Averaging in Forex.

There are many different trading tactics in Forex, including some quite dangerous ones. Averaging is one of them. In some ways, this trading approach resembles Martingale, but at the same time, it has its own distinctive features.

Averaging in Forex is a counter-trend strategy in hopes of a quick reversal or major correction. Using this technique, a trader, despite current losses on existing positions, opens new ones in the same instrument and in the same direction.

The essence of this method is to balance the financial result by opening a second trade at a more favorable price. For example, by buying one lot of euros at 1.2545, you incurred a loss of 10 pips, and the current price is 1.2535. If you open a new order at the existing rate, then if it rises by just 5 pips (excluding the spread ), both trades can be closed with a breakeven result.

However, not all traders follow logical reasoning and wait for a trend correction. Most who use this method trade haphazardly, simply insisting on their conclusions regarding the existing trend.

Typically, it's the latter category that ends up losing their deposits and becoming disillusioned with trading. The main reasons they use averaging are a lack of practical experience, errors in trend identification, and false hope for a quick trend reversal.

Another reason for using averaging in Forex is fluctuations in open positions. For example, a long trade opened with a loss of 15 pips, but then the loss begins to narrow and is now only 10 pips. The trader begins to believe the price has moved at the right rate and opens another order. However, just a few minutes later, the price begins to fall again, and the loss on the first trade is now 20 pips, and on the second, 10.

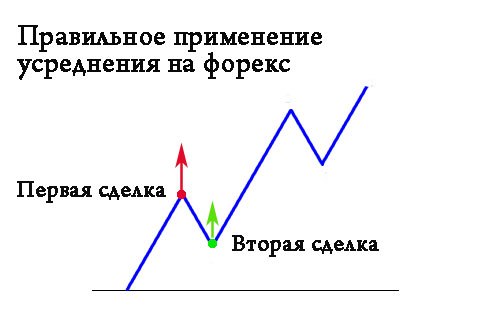

At the same time, there are successful examples of using averaging, but in these cases, it's important to choose the right entry point when opening the next order. And understand whether a trend reversal or correction . Once you've determined the actual state of affairs, find the nearest price minimum or maximum and open a trade.

The tactic is quite simple; an example of its application is clearly shown in the figure below.

But even with all the precautions taken, most Forex professionals still advise against using averaging in your trading, and it's better to close the trade at a loss and conduct a new technical analysis .

But even with all the precautions taken, most Forex professionals still advise against using averaging in your trading, and it's better to close the trade at a loss and conduct a new technical analysis .