Trading on the Stock Exchange on Weekends, or How to Check if an Asset is Available for Trading

Not all traders and investors have the opportunity to trade on the stock exchange on weekdays, as they are busy with their main jobs at this time.

Therefore, people often ask whether it is possible to trade on weekends or holidays and how to take advantage of this opportunity?

In today's world, there are several options available that make exchange trading available virtually 24/7, meaning at any time.

However, there are certain nuances, which, if taken into account, will allow you to earn money at a time convenient for you.

How to install a trader's trading platform?

The key element, without which it is difficult to imagine modern exchange trading, is the trader's trading platform, or as it is also called, the trader's terminal.

It is in this program that trades are opened and closed, technical analysis is performed, and trading advisors operate.

Today there are several dozen similar programs, but the most popular of them are Metatrader fourth and fifth versions.

MetaTrader's main advantages are its versatility; it allows trading virtually any asset, and the program's popularity means it's available at virtually any broker.

Columns in the MT4 and MT5 market overview: hidden features of the trading platform

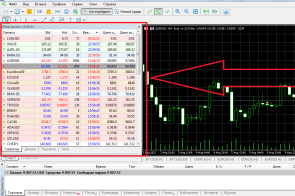

One of the most frequently used tools in the MetaTrader trading platform is the Market Watch information window.

This is where you can find out the current purchase and sale price of an asset, the spread size, and some other parameters.

Moreover, not all traders realize how many parameters can be displayed in the Market Review if they wish, by simply placing checkboxes in the right places.

Moreover, the difference between MetaTrader 4 and 5 is simply enormous. In MT4, you can use only 6 indicators, such as Bid and Ask, spread value, Maximum and Minimum prices, and Quote Time:

Basic account status parameters in the trading platform

Beginning traders, when opening their first trades on the exchange, ask a lot of questions, although answers to many of them can be found directly on the trading platform.

The MetaTrader trading platform is distinguished not only by its functionality but also by its information content, allowing you to obtain a wealth of information simply by looking at the open order indicators.

The main thing is to know what all these numbers mean that appear after you click buy or sell and a new order appears on the “Trading” tab.

Essentially, this tab contains the most complete information on the funds in your account and open positions in the trading platform; you just need to know how to use it.

Commission for the purchase of shares, its types and impact on the financial result of the transaction

Investing in securities can be called the second most popular way to save money after bank deposits.

Moreover, in some cases, the growth in the value of a security and the amount of dividends paid allows you to receive a profit greater than the interest on a bank deposit.

But unlike deposits, investing in securities isn't as straightforward as it seems. There's a commission when purchasing shares, and in some cases, a fee for carrying your position over to the next day.

Therefore, it is worth understanding which stock purchasing option is preferable for long-term investments, and which is suitable only for intraday transactions.

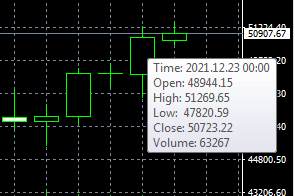

We use the data window to obtain complete information on the time frame

An important component of successful exchange trading is information about the price movement parameters of the selected asset.

Most traders use data such as minimum and maximum prices, opening and closing prices, and the volume of completed transactions in their work.

All this information is quite easy to obtain in the MetaTrader trading platform; all you need to do is hover your cursor over the desired candle on the currency pair chart.

After this, a tooltip displaying the above-mentioned data will appear on the screen. If it doesn't appear, you likely haven't checked the "Show OHLC" box in the chart settings.

Pip Value Calculator for Forex and Cryptocurrency Pairs

The smallest unit of price change on Forex is a pip, or, in other words, the last digit in the quote.

This value is quite important, as it often measures the speed of price movement and defines the parameters of trading strategies.

You can calculate the value of a pip on Forex either manually or using a special calculator.

The latter option is obviously preferable, as it allows you to quickly calculate and also review other parameters for the entered currency pair.

How to use the point value calculator and what does it show?

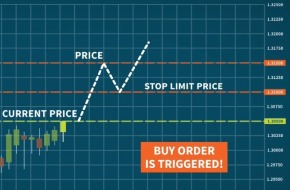

What are Stop Limit orders for?

If you trade in the MetaTrader 4 terminal, you've probably never heard of pending orders like Stop Limit.

We're more accustomed to using buy or sell stop orders, and buy or sell limit orders—they seem incredibly simple.

Stop orders are placed above the price during an uptrend or below the price during a downtrend, and are opened after the price has moved the required distance.

Limit orders assume a market correction and are placed against the trend, hoping the price will pull back and then move in the desired direction. Example of placing a Buy Limit.

