification is a key principle that allows you to reduce risks and achieve stability even in volatile market conditions.

At different times of the year, some industries grow, others decline, and a balanced portfolio helps smooth out these fluctuations.

My portfolio is dominated by dividend stocks, but also includes bonds and non-dividend growth stocks.

When selecting issuers, I focused on the profitability of the business, the current financial condition of the companies, and how far their shares are from their historical highs.

At the same time, the portfolio also included stocks that defied the general trend, such as Intel. While they were losing money at the time, their price was three times lower than their peak, making them attractive from the standpoint of a possible recovery.

Top Polish dividend stocks for 2025-2026

Investors often unfairly overlook shares of Polish companies, preferring issuers from countries with larger economies – and completely in vain.

Poland has significantly improved its macroeconomic indicators over the past few years and is now ranked 20th in the world by GDP.

The economy is growing steadily, inflation is steadily declining, and the corporate sector is showing strong financial results.

Against this backdrop of stability, shares of Polish companies are becoming an excellent tool for receiving high dividends and potential capital growth.

Today, we'll look at three Polish companies that you can confidently add to your investment portfolio to significantly boost its returns.

How to buy Revolut shares for profit and dividends

Most potential investors dream of receiving profits from their investments in the form of stock dividends.

That's why investing in company shares is the most popular type of investment today, but the complexity of the process of buying shares can sometimes be an obstacle for beginners.

To make the stock market more accessible to ordinary investors, Revolut Bank has launched trading in securities such as company shares, government bonds, and corporate bonds.

Currently, over 6,500 stocks are available for purchase in the bank's app, and this number is growing daily. These securities come from regions such as the US, Europe, and Asia.

Promising European stocks with good dividends

Even a novice investor knows that the most popular stocks today are securities of American companies.

But any investment portfolio requires diversification, so it is not advisable to form it only from US stocks.

Therefore, European stocks should also be a component of the portfolio; this step will reduce exchange rate risks.

In this case, the size of dividends is an important indicator; for many investors, this criterion is decisive when making a choice.

At one time, I also bought securities of two European companies, and I want to share this choice.

What is bond duration in simple terms?

When it comes to bonds, the most commonly mentioned parameters are yield and maturity.

But investors have another important tool to help them assess a security's risk and sensitivity to interest rate changes: duration.

At first glance, the term sounds complicated and is more suitable for academic finance textbooks.

However, when you think about it, duration is simply a way to measure how quickly an investor will get their money back and how the bond's price will change if market rates rise or fall.

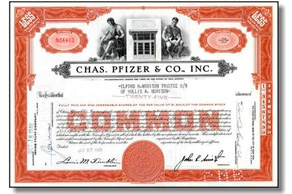

What influences the price of bonds, and when is it best to buy or sell them?

Bonds are one of the most understandable and reliable instruments: they provide a coupon, have a maturity date, and a clear legal structure.

But unlike a bank deposit, their market price fluctuates during the trading process. This is the key to profit (or loss) when selling before maturity.

Imagine you bought a 5-year Pfizer with a face value of $1,000 and a 5% annual coupon. A year later, the bond's price falls, and the same bond is now trading at $900, with the annual yield rising to 5.5%.

At this point, it's advantageous for the buyer to enter (the yield is higher than before), but not for the seller: they will lock in a loss to the par value. The idea is simple: price and yield move in opposite directions.

BlackRock is a billion-dollar fund. How can you buy its shares and become part of its empire?

BlackRock is not just an investment fund, but a true "grey cardinal" of global finance, and its owners secretly rule the world.

The fund manages assets worth US$11.5 trillion, a sum so large that it exceeds the GDP of many countries.

The fund was founded in 1988 by a group of financiers, including Larry Fink , who still heads the company.

There is talk in Wall Street circles that BlackRock has more influence than central banks and that its analysts can predict market movements before anyone else.

An interesting fact is that BlackRock owns stakes in almost all of the largest American companies, from Apple to Coca-Cola.

What is Buffett's Berkshire Hathaway fund and how to invest in it?

Warren Buffett is one of the largest and most famous investors in the world, nicknamed the "Oracle of Omaha.".

His fortune is estimated at more than $130 billion, and his investment strategy has become a benchmark for millions of people.

Buffett was able to accumulate such a vast fortune because he used not only his own capital but also attracted investors' money in his investments. For this purpose, he created an investment fund: Berkshire Hathaway.

