What influences the Swiss franc exchange rate?

The Swiss franc is one of the most popular world currencies, and is in 6th place in terms of turnover (after USD, EUR, JPY, GBP and CNY).

Currently, the franc's share of forex turnover is around 6.5%, which is significant given the scale of the currency market.

Over the past five years, the Swiss franc has strengthened significantly against global currencies such as the dollar and the euro. This change amounted to 14% against the US dollar and 16% against the euro.

But the rate does not always move upwards; the price periodically makes corrections , so if you want to buy or sell the franc at the most favorable price, you need to know what influences the Swiss franc exchange rate.

Inflation and exchange rates: how do price changes affect the exchange rate of the national currency?

The inflation rate is one of the key economic factors; its change affects many other economic indicators, including the country's exchange rate.

Let's try to understand how inflation and exchange rates are related, and to what extent the value of the national currency depends on changes in consumer prices.

It is generally accepted that there is a stable relationship between changes in the inflation rate and the exchange rate of the national currency.

That is, as prices for goods and services rise, the value of the national currency falls relative to other global currencies. And as domestic prices stabilize and inflation slows, the currency's exchange rate stabilizes.

Fundamental analysis for Forex and the stock market: similarities and differences

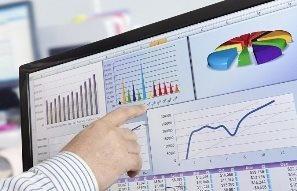

In stock trading, two types of price analysis are used: technical, which analyzes the history of trends, and fundamental, which is based on the analysis of financial indicators and news.

While technical analysis is essentially a fairly universal method of market research, fundamental analysis is not so simple.

When using fundamental analysis, you should consider which market you are trading in and, depending on this, use methods appropriate to that market.

Today we'll compare fundamental analysis for the forex and stock markets, or more precisely, how the same research method is applied to different assets.

What influences the price of silver on the exchange?

Silver has played a vital role in the global economy for centuries, remaining a valuable resource and an essential element of financial systems.

Today, its importance has not diminished, but on the contrary, has acquired new aspects associated with its widespread use in various industries.

In this article, we'll examine the importance of silver in the global economy and its main uses, as well as discuss the factors that influence silver prices on the stock exchange. Understanding these factors will help you profit from the precious metal's price fluctuations.

Silver is not only used in jewelry but is also an essential component in the production of electronics, medical devices, and even solar energy. This makes it an indispensable resource in modern technology.

Economic indicator - "Core durable goods orders"

If you trade the news and use a tool like an economic calendar , you've probably come across an indicator of the US economy called "Core Durable Goods Orders."

Moreover, the economic calendar indicates that it is a fairly significant factor and can influence the US stock and currency markets.

Therefore, we will try to understand what this index is and how its changes affect financial markets.

Core Durable Goods Orders is an economic statistic that measures the change in the total volume of new orders received by U.S. manufacturers for durable goods, excluding transportation.

What is the NFP employment indicator and how does it affect the US dollar exchange rate?

One of the most important indicators of fundamental analysis is the unemployment rate, but in addition to this indicator, there are also indirect indicators that characterize the level of employment.

Non-Farm Payrolls (NFP) is a key indicator of the economic health of the United States.

This measure reflects the total number of jobs created in the economy excluding the agricultural sector and is a significant component of the monthly employment report published by the U.S. Bureau of Labor Statistics.

Job growth indicates a strengthening economy and a potential increase in consumer spending, which in turn could lead to higher inflation and, consequently, a tightening of monetary policy by the Federal Reserve.

Factors Affecting the British Pound Exchange Rate

The exchange rate is one of the key indicators of a country's economic condition; it is the value of the national currency that best demonstrates confidence in its monetary unit.

In the case of the British pound (GBP), its rate depends on many factors that can have both short-term and long-term impact.

Let's take a look at some of the main factors that influence the British pound exchange rate.

Economic indicators of the country

The health of the UK economy is a major factor determining the pound's exchange rate. GDP , inflation, unemployment, and other economic indicators can influence investor expectations regarding future currency movements.

Sources of information for news strategy

News trading strategy is one of the most popular trading options on virtually any exchange.

It can be used both in trading on the Forex currency market and in trading on the stock market or commodity exchange.

Despite its apparent simplicity, there are a large number of nuances that should be taken into account when using this strategy in practice.

