CurrencyStrength indicator for mt4

Currency strength is an analytical tool that quantifies the relative strength of each currency in the Forex market.

It allows you to determine which currencies are in a growth trend and which are in a state of weakness.

The Force Index takes into account price movements relative to a basket of major currencies and helps traders better understand market structure.

The basic idea is simple: buy a strong currency and sell a weak one. This approach reduces risks and increases the chances of a successful trade, especially when trading pairs with a clear leader and an underdog.

Currency strength indicators are actively used in both short-term and long-term trading.

About the Currency Strength indicator (on the MT4 platform) and its settings

The tool calculates the strength of each currency based on the percentage change in its pair with the Japanese yen (e.g., USD vs. USDJPY, EUR vs. EURJPY, etc.). If the yen strengthens sharply, all other currencies may show negative values, while the JPY may show zero, reflecting market imbalance.

The algorithm is optimized for high speed and minimal load on the terminal, and data is updated every second to accurately track the current strength of currencies.

On the indicator panel in the MT4 terminal:

Current Ranking — shows the current strength of currencies. The strongest currencies are at the top, in green, the weakest are at the bottom, in red, and neutral currencies are in white.

Previous Ranking (previous rating) - similar, but one step back (for example, one candle earlier), which allows you to track the dynamics of changes in strength.

Each line contains:

- currency ticker

- the percentage change in strength (e.g. USD +0.03)

This allows a trader to determine in literally a second which currency is strengthening and which is weakening, and use this to make a trading decision based on the principle of "strong versus weak.".

- Real Time: Calculates and updates the strength of eight major currencies (EUR, USD, GBP, CHF, AUD, CAD, NZD, JPY) every second (configurable).

- Percent Change: Measures the strength of a currency based on the percentage change in the current closing price relative to the previous one.

- Currency Ranking: Displays currencies ranked from strongest (top) to weakest (bottom), showing the currency ticker and its percentage change (e.g. USD +0.23).

- Dynamics of Changes: Shows the current and previous currency rankings for easy visual analysis of market changes.

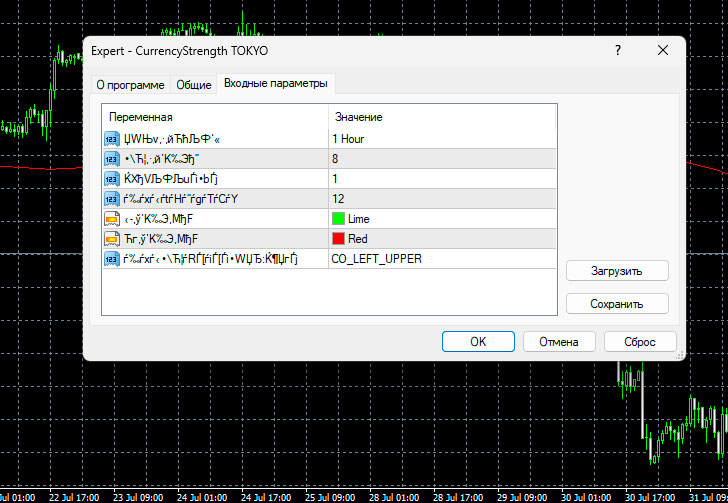

Setting up the Currency Strength indicator

The CurrencyStrength indicator works fine with the default settings set by the developers:

Install on MT4 (Experts\Market folder) and add to the chart - preferably on any timeframe , from M15 to H4.

In the settings, select the list of currency pairs: include all major pairs containing base currencies.

Select the calculation period (for example, 14 or 21).

Set up smoothing - for example, SMA or EMA with a window of 5-10 bars.

Enable or disable visual elements: lines, histograms, highlighting of bullish/bearish zones.

How to Use the Currency Strength Indicator in Live Trading

- Identifying Dominant Currencies: First, observe which currencies are showing maximum strength and which are weak. If, for example, the USD is significantly stronger than the CHF, it might be wise to consider a long USD/CHF trade.

- Currency pair selection: Choose pairs with the greatest difference in strength. The higher the delta between currencies, the stronger the potential trend.

- Trade entry: Use the indicator in conjunction with chart confirmation— support/resistance lines , candlestick patterns, or trend lines. When a strong currency strengthens, look for an entry in its direction.

- Exit and risk management: Profit can be taken when the leading currency's strength declines or when the opposing currency's strength increases. It's a good idea to place a stop-loss beyond the last swing low/high on the chart. You can also set a take-profit when a predetermined strength difference is reached (for example, when the delta falls below a certain level).

Download the currency strength indicator

The Currency Strength indicator is a powerful tool for determining the strength of each currency. It helps you identify pairs with the greatest trend potential, enter trades with informed currency selection, and manage risks effectively. To get the most out of it, combine strength visualization with classic technical analysis and strictly adhere to capital management.