Forex and Stock Market Trading Strategies

Basic trading options for working in the forex and stock markets, which are necessary for successful trading of currencies, cryptocurrencies, and securities.

The forex strategies presented in this section are described in detail and, in most cases, have been tested in practice.

CPI trading strategy in the foreign exchange market

There are many simple Forex strategies that even a novice trader can use. One of them is presented below. Its essence is as follows:

Fluctuations in the exchange rate of the national currency directly depend on the actions of the central bank and its interest rate .

When inflation accelerates, the regulator usually raises the rate to cool the economy and keep prices under control.

A higher rate makes the currency more attractive to investors, increasing demand and strengthening its exchange rate. If inflation slows, the central bank gains room to ease policy, weakening the currency and reducing the return on assets in that country.

A gold trading strategy for a newbie on the stock exchange

Today, there is a huge number of gold trading strategies, but almost all of them have one major drawback: the difficulty of using them for a novice investor.

Not long ago, a friend of mine asked me for advice. He wanted to know how to make money trading gold, and what strategy was best to use

Moreover, this was not about a banal investment of money in gold bars for an indefinite period, but about earning money over a short period of time.

The difficulty in answering the question posed was also due to the fact that my friend had never been involved in stock trading.

Pairs trading strategy in stock trading

Pairs trading is a fairly simple strategy that involves making a profit through the correlation of several assets.

That is, in stock trading, the principle is used: if the price of one asset rises, then another asset that has a direct correlation will also necessarily rise in price.

The concept of pairs trading originated in the 1980s thanks to mathematicians and quants at investment bank Morgan Stanley.

Since then, the strategy has undergone significant changes and development, becoming accessible and attractive to a wide range of investors.

Today, pairs trading is one of the most popular strategies in stock markets due to its unique ability to minimize risks and stabilize returns in any market conditions.

Copy Trading Strategy: Can You Blindly Trust Trading Gurus?

The saying that there is no need to reinvent the wheel is familiar to everyone, and its postulate can also be applied to stock trading.

This means that when trading on the stock exchange, it is not at all necessary to invent your own unique strategy; to make a profit, it is quite sufficient to copy the actions of leading financiers.

The essence of this strategy is that as soon as information appears that one of the large investors has acquired shares of a particular company, you also make a similar transaction.

For example, Warren Buffett invested in Japanese stocks, and you open a similar trade hoping for profit, because this man has made thousands of profitable trades.

Shorting Stocks: How to Make Money on Uncovered Trades

We are all accustomed to the fact that traditionally, earning money on securities involves buying them and then selling them at a higher price.

But after the advent of contracts for difference (CFD Contract For Difference), it became possible to enter into unsecured sales transactions, including on securities.

Exchange trades to sell are often referred to as short trades, which allows one to immediately indicate the direction of the open position.

Shorting stocks is when you sell securities without having them in hand, so to speak, borrowing shares of a particular company from a broker, and an amount equal to the current value of the security is debited from your account as collateral.

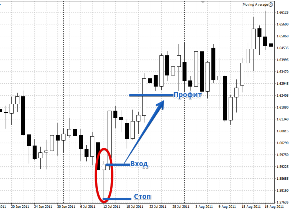

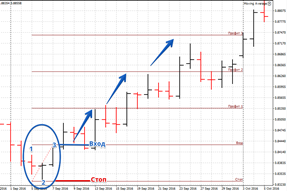

A simple strategy using pending buy and sell limit orders

Trading with pending orders is one of the most common strategies.

Most traders use buy and sell stop orders in their trading because they allow them to open trades with the trend.

However, limit pending orders are not as popular due to their complexity.

In fact, most traders simply don't know when to use this tool.

Furthermore, calculating entry points in this case is quite complex and requires some effort before placing a limit order.

Forex strategies based on interest rates

It's just that over the past 10 years of familiarity with the forex market, I've almost completely abandoned the use of overly complex trading methods.

Experience has shown that the more components you need to consider when formulating a strategy, the greater the likelihood that something will go wrong.

Furthermore, if you don't fully understand the essence of someone else's forex trading strategy, it doesn't make your trading more effective.

The process of preparation, setup, and testing itself can sometimes completely discourage trading, at least for me.

Therefore, to achieve profit, I almost always try to use the simplest forex strategies , ones that don't require extensive preparation or in-depth knowledge.

Win-Win Strategies for Forex Trading and More

Losing money on Forex is something almost every beginning trader faces.

It's a good thing you started with a small sum of a hundred or two hundred dollars, but it's also true if your deposit was tens of thousands.

After these losses, some quit trading, while others begin searching for sure-fire Forex strategies.

But do such strategies actually exist, or are they just hype from brokers and assurances from people selling their advisors?

Yes, there are indeed Forex trading strategies that, with some caveats, can be called sure-fire.

These options don't completely eliminate losses, but they reduce the likelihood of losses to virtually zero.

Strategy for a cent account

After the introduction of mini-lot trading on Forex, as small as 0.01 of a standard lot, the market became accessible to almost anyone. With the introduction of cent accounts, trading became possible for everyone.

A cent account allows trades to be opened starting from just $1. This account type is most often used to test new strategies.

This allows for a thorough testing of a new trading strategy while minimizing the risk of loss. However, in some cases, a cent account can also be used for profit.

What strategy should I use for a cent account in Forex?

Traders generally choose cent accounts because they require much less funds to get started.

Simple strategies used in Forex

Exchange trading has always been portrayed as something complex, something only seasoned professionals with Harvard or Stanford degrees can do.

But in reality, the secret to success lies in the approach used to generate profit.

You can create complex and cumbersome trading systems that are daunting to even look at, let alone trade in practice.

Or you can use simple strategies that make Forex trading understandable and accessible even to those with a high school education.

In fact, there are quite a few such trading options, and all of them are increasingly popular among most traders.

Even a newbie to the stock exchange can use them effectively.

Momentum Trading Strategy

Momentum trading is a short-term trading strategy widely used for profiting in the stock market, and has recently found its way into Forex.

The principle used to open trades with this strategy is quite simple, based on unusual price behavior.

This type of trading is often referred to as momentum trading, as the investor needs to notice the emergence of momentum and open an order in its direction.

Positions are opened based not on fundamental factors, as is typically the case in the stock market, but on price action statistics and technical analysis.

The strategy is quite complex to use, so it was previously only used by experienced traders.

The "Foundation" Strategy - It's Time to Make Money!

Profitable Forex trading is impossible without a proven trading strategy. Most money-making systems found freely available online prove useless in practice.

The main reason for this is the imperfection of indicators as an analytical tool.

An effective strategy must be based on statistically proven results and fundamental analysis.

Fundamental analysis is mentioned throughout the course for informational purposes.

All that novice traders know about it is limited to macroeconomic factors and the calendar of publications of significant events that can influence price fluctuations of exchange rates.

Mentors claim that to earn a profitable and stable income, it is enough to master a few technical analysis techniques and understand the functionality of standard oscillators.

Fork Strategy for Forex

One of the most common mistakes beginners make when developing strategies is going to extremes.

This occurs when they adhere to one type of analysis and completely ignore the advantages of another, which inevitably leads to a strategy consisting either solely of technical indicators or entirely of chart patterns.

However, the market isn't so simple and straightforward that it can be easily predicted, so more experienced traders use several different strategies in their trading.

They also employ strategies that are essentially built on a symbiosis of technical and graphical analysis. You'll learn about one such strategy in this article.