This is all pretty clear, but why did MetaTrader 5 introduce buy and sell stop limit orders, which combine the names of familiar pending orders?

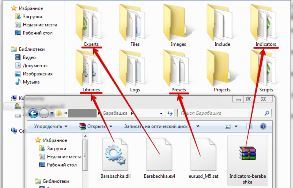

Install an Expert Advisor, Indicator, or Script in MetaTrader in a Few Clicks

Traders often need to use third-party scripts for the MetaTrader trading platform.

After downloading

scripts , expert advisors , indicators Previously, this process was accomplished by transferring the downloaded files to the appropriate folders in the trader's trading terminal.

However, progress continues, and after updating MetaTrader, you may suddenly find that the Experts, Indicators, or Scripts folders are no longer in their usual locations.

Don't worry; in fact, it's become much easier, and you can now install any script into your trading platform in just a couple of clicks.

What is a gap level?

Almost every trader who uses pending orders the concept of a gap .

After a weekend or during certain events, the price makes a sharp jump, creating a price gap between quotes.

As a result, the pending order is executed at a price significantly different from the one initially placed.

Typically, this is the first price that appears after the gap, that is, the first quote after the price break, but another execution option exists if the broker has a gap level

. The gap level is a value, in points, specified for each individual currency pair. If the price break is greater than or equal to this value, the order is executed at the first quote after the break. Otherwise, the order is executed at the pending order price.

MetaTrader for iPad: Similarities and Differences

The development of various communication technologies and the global Internet allows almost every trader to stay informed about all events.

While currency speculators previously could only trade through dedicated trading platforms installed on personal computers, you can now trade using your phone or tablet.

The fact is that progress does not stand still, and the smartphones and tablets that are being released are now an order of magnitude more powerful than the computers you bought just five years ago.

Naturally, with the advent of technological opportunity, programmers and brokerage companies They don't stand still, so the appearance of such applications didn't come as some kind of big news.

Methods for testing Forex strategies: choosing the best option.

Today, on many websites dedicated to forex topics, you can find dozens, if not hundreds, of different trading strategies.

Their vast number reflects the worldview of thousands of traders who poured their hearts and souls into creating their approach, not to mention the programmers who implemented these ideas.

However, it is a well-known fact that the market is volatile, so almost any trading tactic eventually becomes outdated and begins to bring losses instead of profits.

This is why many novice traders, having adopted someone else's strategy, tend to lose money and become forever disillusioned with the possibility of making money in the Forex market.

What is a swap in Forex and how much does its size affect profits?

Relatively few traders delve into the trading conditions offered by their broker, much less any commissions and costs that are independent of the company itself.

Forex swap a commission charged to a trader for holding a position overnight, is the same for all companies and is not subject to any brokerage regulations or preferences.

The additional cost or benefit a trader may experience beyond the spread has a simple mathematical explanation. It's worth noting that swaps can be beneficial or detrimental to the profitability of your trade.

The concept of swap and its importance in trading

Many traders mistakenly believe that the size of the fee for carrying a position depends solely on the broker, and some companies manage to speculate on the basis of traders' ignorance.

In reality, a forex swap is the difference in interest rates between the two countries involved in a currency pair, which is charged for holding a position overnight.

Installing multiple advisors - solutions

Traders who actively use automated trading strategies, or, in simpler terms, advisors, repeatedly encounter a number of problems regarding the compatibility of various experts.

a number of problems regarding the compatibility of various experts.

This is reflected in the fact that many simply do not know how to install several advisors on one account, in which cases it is necessary to separate robots, and in which cases their joint work is acceptable.

This problem isn't new, but with the understanding of the necessary diversification of risks from advisors, it becomes even more pressing. Any algorithm is only effective in a specific market segment, making your account vulnerable during bad periods.

This is why a portfolio approach to working with advisors, where multiple robots operate on a single account, is increasingly common. This allows traders to hedge risks , since while one robot is losing money, the second and third are generating profit, offsetting losses.

Locking in Forex

A competent approach to loss management and money management is perhaps one of the most important components, without which even the most profitable trading strategy will sooner or later become unprofitable.

A competent approach to loss management and money management is perhaps one of the most important components, without which even the most profitable trading strategy will sooner or later become unprofitable.

Essentially, this is a special approach to fixing losses, which is delayed in time, although it requires large financial expenses on the part of the trader.

Unlike a standard stop order, where a loss is immediately fixed, a lock allows you to delay the closure of unprofitable positions and, with the right approach, turn the situation around to your advantage.

