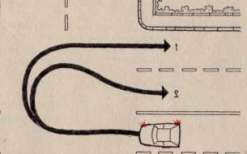

Reversal with doubling.

A Forex trend consists of fluctuations in the exchange rate, some of which occur against the main trend. For example, if the price of a currency pair is rising, it's highly likely to fall soon, even if only by a few pips. The "Reversal and Double" tactic is based on this fact.

occur against the main trend. For example, if the price of a currency pair is rising, it's highly likely to fall soon, even if only by a few pips. The "Reversal and Double" tactic is based on this fact.

When opening a position, traders are confident they've chosen the right direction, but this belief isn't always true, and losses on a recently opened order continue to mount. In this case, the position reversal tactic is used.

The key to using this tactic is choosing the right place to close a Forex position and reenter the market to avoid making another mistake.

A practical example illustrates the use of a reversal tactic:

You open a buy trade of 1 lot on Forex , regardless of leverage or the currency pair being traded. The key is that the price highs and lows are clearly visible on the chart.

After a few minutes of trading, the price moves against your position and reaches the nearest low opposite to your uptrend.

This gradually breaks through, effectively signaling a trend reversal.

However, don't act hastily; after the price forms a new low, it will rise again. Close the first trade at its high, thereby minimizing losses, and simultaneously open a sell trade of 2 lots on the same currency pair.

This strategy offsets the losses incurred from the first order.

The final trade is closed as soon as the price begins to approach its previous low.

Despite its frequent use, the doubling-up reversal tactic has several weaknesses. Firstly, setting a stop-loss order ; it must be placed well beyond the most recent high or low. Secondly, if the price moves much further after breaking through the level, and the trader is trading with a poorly secured position, significant losses are possible.