The "Fork" strategy is a unique trading method designed to generate profits by trading with the global trend during pullbacks.

Nahuatl Strategy

Any trader can choose between two paths: trend trading, which means following the crowd, or counter-trading, seeking a reversal point.

Both variations of this Forex strategy are quite common, and each has its own advantages and disadvantages.

For example, trading against the market requires nerves of steel and a large deposit.

Therefore, there's an unspoken rule among traders to always follow the trend, as this is the path to profitability with the least resistance.

However, trend trading isn't as simple as it might seem at first glance.

Victor Niederhoffer's Strategy

Many people have achieved success simply because they were in the right place at the right time, they successfully took advantage of the stock market rally and were able to make a fortune from it.

However, not all of them survived the crisis; their quickly earned fortunes were lost just as quickly.

It is the human ability to learn from one's mistakes that drives progress, allowing traders to progress very quickly.

However, while fools learn only from their own mistakes, smart people actually study the mistakes and advice of more experienced traders.

In this article, you'll learn the basic principles of a strategy that allows you to profit in Forex and other markets.

Viktor Niederhoffer's trading tips and rules.

Viktor Niederhoffer was one of the most flexible traders, effectively using both technical analysis for short-term trades and fundamental investing.

Forex Profit Strategy

Following the trend remains the top priority for almost every trader. A clearly directional market, also known as a trending market, can generate very high returns for all traders who follow it.

However, despite understanding the meaning of a trend and how to use it, most traders experience significant difficulties identifying it and finding entry points.

For this purpose, trend indicators are commonly used, which, with a slight delay, yet clearly determine the market direction.

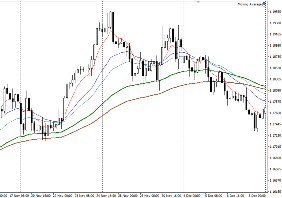

The Forex Profit strategy is a trend-following tactic based on two trend indicators, the Moving Average and Parabolic SAR, and is designed for trading any currency pair.

A specific feature of trend strategies is that they only perform well on higher time frames, but Forex Profit can also be used on a minute chart with minimal adjustments to the indicator settings.

Trading with Michael Marcus: The Golden Rules of a Great Investor

How many people do you know who have achieved success in the financial markets? How confident are you that their words are backed by real results, not just words?

A natural question arises: if you've rarely encountered such people, why do you trust advertising and stories about easy money, believe various analysts, and even follow their advice?

Michael Marcus, a renowned trader and investor who managed to turn $30,000 into $80 million, asked journalists similar questions during an interview.

The advice and strategy of a practicing trader like Michael Marcus provide real and necessary information, which can provide valuable insights for virtually any beginner.

In this article, we'll examine the key rules and fundamental principles upon which Michael Marcus based his forex trading strategies.

A Simple Correlation-Based Forex Strategy: What Have Brokers Been Hiding From Us?

In online trading terminology, the term "correlation" refers to the relationship in the pricing of financial instruments.

There's a well-known strategy for profiting from spread differences, based on correlation.

There's a well-known strategy for profiting from spread differences, based on correlation.

When working with reliable brokers who provide access to interbank liquidity, the difference between the asset's bid/ask prices (Bit/Ask) is always floating.

During periods of high liquidity (such as the publication of macroeconomic data), the spread widens, while during moderate liquidity, it stabilizes.

This variable liquidity is due to the predominance of demand over supply.

Moving Average Strategy "Fan"

Moving averages, or the correct name, are the very first technical indicator that was created specifically for the objective assessment of price movements by averaging its value over a certain period in order to cut out market noise.

Thanks to the simple averaging Traders were able to achieve better trend identification and, as a result, trend reversals.

It is this simple indicator that has become the basis for many other technical analysis tools, not to mention trend strategies, of which there are hundreds, and all of them have a right to exist.

However, for many, it remains a mystery to this day which Moving Average periods are optimal for trading, since each period has its own unique information content, taking into account a particular level of market noise.

In fact, there is no clear answer to this question, but at the same time, the practice of using several moving averages with different periods simultaneously is very widespread.

John Templeton's Trading Strategy

If we were to list the legendary figures of that era who were able to create enormous fortunes by name, we could include John Templeton.

It was this man who believed in the market at a time when all traders were only playing for a fall, for which he was rewarded with his first million.

The most interesting thing is that John Templeton cannot be called a trader in the classical sense of the word, because his trading principles and decision-making are more similar to the behavior of a classic investor.

In this article, you will learn the key rules and strategies that formed the basis of the future state.

John Templeton's Investing Strategies and Principles

1) Diversification of risk in all possible variationsJohn Templeton, unlike many traders and investors, masterfully manages his risks through diversification.

Inside Bar indicator-free strategy: my opinion

The use of candlestick patterns, price action, and a complete rejection of indicator-based Forex strategies are considered the pinnacle of professionalism among novice traders.

Of course, abandoning the so-called crutches allows us to significantly overcome the situation regarding signal delays.

After all, the entire trading process centers on price patterns, not secondary indicator tools, which in most cases have a lagging nature.

However, a single entry point is often far from sufficient, as sometimes what matters isn't the entry point itself, but how effectively the trader exits the position, whether they can reap the full profit from the price movement or close the trade immediately.

Therefore, the effectiveness of price action is greatly exaggerated.

Lewis Borsellino's Strategy: Effective Use of Technical Analysis.

Renowned stock market traders like Lewis Borsellino have left a huge legacy for the next generation of traders in the form of their books.

The books detail the technical methods the trader used to achieve his goals.

Lewis Borsellino argues that no two trading days are alike, as they are all different, and therefore, the tools needed for his analysis are completely different.

In this article, we will examine the technical methods and strategy Lewis Borsellino used in practice.

Trading Algorithm:

It may come as a surprise to many, but Lewis Borsellino is a vocal proponent of technical analysis. Moreover, he was one of the first day traders to trade in the so-called "Pit."

Nonfarm Payrolls Strategy

Fundamental analysis, which is extremely popular among traders trading stocks and other securities on the stock exchange, has come under justified criticism from traders in the foreign exchange market.

This is primarily due to the fact that the impact of financial statements on the price of one individual share simply cannot be compared with the impact of certain news on the exchange rate of the national currency of an entire country.

Unfortunately, fundamental analysis in the forex market has proven less effective, as exchange rate stability depends largely not only on economic indicators, but also on sound central bank policies and political leadership.

However, there is no need to be strictly tied to a specific scenario to trade successfully, as the very fact of a price impulse occurring at a certain time, as well as a sharp increase in liquidity, can become an excellent opportunity to implement any momentum trading strategy.

In this article, you'll learn about one such impulse strategy that allows you to profit from news such as Nonfarm Payrolls.

The Nonfarm Payrolls Strategy is a momentum trading strategy based on fundamental analysis, namely, based on such a key macroeconomic indicator of the US economy as Nonfarm Payrolls.

George Lane's Trading Strategy

The biography of any successful trader is full of curiosities and interesting moments that completely predetermine their life.

This probably happens to every extraordinary individual, because you'll agree that achieving such great heights and financial success is far from easy.

George Lane's life would have been different if he hadn't accidentally stumbled into the stock market.

A simple student dreaming of continuing a family line of doctors, he suddenly dropped everything and became a trader.

However, while almost everyone can read his biography, information about his trading strategy, capital management models, and the techniques that actually work is virtually nonexistent.

Why, you ask? Because his Forex strategies are banal and simple, and many of you have unwittingly used them in real trading.

