Commission for the purchase of shares, its types and impact on the financial result of the transaction

Investing in securities can be called the second most popular way to save money after bank deposits.

Moreover, in some cases, the growth in the value of a security and the amount of dividends paid allows you to receive a profit greater than the interest on a bank deposit.

But unlike deposits, investing in securities isn't as straightforward as it seems. There's a commission when purchasing shares, and in some cases, a fee for carrying your position over to the next day.

Therefore, it is worth understanding which stock purchasing option is preferable for long-term investments, and which is suitable only for intraday transactions.

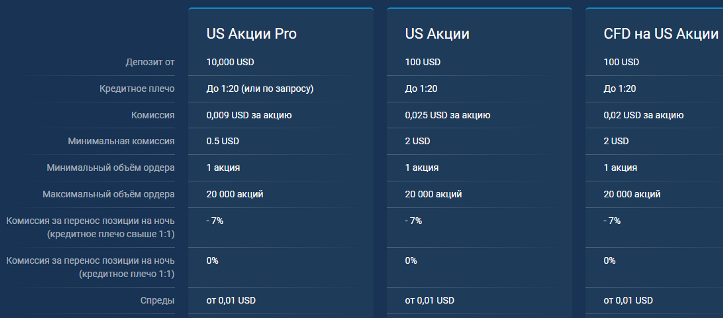

For clarity, you can compare for yourself how significant this difference is:

It's also worth noting that there is a difference in fees when trading on a PRO account compared to a standard account. Opening a PRO account requires a minimum deposit of $10,000.

The commission for purchasing shares starts at $0.009 for classic trading on a professional account, $0.025 for a standard account, and $0.020 per share for CFDs. This means you pay half as much when trading on a PRO account.

The minimum commission is the amount you pay when opening a trade: PRO account - $0.5, classic account - $2, CFD account - $2.

This becomes clearer with a specific example: you buy 1 share on a CFD account, but instead of $0.02, you pay $2 to open the trade. However, if you buy 100 shares, the opening fee would still be $2: 100 x $0.02 = $2.

Overnight commission – this fee is charged only if you use the broker's leverage and open trades with a volume greater than 1:1.

In this case, you'll pay 7% per annum on borrowed funds, or about 0.02% for a one-day rollover. For example, if your equity is 10,000, leverage is 1:3, and the trade size is 30,000, then 7% per annum is charged on the 20,000 amount.

Spreads for opening a deal – in addition to the commission, a spread is also charged when purchasing shares; its value is $0.01, regardless of the account type.

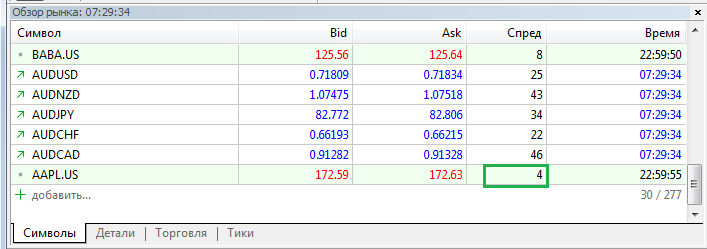

As you understand, this is the minimum fee, which may increase depending on the asset:

For example, the spread on Apple shares is 4 points or $0.04, given the share price of $172.

Analyzing the size of the commission when purchasing shares, we can say that it has virtually no significant impact on the financial result.

For example, you bought 100 Apple shares at $172 for $17,200. The trade entry fee would be commission + spread = $17.20 + (0.04 * 100) = $21.20. To recoup the entry fee, Apple shares would only need to rise by $0.22.

Stock trading brokers - https://time-forex.com/vsebrokery/brokery-fondowogo-rynka