Berkshire Hathaway is known for its stability and success. It owns dozens of businesses and holds significant stakes in some of the largest US companies.

In this article, we'll explain what Buffett's fund is, how much it earns, and how you can invest in it.

Choosing bonds with the highest yield

Bonds are deservedly considered a more reliable investment instrument compared to shares, as they are among the first to be paid off when debt obligations are repaid.

Bondholders receive fixed coupon payments and also receive their entire investment back by the maturity date.

Unlike dividends on shares, payments on bonds are mandatory and do not depend on the amount of profit earned by the company or on the decision of the board of directors.

However, bonds also come in different varieties. Government securities are considered the most reliable, but their yield rarely exceeds 2.5–3% per annum.

You can earn much more on corporate bonds, especially when it comes to companies with moderate or high risk. These securities can yield up to 7–9% per year, especially when considering companies not only from the US but also from Europe and Asia.

What is the difference between stocks and bonds, and which securities will yield a higher percentage of profit?

Securities are one of the most popular and profitable investment assets, but investors always face the question of whether to choose stocks or bonds.

To make the best choice, you should know the difference between stocks and bonds, and which security is best for you.

Stocks and bonds are two popular types of securities that investors use to make a profit.

Stocks are shares in a company, with compensation in the form of dividends, while bonds are debt obligations that obligate the issuer to pay the owner a certain amount with interest over a period of time.

How to identify undervalued stocks quickly and easily?

When buying company shares, you should focus not only on their popularity rating and how much dividends you can expect to receive in the future.

A more important indicator is the valuation of a security, how high the market price of a share is in relation to its real value.

Based on this, the stock may be undervalued – with high growth prospects, or overvalued – with a high risk of price decline.

Investing in undervalued stocks is profitable because it provides an opportunity to purchase securities at a price below their actual value and thereby generate additional profit.

However, you shouldn't completely trust analysts' recommendations—their assessments may be delayed or incorrect.

Taxes on dividends from US stocks and how to reduce them

It's no secret that today, virtually all forms of investment income are subject to taxation, including interest on deposits and dividends on company shares.

Moreover, taxes on dividends depend on whose shares you buy; for example, if you buy shares of American companies, they will be taxed according to US law.

Today, dividends paid to foreign investors on American stocks are taxed at a rate of 30%.

This means that when dividends are accrued, you are automatically charged a 30% interest. For example, if you receive a $500 dividend payment on Pfizer shares, only $350 will be credited to your account.

Passive Investing: How to Earn Money Without Effort

If you have money, you probably dream of investing it in a way that would generate passive income without much effort.

The topic of passive investing is quite popular on social media, but in reality, not many investment options can be classified as passive income.

Passive investing is an investment strategy in which an investor is minimally involved in the asset management process, seeking to generate regular income without actively participating in the management of their investments.

Traditionally, such investments include securities, bank deposits, and real estate. Recently, staking cryptocurrencies pegged to hard currencies ( stablecoins ) has also become a popular option.

Gold Investing Mistakes You Can Easily Avoid

Over the past few years, gold investment has grown severalfold in popularity. National banks and small investors are actively buying up the precious metal.

At first glance, it seems that there is nothing easier than buying a gold bar or coin and then waiting for it to rise in price.

But even in such a simple matter, there are many nuances that should be taken into account if you are planning to invest in gold.

To avoid mistakes when investing in gold, you should first answer questions such as: What to buy, where to buy, when to buy and for how long?

Is it more profitable to invest in dividend-paying stocks or a bank deposit?

If you're wondering where to invest your money, you probably already understand that your savings will be quickly devalued by inflation.

Moreover, it is desirable that these savings be kept in hard currency, since high interest rates on deposits in national currencies are easily offset by losses from a depreciation of the exchange rate.

The simplest investment option today is still a bank deposit, but a reasonable question arises as to why large foreign investors prefer to invest their capital in company shares.

Let's try to evaluate what will bring more profit: shares or a bank deposit, and compare both of these investment options.

How to invest for a beginner investor: simple investments in stocks, bonds, or precious metals

Surprisingly, most people do not engage in long-term investing because of its complexity.

Not everyone wants to learn how to trade on the stock exchange through a professional broker and master the basics of working on a trading platform.

But today, there are simpler options for investing for a novice investor; all you need is a mobile phone and internet access.

We are talking about purchasing stocks, bonds, and precious metals through the Revolut bank app , which is available to residents of the European Union and, a few days ago, launched in Ukraine.