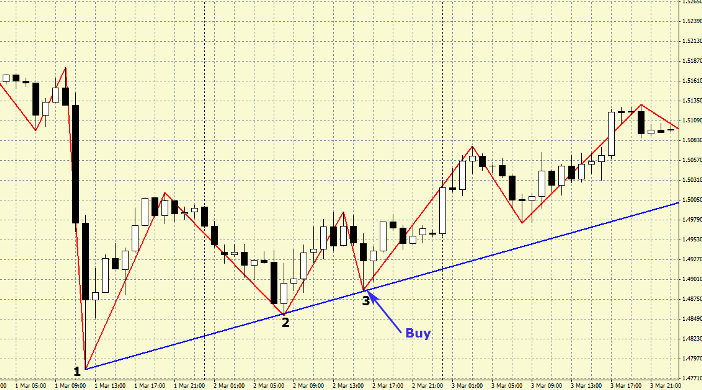

Trend Lines Strategy

Many novice traders, after studying graphical and technical analysis, typically begin to develop their own Forex trading strategies based on indicators.

The acquired knowledge of graphical analysis, such as support and resistance levels and trend lines, instantly vanishes from their minds, and if technical analysis is applied, it's done chaotically and unsystematically.

The fact is, people tend to trust something or someone more than simple things and themselves.

Thus, support and resistance levels and trend lines seem simpler and more effective at first glance, yet traders still prefer complex indicator systems.

There's a belief that graphical analysis hasn't worked in Forex for many years. However, in reality, almost no one approaches level analysis systematically, and only rarely does graphical analysis become a system with a set of clear rules and requirements.

Tudor Jones' Strategy: The King's Basic Techniques

Tudor Jones's biography still captivates many minds and hearts today, as he was the one who made money during periods of market panic and depression.

His investment fund was giving its investors 60 percent annual returns when most couldn't beat bank yields.

The life journey of this manager, who dropped out of school and devoted himself entirely to a career as a trader, simply cannot fail to amaze or motivate one to take action.

However, let's be honest, lyrics are lyrics, but a real trader should be interested not in the success story, but in what practical techniques he used that helped him achieve success.

So, in this article, you will learn the basic techniques and strategy used by the king of financial markets, Tudor Jones.

Practical tips and techniques used by Tudor Jones

If you study most of Jones's own statements, you might get the impression that he is a practically systemless trader, and his trading style is more reminiscent of improvisation based on the market situation.

Session Close or Day Close Strategy

To trade successfully on the Forex market, it's important to understand that once a position has been opened, the trader has virtually no control over anything, as the decision has already been made and all that remains is to wait for the outcome.

The reality is that we don't control the market, we can only follow it and not succumb to its provocations by controlling our emotional state!

However, in practice, traders do not realize this and, instead of starting to fight with themselves, they begin to trade intraday, scalp, and use strictly small time frames.

Such preferences of beginners are caused primarily by the desire to control the market, because by constantly opening positions and immediately closing them, that very feeling of control appears.

In practice, a higher number of bars has nothing to do with the quality of the signals, since the vast majority of them are nothing more than price noise that distracts your attention from the real signals.

Strategy for trading in the European Forex session

The impact of Forex trading sessions on the profitability and effectiveness of strategies simply cannot be underestimated.

So, many traders, and especially novice scalpers, make two fatal mistakes: they trade the wrong asset at the wrong time.

As a result, instead of observing an active market response to the received signal, the trader sees a very sluggish market.

Naturally, in conditions where the price is practically motionless and enters a deep flat, trading effectively is simply impossible due to the fact that the probability of losses increases significantly.

At the same time, traders who focus on just one trading session, which coincides with the peak market activity for a given currency pair, achieve phenomenal returns because they don't waste their time and energy on inactive market segments.

In fact, one of the most active trading sessions for major currency pairs is the European one, and in this article, we will look at a very simple scalping strategy designed specifically for this time period.

Bar Strategy: A Simple Market Analysis Method by John Benjamin

Human psychology is structured in such a way that as soon as big money is mentioned, it is associated with work of enormous complexity.

Therefore, most traders approach the choice of strategy based on the principle: the more complex the strategy, the more money it can bring.

This distorted perception of reality leads to a newcomer to the exchange immediately drowning in a mass of unnecessary information that is simply impossible to grasp without professional knowledge and experience.

Therefore, whether you are an experienced market participant or just starting out as a trader, you need to remember a simple truth: the simpler the strategy, the more profitable and resilient it will be to sudden market changes.

The Bar Strategy is a simple trading strategy based on a three-bar pattern that was first published and widely promoted by John Benjamin, a renowned analyst with over nine years of stock market trading experience.

Binario Strategy: Breakout of the Moving Average Channel

Forex trend strategies can provide huge potential profits with minimal risk.

This is very difficult to achieve when trading in a flat market or scalping , where the reward-to-risk ratio is typically one to one.

The downside of such strategies is the infrequency of signals, which are easily missed by leaving your desk for a few minutes.

The only way to resolve such situations is to abandon the use of market orders and instead build a strategy based on pending orders, which your broker will execute at any time without your intervention.

The Binario strategy is a trend-following breakout method based on moving averages, with the breakout detected and the trade opened using pre-placed pending orders in opposite directions.

DiNapoli Strategy.

The vast majority of traders are very biased towards trading methods from the distant past, as they are convinced that the markets have changed dramatically, and the tactics that were relevant 10-20 years ago are incapable of generating profit in today's realities.

Of course, there's some truth to this statement, but if you look at most modern Forex trading strategies, you'll see that they're based on the same old indicators, slightly modified.

Therefore, it's rather foolish to write off strategies that are more than a decade old, especially if they've generated huge profits.

One such strategy, which we'll examine in this article, was created by John DiNapoli, a renowned trader with over thirty years of trading experience.

It's worth noting that John DiNapoli described numerous approaches and market entry signals in his book, and this DiNapoli strategy is just one of them.

Another Simple System Strategy

When trading any trading strategy, it is crucial to correctly identify the current market trend and then consider signals to open in its direction.

Many traders underestimate the importance of identifying the global trend, although in fact, even those impulse strategies, in one way or another, are guided by global price movement.

Let's not even get into details, even if we look at it from a mathematical point of view, namely, taking the theory of probability, the chance of making a profit by following the price is an order of magnitude higher than if you take a position against it.

This is why trend strategies remain a viable tool in the Forex market, despite the fact that markets change and some indicators may become obsolete.

V. Barishpolts's strategy - "Surfing"

Viktor Barishpolets is one of the most notorious post-Soviet traders, who, at the peak of his popularity in 2007, closed his open-end hedge fund and ran off with a huge pile of money.

Victor earned credibility thanks to his openness; virtually all investors knew which accounts he was trading on and, most importantly, what strategy he was using.

Victor published a weekly newsletter in which he shared trading tactics and trained his own investors.

The most interesting thing is that the man actually traded on Forex, and anyone could see his trading statistics in real-time mode.

In his last letter, Victor mentioned that the forex fund was beginning to fall outside the law, as there was no formal tax accounting, and the rapid influx of people wanting to invest in it was only hastening its demise.

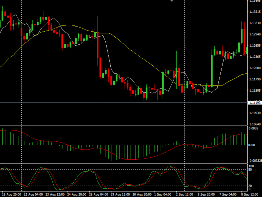

Forex Eyes Divegence Strategy

Following the global trend allows a trader to always stay afloat and be content with little, since, as a rule, it is only possible to determine the trend at the very end of the trend.

