Real-time commodity futures quotes

Futures are one of the popular financial instruments on the market, representing an agreement between two parties to buy or sell an asset in the future at a pre-agreed price.

They are widely used for both risk hedging and speculative trading. The key characteristic of any futures contract is its quote—the price at which the contract can be concluded at a given point in time.

A commodity futures quote is the current market price of a contract for a commodity or raw material, which is formed on the basis of supply and demand.

The informer below displays such important indicators as the current price, daily change in dollars, daily change in percentage, and time remaining until the contract expires:

Recommended brokers for futures trading.

Key indicators that may appear in commodity futures quotes

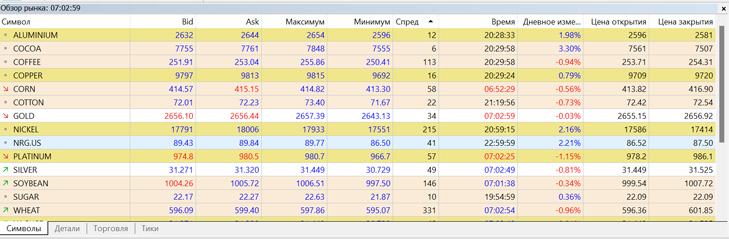

The online informer provides information only on basic indicators. For more comprehensive information, use the commodity futures quotes in the trading platform:

Bid Ask prices are the current cost of opening buy and sell trades.

Spread is the difference between the buy and sell price, or, in other words, the commission charged by the broker for opening a trade in commodity futures.

Opening price - This is the first price of a futures contract at the start of a trading session. The opening price is an important reference point for traders, as it indicates the starting point of trading for the current day.

Closing Price - This is the price at which a futures contract closes trading at the end of the trading session. The closing price is a key indicator that helps traders evaluate the day's results and predict potential market movements for the following day.

High Price - The maximum price for a given period (e.g., a day) reflects the highest level of demand for a futures contract. This indicator demonstrates the level the price could reach under conditions of increased demand.

Low Price - The minimum price of a futures contract over a period demonstrates the lowest level of demand for the contract. Traders often use this indicator to analyze possible market entry points.

Depending on the brokerage company and the settings in the trading platform, other futures contract quote indicators may also be displayed, such as transaction volumes, margins, and volatility.

Factors Affecting Commodity Futures Prices

Economic Indicators - Important macroeconomic data such as inflation, unemployment and interest rates have a significant impact on futures prices.

Changes in the underlying asset market - Since futures are linked to underlying assets (e.g., oil, gold, currencies), changes in the prices of these assets directly impact futures prices. An increase in the value of the underlying asset leads to an increase in the futures price of the asset.

Political Instability - Geopolitical events such as conflicts or changes in international trade agreements can dramatically impact futures prices.

Natural disasters and weather conditions - Natural phenomena also impact prices. For example, a drought can increase futures prices for agricultural commodities such as wheat or corn.

Futures contracts are used not only for short-term trading but also for long-term strategies. For example, investors can use futures to hedge their risks in the stock or commodity markets.

Commodity futures quotes are a crucial tool for assessing market conditions and making trading decisions. Knowing key quote indicators allows traders to better navigate market dynamics and maximize their futures trading profits. Understanding the factors that influence quotes not only helps protect your assets but also profit from market fluctuations.