The strategy itself has been described many times on our website " Forex News Trading, " but today we'll talk about sources of information from which you can receive signals to open trades.

Books on fundamental analysis of stock and currency markets

One of the choices a novice trader must make is choosing the most effective market analysis method.

This is quite difficult, as technical and fundamental analysis have roughly equal numbers of proponents.

While there is a considerable amount of literature on technical analysis, it's much harder to find books on fundamental analysis. For some reason, authors don't particularly like to describe this particular method of market analysis.

However, in my personal opinion, a forecast based on news and the current economic situation has a much better chance of success.

Furthermore, the basic principles used in fundamental analysis are much easier to understand than the intricacies of technical analysis.

Secrets of Economic Indicators by Bernard Baumol. A Textbook of Fundamental Analysis

The US stock market has always been considered one of the most profitable global markets.

Trading American securities has enabled many financiers to amass billions in fortunes.

Furthermore, American stocks are an excellent long-term investment opportunity, providing not only a stable income in the form of dividends but also rising in value.

Selecting the most promising investment requires a thorough analysis of the market situation.

This is quite challenging; effective analysis requires knowledge of microeconomics and finance, as well as the ability to draw accurate conclusions.

The book "Secrets of Economic Indicators," written by analyst and consulting firm director Bernard Baumol, will be useful to investors and traders.

How is fundamental analysis of the stock market conducted?

To consistently profit from securities, you should use fundamental stock market analysis.

While many traders claim that technical methods for studying trends are just as effective, I still prefer to use fundamental analysis on this exchange.

Unlike Forex, the analysis here is more complex, as it relies on several sources of basic information.

The first is news, the second is company reports, and the third is industry trends in the selected company.

Therefore, to forecast a stock price, you need to consider not only the financial state of the company itself but also the overall industry outlook.

Forex macroeconomic indicators

It is no secret that there are two main methods of market research - technical and fundamental analysis.

The first type of analysis, namely technical, is designed to analyze the inertia of market movement, crowd behavior, and psychological analysis of a particular category of traders.

The second type of research is based on the study of the country's economy, its potential, as well as factors that may influence changes in the national currency exchange rate.

It's worth noting that both of these types of analysis are, in one way or another, interconnected and effective.

However, it's important to understand that any significant changes in the price of a given asset always occur for economic reasons.

How to Use an Economic Calendar for Stock Trading

Effectiveness on the stock exchange directly depends on the ability to analyze; an analytical mind is one of the most important qualities of a trader.

First and foremost, a trader must not only understand the processes occurring with a given currency instrument, stock, or futures, but also be able to track, find, and sort through vast amounts of relevant data that can influence price movements.

However, few traders can boast the ability to make forecasts based on analytical data.

Fundamental market analysis has generated so many myths that beginners avoid news like the plague as soon as they hear the word "news," much less master the specific patterns it evokes.

Trading on bad news

Fundamental market analysis generally produces the best results when it is aimed at identifying a downward trend.

Bad news related to various terrorist attacks, natural disasters or the outbreak of military action in a particular region has always had an impact on the exchange rate of the national currency.

The harbinger for writing this article was the terrible terrorist attack that took place in France, where, according to official figures, 128 people were killed and over 250 people were injured to varying degrees of severity.

According to preliminary data, the terrorist attack was carried out by representatives of the Islamic State, against which the entire international community has declared war.

This event in the center of a European capital provoked a very strong public reaction, since one of the explosions occurred right before the eyes of the French President during a football match between the national teams.

Fundamental analysis of the Forex currency market

Forex trading requires not only the ability to open trades and work with a trader's trading terminal, but also knowledge of fundamental analysis.

analysis.

This type of forex market study is easier for a novice trader to understand, so it is recommended to begin learning the basics with this discipline.

Fundamental Forex analysis examines the key factors that influence exchange rates. The resulting data not only provides information about the current market situation but also serves as a basis for forecasting.

Learning the basics of this discipline will only take you a few weeks, but after that, you will no longer be opening trades blindly, but will be able to develop your own effective trading strategy.

It's worth noting that we're talking specifically about the basics, as a full course in fundamental analysis could take you more than one month.

NAB Business Confidence Index and AUD/USD

Another important indicator that uses fundamental market analysis is the business confidence index.

A trusting relationship between investor and government is a key condition for the development of successful business in any country in the world.

the development of successful business in any country in the world.