Millions of traders have made money simply by following the crowd, but the only ones who truly became rich were those who anticipated a reversal and entered a trade first.

Finding reversal points on Forex is the most dangerous and at the same time the most profitable business, because by opening a position before the start of a new trend, you cannot always guess the entry time.

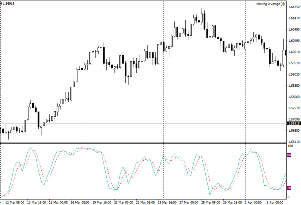

The Forex Eyes Divegence strategy is a special indicator strategy that has absorbed two reversal indicators

Namely, the predictive forex eye and the divergence of the MACD indicator.

Sidus Method Strategy

Trend trading requires a trader to be able to clearly identify market trends, but knowledge of one direction is not enough in practice.

The fact is that the presence of a global trend doesn't guarantee a stable move, as any global trend is made up of microtrends.

Moreover, a change in microtrends is usually accompanied by a kind of accumulation and price stall, during which it's unknown which category of traders will gain the majority and push the market.

This is why a price breakout from consolidation in the direction of the global trend is one of the strongest signals of any trend strategy on Forex, as the price very quickly reaches its target.

Cash Cow Trading Strategy

It's no secret that technical analysis, one way or another, is built on various patterns. Many people mistakenly believe that patterns exist solely in analysis candlestick chart, however, this is far from the case.

In fact, a pattern is a kind of regularity that has been repeated many times in history.

That is why crossing moving averages, breaking through support and resistance levels, and entering the market based on an oscillator are pattern trading.

Actually, let's be honest, a pattern is just ordinary statistics that we record and process on a daily basis.

However, there is one unspoken rule among traders that has stood the test of time.

Trading Strategy Using the TRO MultiPair Indicator

Determining the trend is the most important task of any trader trading on the live market or Forex.

However, each stock market player often sees the trend direction in his own way, since for some, a sequence of ascending candles on a minute chart indicates an upward trend,

For another, this segment may be the shadow of one of the descending candles on the hourly chart.

A logical question arises: who is right and how did they correctly determine the trend?

Strategy on the sma indicator

The simple moving average is one of the most effective technical analysis tools, used by most traders to determine both the trend direction and market entry points.

The moving average is one of the oldest technical analysis indicators and is used on virtually every exchange.

Naturally, the SMA as a standalone tool cannot demonstrate the effectiveness a trader expects from it.

Despite the SMA's versatility, it cannot capture all the nuances of market volatility, so a strategy based on the SMA indicator with additional filters is the optimal solution.

Impulse trading strategy.

The impulse trading strategy is the simplest and at the same time one of the most effective approaches for trading in financial markets.

Trading on market momentum boils down to buying rising assets and simultaneously selling falling ones.

Incidentally, a trader using a momentum strategy never delves into the underlying logic of what's happening, as they simply ride the tide, chasing the market's undulating movements.

Reasons why momentum strategies are profitable

To understand which direction a purchase or sale is taking, statistics are analyzed, specifically, a specific historical period is analyzed to determine the percentage deviation and the asset's current trend.

ema strategy

The exponential moving average is one of the most effective trend indicators. The EMA is one of the oldest technical analysis indicators, used not only in stock and commodity markets but is still successfully used today in the Forex market and even in binary options trading.

This tool has become the basis for millions of different trading strategies, and its multi-tasking capabilities allow it to be applied in any market conditions.

However, EMA is primarily designed for trend analysis, so strategies based on it are typically trend-following.

The EMA strategy is one of the most common trend-following trading tactics, relying solely on moving averages and no other technical analysis indicators.

Trading strategy "Sniper"

The Sniper trading strategy is considered one of the most popular buying trading strategies in recent years in the Russian-speaking segment.

This tactic was invented by a certain Pavel Dmitriev, who positions himself as an established trader. He claims that this type of exchange trading is effective even when used by a novice trader.

Genesis Matrix Strategy

Scalping , as a trading style, involves the use of special trading tactics that are aimed at working with market noise.

There are a huge number of strategies online that are called scalping, but only a few are truly effective.

Unfortunately, applying any trading tactic on a five-minute chart is far from scalping, and when we do so, we're simply mistaking wishful thinking for reality.

Therefore, no matter how much you search for real, working tools specifically for scalping, you'll continue to run into the same pitfalls in the form of losses for a very long time.

The Genesis Matrix strategy is one of the most popular trading tactics, familiar to virtually every experienced scalper.

When the strategy first appeared on the market, it generated a huge amount of buzz, with enthusiastic reviews on various platforms.

Algorithmic strategies

According to recent data, algorithmic trading accounts for half of the trading volume of US stocks on the stock exchange.

Today, thanks to algorithms, millions of trades are executed on the stock exchange and forex market using ready-made algorithms that can completely replace human traders.

It's worth noting that specialized programs have enabled traders to open and close orders at incredibly fast speeds, leading to the development of high-frequency trading.

The history of algorithmic trading

It's no secret that, prior to the 1970s, stock exchange trading was conducted as auctions, with crowds of traders gathering on specialized platforms, paying for a seat, and conducting their transactions virtually by word of mouth.

Moving Average Strategy

Everyone's heard the famous stock market saying that the trend is your friend. However, determining the trend's direction and trading only in line with it is one of the most difficult tasks for any beginner.

To determine a Forex trend, you need to use various trend-following tools. If you want to develop a truly effective trading strategy, you simply must incorporate trend-following indicators into your strategy.

The moving average strategy is a trading strategy based on the most popular trend-following technical indicator, the Moving Average . It's no secret that moving averages are the best way to clearly depict the current market trend, promptly indicate entry points, and also indicate a potential market reversal. The

moving average strategy we'll explore in this article uses three moving averages that indicate entry points, eliminate false signals, and allow you to identify the global trend.

Martingale strategy in binary options

Martingale is one of the most popular capital management methods, which is actively used in the Forex market and the stock exchange when trading almost any trading instrument.

actively used in the Forex market and the stock exchange when trading almost any trading instrument.

Yes, martingale is considered the most dangerous trading tactic, but at the same time, it is the most profitable, and the trader who uses it experiences virtually no psychological stress due to the absence of losses.

But is this true? Does the most popular capital management method for beginners in the binary options market work?

So, let's look into this issue in more detail and try to build a clear picture of the application of the martingale strategy in binary options.

Spread Trading Strategy

Every newbie or outsider, upon hearing the words "exchange" and "trading," assumes the purchase or sale of a specific asset with the aim of profiting from price differences.

the purchase or sale of a specific asset with the aim of profiting from price differences.

In fact, every trader who has never heard of spread trading is engaged in exactly this type of trading in the classic sense, where they try to buy or sell an asset with the goal of profiting from its intraday movement.

Simply put, for 90 percent of traders, trading boils down to simple speculation. However, speculative trading on a single asset is considered the riskiest method and approach when trading on the exchange.

After all, it’s all quite simple: if you entered into a purchase and the price went up by 100 points, you made money, but if the price went down, you lost those 100 points.

RSI Strategy

The RSI indicator is one of the most popular oscillators, used by almost all traders.

traders.

The abundance of trading signals, such as selling and buying in overbought and oversold zones, breakout of the average level and divergence, make it possible to use the indicator even on its own.

However, as practice shows, the RSI is very weak on its own in trending markets, so to enhance the effectiveness of this tool, it is most often used with additional trend indicators.

