Is it worth buying company shares now?

Many investors know that there are good and bad times to buy shares in the stock market.

One of the best options is to buy shares on a pullback, when the price of a security falls against the background of the general market sentiment, and this allows you to purchase the stock at a more favorable price.

This approach helps not only to buy shares at a reduced price, but also to receive higher dividends relative to the amount invested.

Let's figure out whether it's worth buying shares now or whether it's better to wait until the market offers a more attractive price.

The situation on global stock markets

To understand the market sentiment and whether it's profitable to buy stocks today, you need to assess the current levels of the major stock indices. It's important to understand how close they are to their historical highs and lows, as well as the current trends.

USA

The S&P 500 index , which reflects the performance of the largest US companies, is trading at historic highs. In mid-December 2025, it was at around 6,900 points, a record high.

Since the beginning of the year, the index has grown by 17%. Notably, the growth was supported by strong corporate earnings and expectations of monetary easing by the Federal Reserve System (Fed).

However, it's worth noting that current US stock valuations are high. The S&P 500 trades at a price-to-earnings ratio (P/E) of around 22, above the average of the past ten years (around 19). This suggests that stocks are overvalued and risk a reversal if negative factors arise.

Europe

The European STOXX 600 index, which includes Europe's largest companies, is also approaching records. As of mid-December, it was just 0.6% below its all-time high.

Growth was supported primarily by the financial sector and industry, including thanks to the expected slowdown in interest rate growth in Europe.

However, despite the positive data, European markets are not as overheated as their American counterparts. Many analysts believe there is potential for growth in European markets, especially if the EU economy continues to recover.

Asia

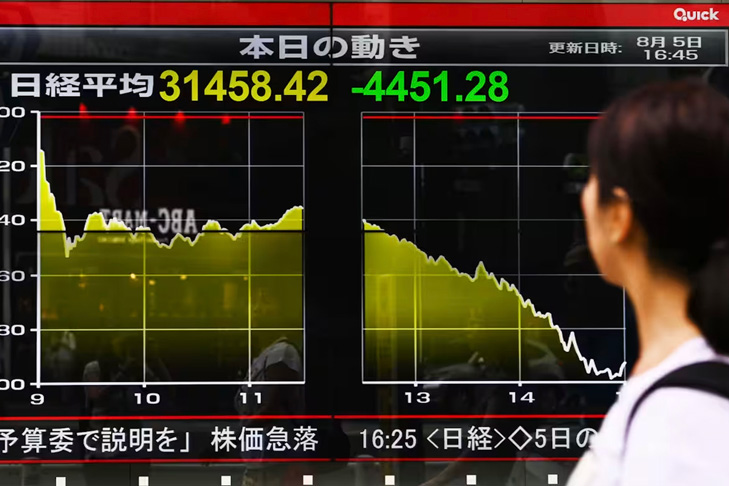

In Asia, the situation is more mixed. Japan's Nikkei 225 set a new record in October, but it corrected slightly in December. The index stabilized around 50,000, which remains a high but also signals a possible correction.

The situation in China and Hong Kong is more complex. Local indices are below historical highs, and there are concerns about a slowdown in China's economy and real estate problems.

Current price levels here look more attractive, which may indicate an opportunity to buy shares in these countries on a rebound.

Analysts' opinion

As we can see, the market situation varies, and analysts' opinions help us assess how events may develop in the near future.

| Analytical agency | Opinion | Recommendation |

|---|---|---|

| Goldman Sachs | Expects a 5-10% correction in the US market due to overvalued stocks. | Wait |

| JPMorgan | High risk at current levels, but growth could continue if monetary policy is eased in 2026. | Wait |

| Morgan Stanley | Forecasts short-term volatility, recommends being prepared for pullbacks in highly valued markets. | Wait |

| BlackRock | Recommends a cautious approach to purchases, with an emphasis on the European and Japanese markets, where growth is possible. | Buy |

| UBS | Advises to diversify the portfolio, preferring more stable assets such as bonds. | Buy |

Most leading analysts agree by the end of 2025 that markets are generally overheated and a correction is expected.

What to do now, buy or wait?

So, is it worth buying stocks now? The answer depends on your strategy and risk tolerance. Many markets are currently at high levels, making buying at the highs risky.

If you're looking for long-term investing, it's worth paying attention to pullbacks and using averaging strategies, buying shares gradually at each price correction.

If you're looking for short-term investments, it's best to exercise caution. Markets are expected to decline in the coming months, especially in the US and other overheated regions. Wait for a correction and buy stocks when their prices are more attractive.

Conclusion: It's worth buying stocks now, but proceed with caution. Use a buy-on-dip strategy and monitor market conditions in the coming months. Volatility or market declines will present a good opportunity to acquire shares at a better price.