Futures in the MetaTrader terminal

For the vast majority of forex traders, the MetaTrader trading platform is the only tool they use for trading. It so happens that almost all brokers in the forex market exclusively provide access to this platform, as it combines two key criteria: quality and a competitive license fee.

the only tool they use for trading. It so happens that almost all brokers in the forex market exclusively provide access to this platform, as it combines two key criteria: quality and a competitive license fee.

Many beginners don't even realize that MT4 and MT5 can be used not only for trading currencies and metals, but also for the well-known futures and stocks.

The program doesn't care which asset the trader is trading; all available instruments depend solely on the broker you choose. If the broker doesn't offer futures trading, you won't see them in the list of instruments, which also applies to stocks and indices. Therefore, if you want to trade futures, I recommend carefully reviewing the broker's trading conditions.

Blocking a trader's account.

One of the most critical problems you can encounter when trading forex is having your trader's account blocked. This is a fairly common occurrence, and you can become a victim simply through ignorance.

One of the most critical problems you can encounter when trading forex is having your trader's account blocked. This is a fairly common occurrence, and you can become a victim simply through ignorance.

As a result, not only are your funds blocked, but you won't even be able to access your account, leaving you to pester support with questions about the cause.

To avoid this, you need to know the reasons why a forex account can be blocked.

Hedging methods: How to protect your transactions

The primary objective of hedging is to protect transactions and capital. This is achieved by buying the underlying asset and selling the derivative, or vice versa.

by buying the underlying asset and selling the derivative, or vice versa.

Thus, the investor or manager conducts insured transactions, thanks to which the risk of capital loss is practically minimal, and the only thing the investor loses is the commission for opening and holding orders.

However, hedging is primarily used in the stock market, where the main objective is to save money from a possible price drop, while other various instruments can be used to compensate for losses.

Hedging is rarely used in the forex market, but certain instruments from the forex market can be used individually to protect the underlying asset from losses.

Opening a new forex position

To begin trading on Forex, you need to open a position. This action is performed in the trader's trading terminal and, despite its simplicity, raises many questions among novice traders.

the trader's trading terminal and, despite its simplicity, raises many questions among novice traders.

After all, it is necessary not only to open a position, but also to correctly choose the direction of the transaction and set all the relevant parameters of the future order.

Opening a Forex position consists of the following steps: choosing a currency pair, trading volume, setting stop-loss and take-profit, order type, and the direction of the trade.

It is advisable to enter all settings at once, especially regarding the value of stop orders.

In addition, before opening each new order, you should evaluate the current market situation in order to choose the correct direction for the future transaction and the optimal time for its existence.

Stop loss technique.

There are many options for setting stop-loss orders when trading Forex. Each method has its own advantages and disadvantages, so it's best to choose the one that best suits your strategy and deposit size.

so it's best to choose the one that best suits your strategy and deposit size.

Forex stops are designed to protect a deposit from a large drawdown and the triggering of a margin call or stop out , the latter of which can almost completely deprive a trader of their funds.

Let's review the main techniques used to set safety stops.

1. By levels – these levels can be support and resistance lines, significant highs and lows, or simply significant levels.

Psychological levels of Forex.

Forex trading is closely linked to psychology. Psychological factors often cause surges in supply or demand, which inevitably impact exchange rates.

supply or demand, which inevitably impact exchange rates.

Forex prices typically move within a certain price range, often defined by so-called psychological levels. Where are these levels located, and how are they formed?

Psychological Forex levels appear around round price values, as most traders believe that the price, having broken through a certain value, is more likely to move further than reverse. Examples of such levels include 1.2000; 1.3500; and 2.7550.

Risk Reduction or Risk Management in Forex.

Numerous articles have been written about risk management in forex, but this topic remains relevant. New solutions for reducing losses are constantly emerging.

relevant. New solutions for reducing losses are constantly emerging.

By using the right approach to trading, you can virtually eliminate the risk of losing your deposit, which is the main danger of forex trading for beginners.

Forex risk management includes the following measures and approaches.

Placing pending orders

Strategies based on placing pending orders generally yield more profit than working with a standard trading scheme.

a standard trading scheme.

The reason for this phenomenon is the exclusion of the psychological factor from the trading process, which only hinders making the right decisions.

A pending order allows you to set a price level upon reaching which a position will be opened. Furthermore, you also have the option to immediately limit the amount of losses by setting a stop-loss and plan the amount of profit using a take-profit.

Placing pending orders is not as simple a task as it may seem at first glance; when setting them correctly, a number of important aspects and parameters should be taken into account.

Beyond the purely technical aspects, you also need to determine where exactly to place a pending order so that when it triggers, it will generate a profit and not end up with a loss.