The RSI strategy is a universal trend strategy based on the most popular RSI oscillator.

Gann & Price Action Strategy - Trading with Signals

Many financial websites, including brokers, actively distribute forecasts for the near- term movement of certain currency pairs , futures, or CFDs.

term movement of certain currency pairs , futures, or CFDs.

For brokers, forecasts are another way to attract clients, as well as a way to enhance their own reputation.

However, regardless of the signal source's true purpose, broker signals offer a great opportunity for traders to gain insight from their peers. Some forecasts can not only help them adjust their opinions, but also benefit from using them in their trading.

FreshForex, like other brokers, offers its service and signals delivered directly to your email address, completely free of charge.

Minute MAX MACD Strategy

Compared to other trading tactics, scalping strategies allow you to achieve increased profitability in a short period of time.

Moreover, with proper capital management, the risk per position in points is usually so minimal that if you were using a trend strategy and received one stop order of 60 points, then with scalping you would have to allow 4-6 losing trades in a row to incur the same losses.

This increased profitability is achieved by capturing any micro movements that can be observed on the minute chart.

The minute strategy, like no other, requires the trader's full presence and a very cold-blooded trading tactic.

Fibonacci Strategy: Combining the Fibonacci Fan and MACD

Italian mathematician Fibonacci made an invaluable contribution to the development of technical analysis and helped more than one generation of traders achieve success with his tools.

analysis and helped more than one generation of traders achieve success with his tools.

Tools such as Fibonacci lines, arcs, zones, and fans are integral parts of many trading strategies.

The magical effect of these numbers and the processing of signals shatters into pieces all the claims of traders who use fundamental analysis about the ineffectiveness of technical analysis.

The Fibonacci strategy we want to offer you today is based on the Fibonacci fan and MACD .

For some reason, the fan chart isn't particularly popular among traders, as some beginners have difficulty constructing this tool and interpreting trading signals.

Forex Breakout Strategy

Trading sessions in the forex market are one of the key elements that keeps the market open 24/7. This is because each trading session is tied to a specific region, home to a major exchange.

trading session is tied to a specific region, home to a major exchange.

Thus, when a session closes in one region, it immediately begins in another. Geographical location can also lead to spikes in activity on certain trading instruments.

For example, the US dollar quotes move very actively during the American trading session , while the European currency is active during the European trading session.

And Asian currencies such as the Japanese yen are active during the Asian trading session.

Rollback strategy

Any strong trend movement sooner or later runs into some kind of support and resistance levels, as a result of which we can see a short-term price reversal.

resistance levels, as a result of which we can see a short-term price reversal.

In trader parlance, this situation is called a "Pullback," since the price rolls back a certain distance from the global trend, and then begins to move back in the direction of the global trend.

There is a common belief that rollbacks are deliberately created by large players in order to disrupt as many stop orders as possible from naive players.

Perhaps no one knows the truth, but if you think about it logically, pullbacks are most often formed due to positive news against the backdrop of a significant deterioration in the economy as a whole, or vice versa. It is not for nothing that sooner or later the next pullback develops into a new trend.

Forex indicator strategy "Trend trix Cycle"

The use of technical analysis is one of the main areas of trading within day trading.

trading.

By combining technical indicators, traders have the opportunity to create their own trading strategies, taking into account the pros and cons of each element. A well-designed combination allows you to structure your trading into a systematic approach, rather than chaotic trades without any basis for action.

The "Trend Trix Cycle" indicator-based Forex strategy allows you to trade any currency pair, as the combination of a trend indicator and a number of oscillators makes the strategy universal and unpretentious to a specific instrument.

Futures Strategy

Forex traders have developed a number of myths surrounding futures trading, primarily due to a lack of understanding of the nature of this contract.

a lack of understanding of the nature of this contract.

For example, some argue that only fundamental analysis works when trading futures, others argue that only technical analysis works, and there is a category of traders for whom futures are something out of the realm of fantasy, and they don’t even know which instruments actually work here.

A futures contract is a contract that obligates a supplier to sell a product at a pre-agreed price at a specified time, and a buyer to buy the product at a specified time at a pre-agreed price.

Let's say you think the euro will go up in a month, so you decide to enter into a futures contract at the current price so that you can receive your euros in a month at the current price, not at what might happen.

Martingale trading

Fear of losing money and an uncomfortable sense of tension constantly haunt traders when trading systematically. For a normal trading strategy, five losing trades in a row is normal, but such a losing streak puts intense psychological pressure on a trader.

a normal trading strategy, five losing trades in a row is normal, but such a losing streak puts intense psychological pressure on a trader.

Therefore, traders are always looking for a kind of Holy Grail that would allow them to always come out unscathed, despite the wrong direction of the transaction.

To avoid losses and psychological stress, martingale capital management was adapted from gambling to stock markets.

Swing Trading Strategy

As I expand my circle of contacts with traders, I come to the conclusion that, for some unknown reason, everyone likes to complicate their lives. Yes, life, and all because everyone is constantly creating complex indicator trading systems, staring at their monitors day and night, and their entire personal lives are transformed into a stock market game, leaving no time even for loved ones.

lives. Yes, life, and all because everyone is constantly creating complex indicator trading systems, staring at their monitors day and night, and their entire personal lives are transformed into a stock market game, leaving no time even for loved ones.

And everything would be fine, but success is also unlikely with this approach, because constantly chasing every point from the market, you will always be haunted by a series of mistakes, unexpected losses due to your emotional state, and strong psychological stress.

Swing trading is a specific trading tactic in which all work is conducted on daily and weekly charts, and its main goal is to take profits along the main trend and ignore intraday price fluctuations.

On average, a swing trader's trade lasts for at least three days, and the main rule of the strategy is to let profits grow, since the main trend is not as easy to change as it seems.

Bollinger Bands Strategy

We've all seen Bollinger Bands used in various trading strategies. The tool is so versatile and provides such a wide range of signals that it can be used by scalpers, pipsers, and swing .

The tool is so versatile and provides such a wide range of signals that it can be used by scalpers, pipsers, and swing .

I decided not to focus on the historical nuances and general properties of the indicator, since the general provisions were written earlier in the article Bollinger Bands, so let's get straight to the point.

If you take the time to read the book "Bollinger on Bollinger Bands," you will discover that even the author himself does not give clear recommendations on when to buy or sell.

John Bollinger provides no more than recommendations for its use, and it is up to you to decide how exactly to use the indicator from all the signal variations, depending on your style and the market situation.

Carry trade strategy

Many of you have heard the term "Carry Trade" when learning about currency pairs and trading tactics , but there is very little meaningful information about this trading tactic available online.

, but there is very little meaningful information about this trading tactic available online.

The point is that carry is a fee for providing a specific service. For example, if you were trading in a commodity market, you'd pay carry for storing your goods in a warehouse, while in the case of stocks, you pay the holder of your shares.

In the forex market, carry is charged by the broker for holding a position overnight, so sometimes when you look at open trades in your trading terminal, you may see a negative or positive value in the Swap column.

Effectiveness of news trading

There's a lot of discussion and speculation surrounding the effectiveness of news trading, but I haven't really come across any compelling arguments for the effectiveness or unprofitability of this approach.

I haven't really come across any compelling arguments for the effectiveness or unprofitability of this approach.

Typically, newbies point to examples of how news didn't work out, more experienced participants argue that it shouldn't have affected the market, and others are completely adamant about trading on the news and profess only technical analysis.