In my opinion, this is currently the easiest way for a beginning investor to invest money and then receive profit from dividends or from the growth in asset value.

Where to buy Pfizer Inc shares to receive dividends and profit from price growth

During periods of economic instability, pharmaceutical stocks often provide a safe haven, as their value is less dependent on politics and geopolitics.

Pfizer Inc. is one of the largest pharmaceutical companies in the world, with a current market capitalization of approximately US$150 billion.

The company produces drugs and vaccines. In 2024, its revenue was $63.6 billion, a 7% increase from 2023.

Net profit reached $8.03 billion, which is 4 times higher than the 2023 figure. In the fourth quarter of 2024, revenue increased by 21% to $17.8 billion.

The company consistently pays fairly decent dividends; last year, the dividend amount was about 6.65% per annum.

Stocks or real estate: which investment will yield greater returns over 10 years?

Those who have money understand very well that earning capital is only half the battle; it is much more difficult to preserve the funds you have.

The simplest option is to keep your money on deposit, but when it comes to foreign currency deposits, the interest rate is usually lower than the inflation rate, and as a result, your savings depreciate.

Therefore, many potential investors are thinking about investing in real estate or buying company shares.

But this raises the question: What will bring more profit, stocks or real estate, in the long term?

Cryptocurrencies with the highest staking yields

Cryptocurrency staking has become one of the most popular ways to earn passive income in the cryptocurrency industry.

The process involves "freezing" a certain amount of coins in a wallet or on an exchange to support the blockchain, for which users receive a reward in the form of interest.

However, returns vary depending on the chosen cryptocurrency and staking platform, but taking these indicators into account, you can earn up to 40% per annum.

staking as profitable today as people say?

In this article, we'll look at which cryptocurrencies offer the highest interest rates and compare the terms on different exchanges.

What to Invest in in 2025: Forecasts, Ideas, and Opportunities

2025 offers unique opportunities for investors as the global economy rapidly changes, providing new growth opportunities.

Innovative technologies, political reforms, and global trends create excellent conditions for those willing to keep up with the times.

It is important not only to preserve capital, but also to increase it by choosing the right investment areas.

How to Seize Investment Opportunities in 2025

In this article, we'll break down key assets, provide specific examples, and introduce you to analyst forecasts so you can make an informed decision.

What is more profitable for investment: a deposit or real estate?

Growing geopolitical tensions and a worsening economic crisis do not add to optimism, and the question of the safety of savings is becoming increasingly pressing.

Investors are trying to choose investment objects that will help them achieve maximum profit and compensate for rising inflation .

Today, some of the most popular investment options are bank deposits and residential real estate.

In this case, the profit from deposits is interest, and the profit from investments in real estate is both the growth in the value of the real estate itself and the income from renting it out.

What to choose: the euro or the Swiss franc?

Over the past few decades, we have become accustomed to mistrusting the national currency, whose exchange rate has fallen several times in relation to major world currencies.

Therefore, the majority of the population prefers to keep money in currencies such as the US dollar, euro or Swiss franc.

The first two currencies are the most popular, but after the onset of the crisis and their sharp decline, many people are thinking about saving in Swiss francs.

Because the Swiss currency is used as an asset for storing savings along with gold.

Moreover, due to the decline in confidence in the US dollar, most investors today are choosing between the euro and the Swiss franc.

An affordable alternative to a bank deposit

The simplest and most accessible investment option at the moment remains a bank deposit.

However, a bank deposit can be blocked as a result of court decisions and other problems, so it is often necessary to find a worthy alternative to a bank deposit that cannot be accessed by enforcement authorities.

It's true that there aren't many decent options, but they do exist, and they're not difficult to use.

These options include staking for cryptocurrency deposits, deposits with stock brokers, and storing funds in financial institutions.

What to choose for investment: gold or real estate?

Once you have managed to earn a certain amount of money, the next task is to maintain its purchasing power.

On average, over ten years, your capital depreciates by half, meaning you can purchase far fewer goods and services with your accumulated money.

In order to avoid losing your accumulated money, you need to invest it in assets that show stable growth and increase their price faster than inflation .

The most popular investments among our citizens are investments in real estate and gold bars.

But which asset will be more profitable in the long term and will bring less worries to its investor?

Which stock should I choose: Airbus or Boeing?

The end of the pandemic and the lifting of COVID-19 restrictions helped restore demand for air travel.