Agree, if you don't trust the state, don't believe you'll receive your payments without securities lawsuits, or if you simply think your business could be taken away from you, you'll never invest in such a state and its economy.

The Australian Business Confidence Index is a macroeconomic indicator released in the first half of the month, and its main purpose is to measure the level of business confidence in the government and its structures.

The National Australia Bank calculates the index through a survey of 350 different companies, from small to large. This provides a comprehensive picture of investor confidence in the government.

The effectiveness of fundamental analysis.

For years, traders have been debating the effectiveness of fundamental analysis in stock trading, with opponents of this method of market research gaining ground.

with opponents of this method of market research gaining ground.

Techies—traders who rely solely on technical analysis—argue that the impact of news on the market is unpredictable, leading to losing trades.

While this is certainly true, the truth isn't so clear-cut.

First, it should be acknowledged that fundamental market analysis was the first method of market research, long before currency charts and other technical analysis tools .

So why are many now claiming that fundamental analysis is not effective?

US Manufacturing Purchasing Managers' Index (PMI) and EUR/USD

One of the most popular tools of fundamental analysis that every fundamentalist uses are indices.

every fundamentalist uses are indices.

Open any economic calendar and you'll see that these are singled out as highly volatile news items. Regardless of the service you use to conduct fundamental market analysis, indices receive special attention, describing their importance and impact on the national currency exchange rate.

In terms of their influence on the thinking of traders and investors, indices can be placed second after macroeconomic indicators such as GDP, interest rates, and the trade balance.

But is this really true? Does a news release about a particular index really have such a strong impact on market participants?

US Retail Sales Index and USD/JPY

The impact of increased retail sales on the stability and prosperity of any country's economy is obvious. Without any economic education, one can easily construct a logical chain that directly traces the relationship between increased retail sales and economic development.

is obvious. Without any economic education, one can easily construct a logical chain that directly traces the relationship between increased retail sales and economic development.

When you look at retail sales data, you should immediately realize that you are indirectly analyzing consumer spending, production, and, oddly enough, employment.

All three of the above criteria, in one way or another, are included in the basic retail sales index, since with the growth of retail sales we can observe an increase in jobs, the expansion of production and small businesses, and also track how much richer the country's citizens have become.

Key news for forex trading.

Financial and economic news are the primary sources for fundamental trading , as they have the greatest impact on exchange rate movements.

, as they have the greatest impact on exchange rate movements.

However, these factors vary in their impact on currency prices; one piece of news can cause a 50-100 pip jump or even change the direction of the underlying trend, while another piece of news may go completely unnoticed.

Therefore, key news items for forex trading are typically classified by importance. It's advisable to use only the most significant events as sources of signals, as they can cause significant changes in the exchange rate.

So, what has the greatest impact on forex trends ?

US trade balance and EUR/USD

Unlike trading based on technical analysis, almost all position entries with a news robot have an economic justification.

have an economic justification.

However, not all news has the same impact on the market, and many often mistakenly link the degree of importance of the news and the possible reaction of the trend to its release.

By reviewing the fundamental analysis section of our website, you can see that sometimes an obvious news item like GDP may not have as strong an impact as many write and claim.

Thus, understanding the market's real reaction to key macroeconomic indicators can be an eye-opener for many beginners who have embarked on the path of studying fundamental analysis.

US GDP and EUR/USD pair.

The release of US GDP data has an undeniable impact on all currency pairs involving the dollar. Any textbook on investing or stock trading places a great deal of emphasis on the GDP figure.

the dollar. Any textbook on investing or stock trading places a great deal of emphasis on the GDP figure.

Moreover, after reading information about the possible impact of GDP on the dollar exchange rate, the opinion that this is 100% news, on which almost everyone makes money, is smoothed out.

After attending courses that teach fundamental market analysis, you'll also be taught how to make large sums of money by publishing this data, spending just a few minutes analyzing this indicator.

But is this really true? Does this news really work out the way almost every trading gurus and various training textbooks claim?

UK Manufacturing Output: Impact of the News Release on the GBP/USD Currency Pair

Countries with developed industries have always been renowned for their stable economies, growing budgets, and rising social standards.

budgets, and rising social standards.

Thanks to the constant export of industrial products, the state accumulates foreign currency reserves, which are so necessary for maintaining the stability of the entire economy as a whole and the banking sector.

The amount of taxes collected from industry is simply enormous and accounts for the lion's share of the country's GDP.

Thus, industrial development is a direct path to economic growth and prosperity of any state.