Therefore, if you choose to apply fundamental analysis to your trading, no one will give you a definitive answer as to whether macroeconomic news influences the Forex market, much less whether it can be effectively applied to your trading.

On the website, in the fundamental analysis section, you can find descriptions of various news items, as well as how they can affect a particular currency pair.

Trading strategy "Super scalper in the channel".

Everyone knows that scalping is an extremely profitable trading tactic. Ensuring successful trades while maintaining a tight stop loss is a basic rule for a successful scalper. However, to ensure profitable trading over the long term and react intelligently and quickly to any price fluctuations, you need to adhere to clear trading strategy rules.

trades while maintaining a tight stop loss is a basic rule for a successful scalper. However, to ensure profitable trading over the long term and react intelligently and quickly to any price fluctuations, you need to adhere to clear trading strategy rules.

The "Super Scalper in the Channel" trading strategy is a scalping trading strategy, and the scalping process itself takes place in a narrow channel, so the strategy can also be defined as a channel strategy.

It can be used on any currency pair, but is particularly effective on the EUR/USD, GBP/USD, and AUD/USD pairs. Trading is conducted on a one-minute chart, but if you notice poorly formed candlesticks, specifically, poorly formed ones, I recommend switching to a five-minute chart.

4H Box Breakout Trading Strategy

Trading success largely depends on the chosen trading strategy. However, as experience shows, most require traders to be at their computer 24/7, monitoring indicator readings, and reacting flexibly and quickly to any economic developments.

most require traders to be at their computer 24/7, monitoring indicator readings, and reacting flexibly and quickly to any economic developments.

But what about the average person with a family, a job, or a business? Not everyone makes a living from trading, and the stability of such a source of income is a matter of debate.

Unfortunately, there are many myths surrounding stock trading, including that the money is easy, you're not dependent on an employer, and you're left to your own devices and have complete independence.

While this is true in theory, the reality is that a successful trader spends more time at their desk than most of us would ever spend in an office. Not to mention the psychological strain and insomnia that can plague you at night due to the possibility of losing money.

3 Bar Buy/Low Set Up Trading Strategy

Traders often choose a single method of market analysis, whether it's indicators, candlestick analysis, volume, or other approaches. However, experience shows that relying on a single type of analysis is insufficient, so most strategies consist of multiple indicators that attempt to compensate for each other's weaknesses.

experience shows that relying on a single type of analysis is insufficient, so most strategies consist of multiple indicators that attempt to compensate for each other's weaknesses.

In today's article, I'd like to share a combined Forex trading strategy that incorporates both indicators and Japanese candlestick analysis . While you won't see any complex patterns, you will learn how to build a unique, profitable trading system using a simple combination of candlesticks and a couple of standard indicators.

The 3 Bar Buy/Low Set Up trading strategy is based on two standard trend indicators: ADX with a period of 14 and a moving average with a period of 50. Before starting, select any time frame for any currency pair, but preferably from H1, and switch the chart type to candlestick.

You can trade any pair, so the choice of pair is yours. As you know, candlestick patterns and candlestick analysis remain relevant on any pair and on any time frame.

Japanese Candlestick Strategy – The Grail That People Don’t Want to Notice.

Every day, traders try to find new schemes for making a profit on the stock exchange, assuming that the secret lies precisely in them.

Various indicators, Forex trading strategies, advisors, mathematical models, and simply intuition are not enough to trade successfully.

Forex trading strategies, advisors, mathematical models, and simply intuition are not enough to trade successfully.

Sometimes new sophisticated methods just boggle the mind, and what's even scarier is that these would-be inventors create trading schools and try to teach you how to trade, not to mention the money and time you're wasting.

Having worked in the market for a long time and used a bunch of technical analysis methods, I realized one, but the most important and simple truth.

No indicator or trading strategy can give me more information about the state of the market than the price and its chart.

Folding Rule Strategy

Greetings, dear visitors. Many of you sooner or later come to the conclusion that finding a trend reversal point is one of the best ways to make money on the stock market.

a trend reversal point is one of the best ways to make money on the stock market.

Another important fact is that identifying a reversal point in a timely manner will help you always exit a position promptly, without losing your profit.

Various indicators are available on various resources whose primary purpose is to identify such points.

But, unfortunately, as a rule, all these indicators give losing signals that are in no way connected with a price reversal.

Today I would like to introduce you to a well-known pattern called the “Folding Ruler”, which is based on technical analysis .

Forex Smart Trading Strategy

The success of a trading strategy largely depends on the volatility of the currency pair. Anyone who's tried trading on shorter time frames has noticed that the price, before moving in the desired direction, manages to reverse two or three times, hitting all stops.

has noticed that the price, before moving in the desired direction, manages to reverse two or three times, hitting all stops.

This is due to the high volatility of the asset, which, unfortunately, we cannot influence in any way.

The Forex Smart trading strategy suggests that we avoid such unexpected price surges by trading on a four-hour chart.

It's no wonder most professionals trade on daily and four-hour charts; volatility is much lower on these time frames, and you won't encounter any market noise.

Breakout strategy of minimum (maximum).

Most analysts believe that if the price breaks yesterday's high or low, it's highly likely that this movement will continue for some time.

will continue for some time.

The key is to create a proper trading system that guarantees profits, which isn't as difficult as it seems.

However, one drawback is the infrequent opening of trades, as breakouts don't happen every day, meaning the conditions for opening a trade may not arise.

Trading is conducted using pending orders, the principles of which are quite simple; the key is to set stops correctly.

Best Forex Strategies.

During my forex trading career, I've tried a ton of different trading systems, and now I'd like to highlight the best Forex strategies.

now I'd like to highlight the best Forex strategies.

They all have one thing in common: they generate profit, although each option differs in complexity of use and the level of profit obtained, so let's look at them in more detail.

As with any other endeavor, choosing a Forex trading strategy should be based on your personal characteristics. For example, cholerics are advised against trading long-term timeframes; they will likely close the trade before the intended time.

So let's move on to a review and description of the most profitable trading options.

Parabolic trading strategy on moving averages.

Using the Parabolic Sar indicator in any Forex trading strategy always solves many problems that often arise when developing your own trading system.

arise when developing your own trading system.

Indeed, it's not for nothing that many traders call the Parabolic indicator a trend guide, because using it you will never go against the market, and you will also have fewer problems with setting stop orders.

Thanks to its versatility and functionality, it's used in various trading strategies and expert advisors. I'll introduce you to one such trading strategy today.

The Parabolic Moving Average trading strategy is a trend-following strategy based on standard technical indicators from the Meta Trader 4 trading platform. This system is used on the EUR/USD, GBP/USD, and the beloved gold currency pair.

Fisher Trading Strategy

Strict adherence to a Forex trading strategy and money management rules are fundamental trading principles, without which no market participant has ever achieved success.

The Fisher trading strategy is one of the most common in trading on the foreign exchange market.

It is based on the well-known Fisher oscillator, which in turn has been used by traders for many years.

This indicator has always been the subject of much debate due to its tendency to redraw. However, if you've ever worked with any oscillator, you'll have noticed that its readings change as quickly as the price moves.

Therefore, this disadvantage is simultaneously an advantage, since your signals will always be relevant, and you will be able to clearly see any deviation from the indicator readings.

The "Traffic Light" trading strategy is a trading classic.

Greetings, dear visitors. Today I'd like to introduce you to one of the most popular trading strategies, one that most beginners eagerly begin their journey with.

strategies, one that most beginners eagerly begin their journey with.

