What is more important when investing in stocks: price change or dividend size?

Investing in company shares is one of the most popular options if you want to invest money for the long term.

When buying securities, investors seek to make a profit. This profit can be achieved in two ways: through changes in the stock price or through dividends.

When choosing which shares to buy, most investors first pay attention to the amount of dividends the company pays.

But is this approach always correct, and is it justified to focus solely on dividend payments, which can generate more profit?

Profit from change in stock price

Stock price movements are the primary source of profit for investors hoping for rapid growth in their holdings. If the stock price rises, an investor can sell it at a higher price than they bought it, making a profit.

Looking at the table, you can calculate what percentage of average annual profit some shares brought to their owners:

- Monster Beverage 6000%

- NetEase 2750%

- Apple 2450%

- Tyler Technologies 1650%

- Tractor Supply Co 1450%

- Booking Holdings 1350%

- j2 Global 1300%

- Old Dominion Freight 1150%

- Amazon 1000%

- Dorman Products 950%

So, if you had invested just $1,000 in Monster Beverage shares 20 years ago, your stock would now be worth $120,000.

There are many factors that can influence a stock's price, including:

- A company's financial results. If a company achieves good results, its stock price typically rises.

- Economic situation. If the economy is growing, the stock prices of companies from that country tend to rise.

- Political events. Political events can have both a positive and negative impact on stock prices.

How big is the dividend yield?

Dividends are a portion of a company's profits paid to its shareholders. The dividend amount is usually set by the company's board of directors and depends on the company's financial performance.

There's a lot of talk about dividends, but in reality, the interest paid to shareholders isn't that great:

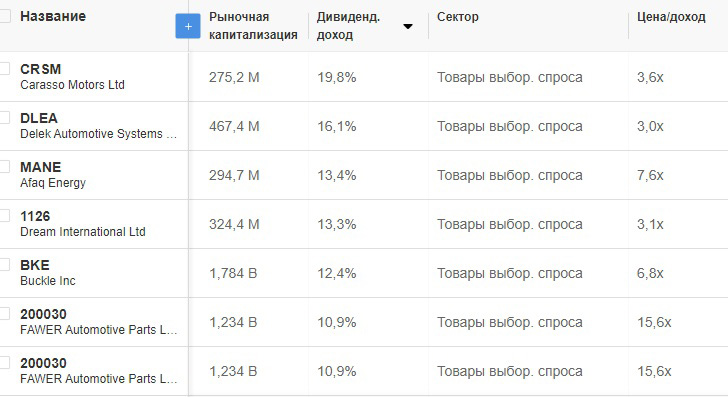

As you can see, the maximum payout does not exceed 20% per annum, and this is a rare exception. Large interest rates are typically paid by smaller companies in the hopes of attracting investors and increasing the market value of their shares.

For companies with a market capitalization of over $10 billion, dividends typically do not exceed 5% per annum.

Therefore, the answer is obvious: when choosing stocks, it's more effective to focus on the company's prospects, how dynamically it's growing, and how much money it's investing in development.

Using dividend size as the main argument in favor of choosing a stock is also quite risky, since if the stock price falls, you can lose not only the interest earned, but also the money invested.

Brokers where you can buy shares - https://time-forex.com/vsebrokery/brokery-fondowogo-rynka