This factor had a positive impact on the share prices of aircraft manufacturing companies, whose securities had significantly lost value during the pandemic.

Today, there are several reasons to say that investing in shares of aircraft manufacturing companies will bring good profits.

According to most experts, this market segment is currently undervalued, and the end of geopolitical tensions will serve as a good impetus for growth.

Investing in Ukraine: Where to invest to preserve capital

Those who have worked all their lives and saved money for a rainy day always face the question of how to preserve what they have earned

This problem is especially pressing for those in Ukraine, where the hryvnia is not considered a stable currency and its exchange rate miraculously remains at 40 hryvnias per dollar.

The ever-increasing inflation does not add to optimism; according to official data, it is 5.1%, but this figure may be significantly understated.

In these circumstances, many people today are faced with the question: where can they invest their money to preserve their capital? Is investing in Ukraine possible now?

What is a financial safety net and what size should it be?

After thirty years of age, every person begins to think about how to provide for themselves in case of unforeseen circumstances or create their own financial safety net.

A financial safety cushion is a reserve of funds that is formed through regular income, such as salaries, bonuses, or other financial receipts.

This reserve can be used for needs such as medicine, unscheduled repairs, or as a means of living during periods of unemployment.

Creating such a reserve is not difficult at all; the main thing is to approach the process creatively and learn to count.

Where to invest money for passive income

Even in these challenging times, there are still people who have managed to accumulate some savings, and they are faced with the pressing question of where to invest money for passive income.

After all, no one needs convincing anymore that unused capital is melting away before our eyes; over the past ten years, inflation even for the American dollar has been around 30%.

That means if you kept your money in cash US dollars, you have already lost a third of your savings in just ten years.

You can spend a long time analyzing possible investment options, comparing their profitability, but it is best to study this issue using a specific example.

Investments – sell or hold until the last?

Even with an uptrend, the price does not move upwards continuously; its rises are followed by corrections, after which growth resumes.

However, no one guarantees that the trend will reverse and that instead of making a profit, you will end up with losses.

For example, a Bitcoin purchased for $40,000 could have been sold for $60,000, but the opportunity was lost and the price fell below the purchase price.

Therefore, many investors ask themselves: Is it better to sell as soon as a certain profit is made or is it better to hold the position until the very end?

How to protect your investments from losses using stop-loss orders

Today, when investing money, you can't be 100% sure that tomorrow the situation will not change and seemingly profitable investments will turn out to be unprofitable.

Therefore, you constantly have to review your investment portfolio, but this does not always save you from losses.

In most cases, you simply don't have time to react to the price drop and sell the asset with quite large losses.

Imagine that you bought a gold bar, and gold began to fall in price. It could take a long time for information about the fall to reach you and for you to sell the metal, which would only increase your loss.

To minimize losses, it is advisable to use the option to automatically close an unsuccessful transaction, that is, use a stop loss.

What is more important when investing in stocks: price change or dividend size?

Investing in company shares is one of the most popular options if you want to invest money for the long term.

When buying securities, investors seek to make a profit. This profit can be achieved in two ways: through changes in the stock price or through dividends.

When choosing which shares to buy, most investors first pay attention to the amount of dividends the company pays.

But is this approach always correct, and is it justified to focus solely on dividend payments, which can generate more profit?

Profit from change in stock price

Stock price movements are the primary source of profit for investors hoping for rapid growth in their holdings. If the stock price rises, an investor can sell it at a higher price than they bought it, making a profit.

How much money do you need to save for retirement to live a normal life?

If you freelance or earn your living through trading, you don't have to rely on a pension fund to retire.

Unless you make payments to the pension fund yourself from your income, but even in this case, the minimum pension will most likely be calculated.

Therefore, it is advisable to ensure a dignified old age for yourself, through savings and successful investments.

But first of all, you should calculate how much you need to put aside for retirement in order to ensure a normal standard of living in old age.

Risks of investing in shares and options for hedging them

Many people associate long-term investments with investing money in an asset such as securities.

Most potential investors are primarily focused on the size of dividends that accrue when purchasing company shares.

But at the same time, we forget about the possible risks that exist in this area of investment, first of all, a decrease in the stock price.

This issue is especially relevant today, when most experts are warning of a high probability of recession in the US and other major economies. According to preliminary estimates, the probability of a recession in the United States by 2024 is estimated at 71%.

Page 1 of 3

- To the beginning

- Back

- 1

- 2

- 3

- Forward

- To the end