Traffic Light is a multi-currency indicator trading system for trading on four-hour and daily charts.

There are many variations of this system online, as each trader begins to find some flaws and tries to patch them, but the framework and core of the strategy remains unchanged.

I've seen many examples of how "Traffic Light" is used on smaller time frames, but I can't say it's been very successful, since scalping on a five-minute chart requires changing the indicator settings.

EURUSD trading: how to make money on this currency pair.

The two currencies that make up this trading instrument make it incredibly popular, as they account for the majority of trades on the forex and domestic currency markets.

the majority of trades on the forex and domestic currency markets.

Trading the EURUSD currency pair is quite complex and has many unique aspects. This is due to the unstable exchange rates of the Euro and the US dollar, with numerous news releases throughout the day causing fluctuations, which hinders stable trading.

However, by analyzing the performance of this currency pair over a month, you can develop your own forex strategies.

Given the specifics of the EURUSD, there are two trading options:

Intraday Forex Strategies.

Most traders prefer to maintain trades exclusively within a single day. The popularity of intraday Forex strategies is due to a number of positive aspects that significantly influence the potential profit margin.

Forex strategies is due to a number of positive aspects that significantly influence the potential profit margin.

The main advantages of this type of trading are described in the article " Intraday Forex Trading ."

Intraday strategies are forex trading schemes that limit the opening and closing of orders to a single calendar date. This means that a trade opened today is closed before the end of the day.

A wide variety of strategies can be used for this type of trading. Below, we'll discuss the most effective and popular ones. We'll also discuss important aspects of intraday trading.

Averaging strategy.

A trend's movement is a curved line, in which segments moving in the direction of the main trend constitute a trend movement, while segments moving in the opposite direction constitute a correction.

movement, while segments moving in the opposite direction constitute a correction.

This trend characteristic is the basis for the averaging strategy in Forex; it is quite simple, as are most effective trading systems.

The averaging strategy involves opening additional positions when a trend correction is detected, thereby generating additional profit.

For greater efficiency and to avoid errors, this trading approach utilizes both technical and fundamental analysis.

Strategy for the lazy trader.

A similar trading option was developed for the stock market, but it can be adapted for Forex trading if desired.

The lazy trader strategy requires a fairly substantial capital base and virtually no leverage.

You also need a forex dealing center that supports long-term trading, as a trade can last anywhere from a few days to several weeks.

The essence of the forex strategy itself is quite simple: first, select several popular currency pairs whose price levels are at their lowest or highest.

Trading on cent accounts

As you know, forex trading offers not only standard accounts but also cent accounts, whose currency is the cent, a unit 100 times smaller than the standard unit of measurement.

currency is the cent, a unit 100 times smaller than the standard unit of measurement.

Furthermore, trading is conducted using micro lots, meaning you open a trade of 1 lot as usual, but in reality, it's only 1,000 units of currency, not 100,000.

This approach allows you to open trades with just a few dozen dollars in your balance.

Of course, trading on cent accounts has its own unique characteristics; there are even entire strategies that can yield a decent profit.

Strategy based on the T3MA indicator.

Indicator strategies for Forex trading are often difficult to apply in practice.

A strategy based on the T3MA indicator's signals, on the other hand, is extremely simple and doesn't require a high level of training.

The indicator is designed for trading the GBP/USD currency pair, but it can also be used on other currencies with similar trend dynamics.

Profitable strategy for a small deposit.

Most newbies enter the market with a small amount of capital, perhaps $50-$100 at most.

In this case, there are two options: trade small amounts and gradually increase your deposit, or try to ramp it up over a few days and immediately begin trading larger amounts.

These are obviously completely different Forex strategies, but both options are viable.

Channel trading.

The price of a Forex currency pair never moves in a straight line; it rises and then falls again, forming new highs and lows.

new highs and lows.

It is precisely this specific trend movement that makes it possible to create a price channel that can be used to formulate a Forex strategy.

Channel trading allows you to immediately get a more complete picture of the market and assess potential price reversals.

In the classic version, a channel is constructed based on minimum and maximum points; the minimums are used to construct a support line, while the maximums form the basis for a resistance line. These two lines form the boundaries of the price channel.

Trading against the trend.

Most recommendations talk about trading with the trend; this option is considered less risky and more promising.

risky and more promising.

But there is also counter-trend trading, which, surprisingly, also brings good profits to some traders.

Counter-trend trading is opening trades against the existing trend on the current or higher timeframe.

There are several variations of this type of trading, which form the basis for various Forex trading strategies.

Correlation Strategy.

It's no secret that there's a clear correlation between the prices of currencies and other financial assets. Almost every trader knows that when gold rises, the Australian dollar rises. This correlation can be observed almost everywhere; the key is to know how to exploit it correctly.

The Correlation Strategy involves identifying patterns in the price movements of specific currency pairs. Its simplicity and effectiveness are appealing. Using it doesn't require in-depth knowledge of technical analysis; a certain degree of observation is sufficient.

The easiest way to understand the essence of this Forex strategy is through specific trading examples, which can also serve as a model.

Supply and demand in Forex.

Concepts such as supply and demand are the basis for price formation on any market; it is the number of people willing to sell and buy that sets the price level on any exchange, and it doesn't matter what is being sold there—currency, gold, or cotton.

it is the number of people willing to sell and buy that sets the price level on any exchange, and it doesn't matter what is being sold there—currency, gold, or cotton.

Supply and demand also play a decisive role. Although the market itself is virtual, it is subject to generally accepted laws and principles.

A timely assessment of these two factors will allow you to develop the most profitable Forex strategies.

A Simple Forex Strategy for a Newbie

At one time, I, like most beginners, used ready-made Forex strategies and could not overcome the break-even point and even break even at the end of the month.

break-even point and even break even at the end of the month.

Most trades ended in losses, and the profits from successful ones were so small that they couldn't offset the previous losses.

As it turned out, the reason for this situation was purely psychological: according to probability theory, the number of losing and winning trades should be roughly equal.

But since most winning trades are closed prematurely, and some losing trades are closed later than expected, the overall financial results leave much to be desired. This prompted the desire to create a Forex strategy for beginners.

Stochastic strategy.

This trading option is completely universal; it can be used on any time frame and currency, and the deposit size is also not particularly important.

The only condition is the presence of a fairly dynamic trend on the Forex market and the absence of uncertainty in its movement.

The Stochastic strategy is highly effective and at the same time does not require a high level of training from the trader.

5-Minute Strategy for Forex Trading

The five-minute time frame has always been considered one of the most preferable for trading using the scalping strategy on Forex. Trading on it is no longer as fast as on M1, but it still allows for the use of high leverage.

The 5-minute strategy involves using the three-screen method in trading.

The 5-minute strategy involves using the three-screen method in trading.

This allows you to practically avoid installing additional indicators. All technical analysis of a currency pair's chart is reduced to a visual examination of the current situation.

The 5-minute trading strategy really works and allows you to make about 10% profit on a single trade, but certain conditions must be met for it to be applied in the Forex market.

An unconventional news trading strategy

When trading on the Forex market, exchange rate fluctuations are typically driven by news. Therefore, when searching for market entry points, one shouldn't completely abandon fundamental analysis.

When trading on the Forex market, exchange rate fluctuations are typically driven by news. Therefore, when searching for market entry points, one shouldn't completely abandon fundamental analysis.

