Nikkei 225 stock index

We have become accustomed to the fact that the news most often talks about American stock indices, which reflect the mood on the US stock market.

But it is logical that in other countries there are also tools similar to the Dow Jones and NASDAQ 100 , which help assess the situation in certain sectors of the economy.

With many investors' attention focused on Japan's economy today, many will be interested in what the Japanese equivalent of the Dow Jones is.

The Japanese stock index Nikkei 225 (Nikkei 25) is one of the most significant indicators of the Japanese economy and is widely known throughout the world.

What is the Nikkei 225 Japanese stock index?

The Nikkei 225 is Japan's main stock index, reflecting the performance of 225 major companies listed on the Tokyo Stock Exchange.

The index was created in 1950 by one of the media corporations, Nihon Keizai Shimbun, and has since become an important tool for assessing the state of the Japanese economy.

The Nikkei 225 is of paramount importance to the global economy, as Japan is one of the world's largest economies. The index reflects the state of the Japanese stock market and serves as an important indicator for investors and traders worldwide.

The index is an indicator of Japan's economic growth and stability. Positive changes in the index often indicate the development of the Japanese economy and its attractiveness to foreign investors.

The selection of companies included in the Nikkei 225 is based on their market capitalization and liquidity. Full list of companies .

This includes such giants as:

- Toyota Motor Corp 196.9

- Keyence Corp 100.4

- Sony Group Corp 99.3

- Nippon Tel & Tel Corp 93.5

- SoftBank Group Corp 67.2

- Mitsubishi Group Inc 63.9

- KDDI Corp 62.6

- Daiichi Sankyo Co Ltd 61.2

- Fast Retailing Co Ltd 56.5

- Nintendo Co Ltd 49.5

- Recruit Holdings Co Ltd 42.7

Toyota Motor Corp., the leader, currently has a market capitalization of $196 billion. The total market capitalization of all companies comprising the index as of July 13, 2023, exceeds $6.86 trillion.

The index consists of companies from various industries, such as automotive, electronics, financial services, and others. This reflects the state of various sectors of the Japanese economy.

The History of Nikkei

The Nikkei 225 Japanese stock index is one of the most well-known and influential indices in the world. Created in 1950 by the Nihon Keizai Shimbun, it is now one of the most important indicators of the Japanese stock market.

The Nikkei 225 was created to reflect the state of the Japanese economy and select the most significant companies for inclusion in the index. Factors such as market capitalization, liquidity, and impact on the Japanese economy were considered in selecting companies.

At the time, Japan was just beginning to recover from World War II, and the Nikkei 225 played a major role in attracting foreign investment into the economy.

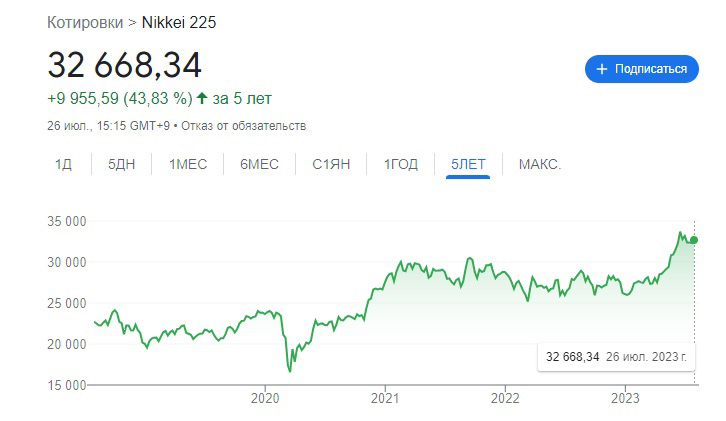

In its early years, the Nikkei 225 index grew relatively slowly. However, in the 1980s, the index began to rise rapidly, fueled by the Japanese economic boom. In 1989, the index reached its all-time high of 38,957.44 points.

Following the market crash of the 1990s, the Nikkei stagnated for many years. However, in recent years, the index has begun to recover and currently stands at 32,000 points.

The Nikkei index selects companies based on their importance and influence on the Japanese economy. The index includes 225 of the largest companies representing various industries, such as automotive, electronics, finance, and others. This reflects the state of various sectors of the Japanese economy and provides a more comprehensive picture of its development.

The composition is updated periodically to reflect market changes. This update occurs annually in September, when the index composition is revised.

Companies that do not meet the selection criteria or have lost their market significance may be excluded from the index, and new companies that meet the criteria may be included.

Nikkei 225 Index Value

The Nikkei 225 index is one of the most popular instruments for tracking the Japanese economy. It is also widely used as a benchmark for comparing the performance of Japanese companies.

The index's value can be used to predict the future performance of the Japanese economy. For example, if the Nikkei 225 index rises, it means the Japanese economy is growing. If the Nikkei 225 index falls, it means the Japanese economy is declining.

Furthermore, the Nikkei is also used to compare the performance of Japanese companies. For example, if the shares of a company included in the Nikkei 225 index grow faster than the index, it means the company is operating more efficiently than other companies on the list.

The Nikkei 225 index is an important tool for investors looking to invest in the Japanese economy. It allows investors to track the state of the Japanese economy and compare the performance of Japanese companies.

At the moment, almost all indicators predict an upward trend for this index, so buying trades will be profitable.