How to set a stop-loss

A stop-loss order is the primary way to reduce losses in Forex trading. It's essentially an order to forcefully close an order if losses reach a certain threshold. This approach prevents your deposit from being completely wiped out.

forcefully close an order if losses reach a certain threshold. This approach prevents your deposit from being completely wiped out.

The question of "How to set a stop-loss" is on the minds of every beginning trader, so in this article I will try to describe the solution to this problem in more detail.

There are several options for setting a stop-loss order, all based on different principles, and each trader chooses the most suitable one for themselves.

Professionals claim that the market situation should be the basis for placing stop orders, but there is also an alternative.

So let's look at the most common ways of setting stops, depending on trading conditions.

Choosing the direction of a trade during a gap in Forex.

gaps in stock trading. Most perceive them as punishment for not closing trades in a timely manner , and only a small percentage of traders regularly profit from gaps.

, and only a small percentage of traders regularly profit from gaps.

A gap is a price break that occurs when, for whatever reason, the market fails to reflect price movement in a quote.

The size of a price gap can range from a few points to several hundred points, depending on the strength of the factors that caused the gap.

Stop loss not triggered?

It would seem that setting a stop loss can protect a trader from various problems and limit the size of potential losses in advance. But where do accounts with negative balances and lost deposits come from?

where do accounts with negative balances and lost deposits come from?

These are primarily accounts that weren't opened with stop orders, but that's not what we're talking about here. In practice, situations often arise where a stop loss simply doesn't trigger.

These aren't common, but they do occur, so any trader should be prepared for such surprises.

How to set a take profit

Placing stop orders is one of the key aspects of Forex trading. Besides allowing you to significantly reduce losses, they also allow you to plan your profit in advance.

to significantly reduce losses, they also allow you to plan your profit in advance.

To do this, you should immediately set the take profit size when opening a new order, which will allow you to close the position when a certain profit level is reached.

How to set a take profit is a question that comes up quite often, so let's look at it in more detail. In addition to purely technical aspects, the correct calculation of the value of this order also plays a role.

After all, any trader hopes to get the maximum profit from a single transaction, but at the same time, the price can reverse without reaching the desired value, and then the transaction will most likely close with a loss.

Closing orders in Forex trading

Many novice traders mistakenly believe that the key to Forex trading is simply finding entry points into the market. It's equally important to hold an open position and close all open orders promptly.

entry points into the market. It's equally important to hold an open position and close all open orders promptly.

Closing orders can sometimes be crucial, as exiting the market in a timely manner can help maximize profits and avoid losses.

Maximizing profit from a single position is the key indicator of effective trading, as the number of losing positions is often greater than the number of profitable ones, and the total losses need to be covered.

There are several options available to complete a transaction, and choosing the most appropriate one depends on the strategy you use.

We're going to focus on profitable options, so we won't cover how stop-loss orders work. In this case, the order closes at a loss, with the exception of some options where the stop order is manually moved to the break-even zone.

Trader's web terminal.

Often, the list of offered trading platforms also includes a web terminal. What is it used for, what functionality does it offer, and whether it makes sense to use this trading option.

it makes sense to use this trading option.

A web terminal is a trader's terminal located on the brokerage company's website. This means that to trade, simply open an account and log in; there's no need to download or install anything on your computer.

To log in, you'll need an existing trader account and access credentials. A link to the web terminal is usually available in your personal account.

Number of simultaneously open positions.

Often, after the first open order starts generating profit, one's hand naturally gravitates toward opening another trade in the same direction.

direction.

Should this be done or is it better to avoid this practice? What is the optimal number of simultaneously open positions when trading Forex?

Answering this question definitively isn't easy; it all depends on factors such as the strategy used, the market situation, and technical capabilities.

Here are the main conditions under which it's advisable to add positions.

How to set a trailing stop and what this order represents

A trailing stop allows you to maximize your profits from the current trend by moving your stop loss along with the price movement and only closing your position if the trend reverses.

along with the price movement and only closing your position if the trend reverses.

That is, if the price moved 200 points in the desired direction, you will take all 200 minus the trailing stop size.

In fact, this is a floating stop loss, which is used in cases where you cannot control the trade at all times.

It's important to remember, however, that unlike the latter, this order only works when the trader's terminal is turned on, and if you turn off the terminal or computer, it will stop working.

The purpose of this tool is to close a profitable position with a profit and prevent a correction from completely destroying the positive financial result of the transaction.

How do I set a trailing stop? This order is placed in the trader's terminal after you've opened a position and begun trading. There are some nuances to working with this stop order, which I'll describe below.

Page 1 of 2

- To the beginning

- Back

- 1

- 2

- Forward

- To the end