Stop-loss and take-profit: simple setup with specific examples

We can talk for hours about the need to set stop-loss and take-profit orders, but inexperienced traders trade without using these stop orders at their own risk.

Furthermore, there are several other rather risky forex trading strategies that simply don't involve these orders.

The main reason for not using stop losses is usually a purely psychological unwillingness to accept the possibility of losses. Traders often set their limits in advance, which results in the deposit being lost .

Finding stop-loss points is a challenge for many traders, but this can be easily solved with the help of scripts.

Stop-losses should always be used, with a few exceptions, as outlined below.

Strategies that don't always allow you to set stop-loss and take-profit

Scalping strategy – when scalping or pipsing, all decisions are made instantly, and the trades themselves sometimes last only a few seconds. Clearly, placing stop orders in such a situation is simply technically impossible.

Locking positions – in this case, a pending order placed in the opposite direction is an option to reduce risk. This is quite an interesting tactic, but also quite complex.

In other cases, setting stop-loss and take-profit orders is simply mandatory. First, let's look at the principles of setting stop-loss orders.

Peculiarities of setting stop-loss

There are two main principles underlying the entire system of working with this order: the size of the loss relative to the deposit amount and the placement location.

These two indicators are closely related; if you use this relationship correctly, it will lead to the best financial result.

To determine the stop-loss size, you only need to perform a few simple calculations.

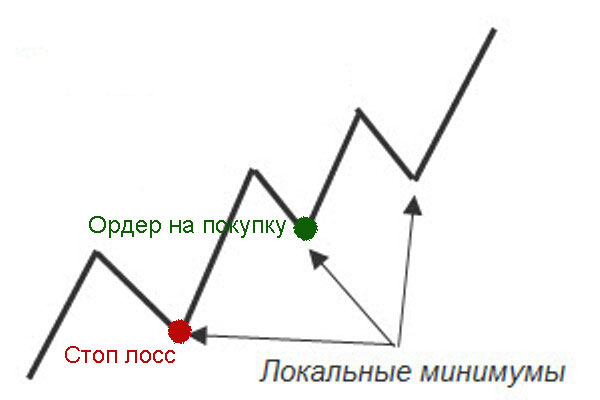

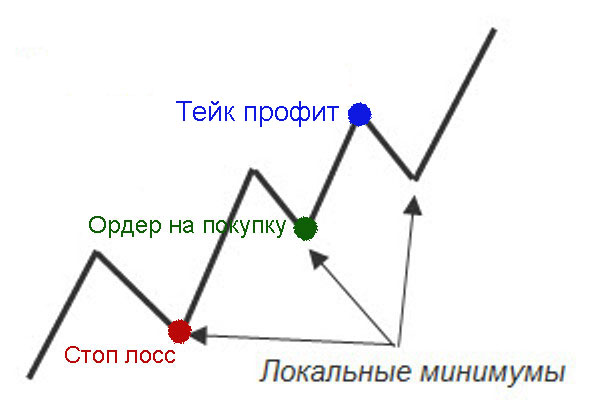

1. Determine the location where the order to close the position will be placed. These locations are past price lows when opening long positions or the nearest highs when opening short positions.

The figure shows a simple example where local lows serve as the reference point; such an order will only be closed in the event of a significant price drop.

Support and resistance lines or other significant price levels also serve as reference points.

2. Loss size – each trader determines this individually; ideally, it's no more than 2-5 percent per trade. So, if you have a $5,000 deposit and set a loss limit of 5%, your loss per trade should be no more than $250.

3. Determine the Forex lot size – here, you'll need to consider the two previous parameters. For example, we first determined that the stop loss should be around 50 pips, and the loss size should be no more than 5% or $250.

Therefore, one pip equals 250/50 = 5, meaning in our situation, with a $5,000 deposit, it's recommended to open positions of no more than 0.5 lots.

This is the optimal calculation option, but as a rule, such an indicator as greed comes into play, and usually a trader with a deposit of $1,000 is already trading with a volume of at least 1 lot, so what kind of risk management can we talk about here?

Take profit as a way to exit on time

There are several opinions on how to properly set a take profit. Some believe it should be at least twice the stop loss, while others base it on daily market volatility.

The classic solution to this problem is to consider possible reversal points and price fluctuations (the same highs and lows).

But in addition, it's important to consider indicators such as the timing of important news releases, support and resistance levels, and global highs and lows. These are the areas where a price reversal is most likely.

Stop losses and take profits are difficult to set only in the first few trades; over time, you'll develop your own system, which will significantly reduce the process time.