Sometimes, reviewing and analyzing past events can help identify the causes of market movements. Technical analysis, however, only helps identify and implement key Forex patterns .

News trading should combine both methods of market research, only then will you be able to achieve the greatest efficiency.

The most profitable Forex strategy

Anyone who begins trading on the forex market strives to earn as much profit as possible. This is precisely the category of people who become traders, preferring this activity to simply going to work. Earnings on the forex market depend largely on the forex strategy used, or, more precisely, on certain elements of trading.

Earnings on the forex market depend largely on the forex strategy used, or, more precisely, on certain elements of trading.

Which can be used in almost any trading option, regardless of the chosen asset.

The most profitable Forex strategy can generate up to 1000 percent or more per month, thereby increasing the initial deposit tenfold.

Moreover, this statement is based on real facts, when in just one trading session, the deposit increased several times.

Trendline Strategy

When trading Forex, you can discover a variety of patterns. Simply observing a currency pair's chart is enough. Once you notice recurring patterns, you can then develop your own trading strategy.

Many Forex strategies are built on this principle, and the trend line strategy is no exception.

It is suitable for any currency pair and can also be used in trading with other trading instruments available in the MetaTrader 4 trading terminal.

Trading takes place on a five-minute M5 time frame, and to identify market entry points, a one-hour H1 time frame will be used. This approach will allow us to work only in the direction of the main trend, without paying attention to price rollbacks.

The trend line strategy is one of the most versatile and can be applied to various timeframes and any instruments. To get started, you only need to draw one trend line.

The simplest forex strategy

This trading option is truly the simplest Forex strategy, as anyone can use it.

If you follow the recommendations precisely, it allows you to make a good profit from a relatively small deposit.

Its use does not require any special knowledge, so it is suitable for traders with any level of knowledge

The application is based on the use of visual analysis of the current market situation. All you need to do is carefully study the chart of the selected currency pair and correctly calculate the transaction volume.

Installation of additional indicators is only at your discretion and is not mandatory.

The best scalping

There are several fairly common variations of the scalping trading strategy on Forex, all of them are quite similar to each other, but still have many differences.

The main ones are the duration of transactions and the amount of profit received as a result of one operation.

Each trader chooses the most suitable option for themselves, but the best scalping, in my opinion, is trading on 15 minutes with a profit of at least 10 pips from one trade.

Pipsing on short timeframes puts a lot of psychological strain on you; you simply don't have time to analyze the situation, and as a result, you end up with more losing trades than profitable ones.

Besides, trading on M1 is simply physically difficult, and trading is work, and you have to work constantly, since on a minute time frame, you earn only a couple of pips from one trade.

Indicator-free Forex strategy

This option is suitable for those who do not trust the technical tools installed in the trader's trading terminal.

Or he uses a web terminal, which does not always allow him to use the required indicator due to limited functionality.

It is based on the use of pending orders and is so simple that even a novice trader can use it.

The indicator-free strategy is based on visual analysis of the trend and the determination of certain price levels, based on which market entry points are calculated.

Trading is based on opening trades after a certain price level is broken. This means that your order is triggered when the price level that was used as a benchmark for choosing the market entry point is broken.

Pending Order Strategy

Forex trading strategies using pending orders are among the most profitable options for trading on the currency exchange. They allow for partial automation of the order-opening process and relieve the trader's psychological stress.

They are based on placing pending orders at a certain price level, upon reaching which a transaction will be opened.

You can also pre-set additional conditions, upon reaching which the open position will be closed.

The trading terminal allows you to set several pending order options and specify the duration of its existence.

The pending order strategy is highly profitable and effective. Most such trades close positively, making this trading method 100% effective.

Trading strategy for breaking through support or resistance levels

If you look at any of the currency pair charts, you will immediately notice that the price of this instrument does not move in a straight line.

Its movement clearly identifies minimums and maximums, which will serve as the basis for a forex breakout strategy.

The level breakout strategy involves breaking through price boundaries, which are best represented by support and resistance lines.

The channel forex indicator is ideal for constructing them .

Its convenience lies in the fact that it immediately plots support and resistance lines on several time intervals, and you can easily find points for placing orders, regardless of which time frame you are working on.

In the same case, if you plot these levels manually, it is very difficult for them to coincide on several time frames selected for analysis.

And it is always easier to automate graphical constructions than to do it manually.

Simple hedging strategies

Hedging is a method of reducing losses when trading Forex or stocks. It involves opening opposite positions to losing trades.

It should be noted, however, that there are other options that are used in the stock market.

This technique has almost equal numbers of supporters and opponents, depending on the methods of hedging and the specific conditions under which trading takes place.

One way or another, forex hedging strategies have their right to exist, and with careful fine-tuning, they can sometimes help pull off seemingly hopeless trades.

Example of use : There is an uptrend on the currency pair chart, you open a trade of 1 lot in its direction.

Forex News Trading: A Simple Strategy for Profitable Trading

Trading on Forex news is a very popular option among most currency traders.

These strategies gained their popularity due to such properties as ease of use and a high level of predictability.

These strategies gained their popularity due to such properties as ease of use and a high level of predictability.

The essence of trading on Forex news is that after the release of an important announcement, one can predict with almost 90% certainty which direction the exchange rate of a particular currency will move.

To earn money using the system, you don't need to have a lot of knowledge in the field of finance.

The main thing is to know how a particular fundamental factor influences the price of a currency, and after its appearance, open a trade in the desired direction.

Elder's Three Screen Strategy - detailed description, indicators, books

This trading method is used by most Forex traders, who don't even realize that their work is based on the "Elder's Three Screen Strategy.".

This trading option is so simple that almost any novice trader can use it.

It's also worth noting its complete versatility; the three-screen strategy can be applied to virtually any trading instrument, both on the Forex market and on other financial markets.

Elder's Three Screens can be used as a standalone trading option or as a complement to other forex trading options.

It's true that there are quite a few different opinions about the effectiveness of this strategy; everything depends on the market situation, your attentiveness, and your experience.

As the name suggests, trading is based on the analysis of three screens, or time intervals, of the trading terminal.

A simple flat trading strategy for Forex and stock market trading

The trend does not always move upward or downward; sometimes the market becomes relatively calm and the price moves horizontally. Many traders consider such moments unfavorable for trading.

On the contrary, it is precisely at this time that I earn the greatest profit; when using the flat strategy on Forex, it practically does not fail.

The flat strategy is extremely simple; it is based on placing pending orders that are triggered immediately after the emergence of a dynamic trend.

In practice, you are conducting automated trading, participating in trading only at the very beginning, setting the main parameters of a new order.

A new order will open if a new trend begins and will close as soon as the profit reaches the level you set.

Scalping in a price channel

The basis of this forex strategy is price fluctuations within a price channel; it is the range of trend movement that will serve as a guideline for opening trades.

Looking at any currency pair chart, you'll immediately notice that the one-minute timeframe clearly shows the underlying trend and price pullbacks.

Looking at any currency pair chart, you'll immediately notice that the one-minute timeframe clearly shows the underlying trend and price pullbacks.

If the correction value is greater than 10 points, you can try trading in both directions, thereby earning more in the same period of time.

The work begins with constructing a price channel. The easiest way to do this is by installing one of the channel indicators of your choice in the trader's trading terminal.

The main thing is that it independently builds support and resistance lines on a minute time frame.

A gap strategy that guarantees profits from price gaps

A more detailed study of the historical characteristics of trend movement reveals a host of patterns that, one way or another, help shape Forex strategies.