Factors Affecting the US Dollar Exchange Rate

There are many reasons why the US dollar exchange rate can rise or fall, and you should know them if you are involved in any way with this currency, especially if you trade on Forex.

Fundamental Forex analysis is simply unthinkable without knowledge of these factors.

The US dollar is one of those currencies whose exchange rate is influenced by literally everything, from the direct impact of news from the stock markets to the publication of data on the state of the United States economy.

If you track the emergence of new news concerning the American currency in time, you can earn good money or simply protect your existing capital from shocks.

Upon closer inspection, the dollar no longer appears to be the stable currency that most economists imagine it to be.

Gold and exchange rates.

Currency correlation is one of the key aspects that is widely used in Forex trading, but at the same time, there are other options for the relationship between exchange rates, for example, with the price of gold.

Forex trading, but at the same time, there are other options for the relationship between exchange rates, for example, with the price of gold.

Gold and exchange rates—two exchange-traded instruments—have always had a close relationship. This has allowed this factor to be used to forecast trends in currency pairs and prices for this precious metal.

The main factors influencing this relationship are the country's economic dependence on the price of gold and the position of a particular currency in the global foreign exchange market.

UK Jobless Claims Change: Impact on GBP/USD

An increase in expenses financed from the budget almost always has a negative impact on the national currency.

the national currency.

This is why this aspect is always taken into account when conducting fundamental market analysis on Forex.

The amount of financial flows that must be paid for unemployment benefits is one of the most expensive for each state, and the more developed the country, the more money is spent on supporting citizens.

This is primarily due to the social standards that are accepted within the country.

However, the chain by no means ends with simple financing, since as the unemployment rate increases, tax revenues paid by employers decrease, leading to impoverishment of the population, which in turn leads to a deterioration in a number of economic indicators.

Fundamental analysis essential for trading on the stock exchange

For successful trading, it is usually necessary to use fundamental Forex analysis in addition to technical analysis.

No matter how much techies claim that technical analysis includes everything, the integrated use of both areas of Forex market analysis is still more effective.

The main advantage is that you know in advance where the price might go, rather than reacting belatedly to changes in the trading terminal. While technical analysis is based on market history, fundamental analysis allows you to see its future and be one of the first to enter the market.

Moreover, to trade on Forex, it is not at all necessary to conduct an in-depth study of the economic situation in the country and analyze the prospects for the next few months; it is quite sufficient to know the basics of fundamental analysis and correctly assess the impact of recent events on the exchange rate.

This is the simplest way to receive trading signals to open positions, so it is the best place to start when learning the basics of the forex market.

US ADP Nonfarm Payrolls. Impact on the EUR/USD currency pair

For virtually any trader who practices fundamental analysis and news trading, the release of new data on US non-farm payrolls is a tempting morsel that would be a shame not to snatch.

news trading, the release of new data on US non-farm payrolls is a tempting morsel that would be a shame not to snatch.

The release of this indicator is extremely important, as the market almost always reacts strongly to it. The fact is that the number of employed people in a country is a direct indicator of the strength of the US economy.

It's important to remember that there's a direct correlation between the growth of the employed population and the growth of a country's GDP. The more people work, the more the state can fill its coffers from taxes and reduce spending on unemployment benefits.

The ADP Nonfarm Payrolls Index is a leading indicator derived from an anonymous survey of a large number of US businesses, with approximately 400,000 respondents. Why do I claim this news has a leading effect?

Factors of fundamental analysis.

To apply fundamental analysis to forex, you need to understand which factors have the greatest impact on currency movements and how to properly consider them when planning new trades and closing existing ones.

Fundamental analysis factors include not only key economic and financial news but also other announcements that directly influence trends.

Therefore, you should be extremely careful when conducting the analysis.

New Zealand Producer Price Index. Impact of the news on the NZD/USD currency pair

Data on national currency inflation are always taken into account when making long-term forecasts for exchange rate changes.

exchange rate changes.

These are some of the indicators that make fundamental market analysis more effective.

Moreover, it doesn’t matter which instrument you work with—dollar, euro, or franc—inflation data always has a significant impact on the chart’s movement.

Since the inflation indicator almost certainly helps a trader predict the possible movement of a currency pair, draw conclusions about the economy, and put together a general picture.

The New Zealand Producer Price Index is a leading indicator that can provide a high level of accurate indication of inflation.

To calculate it, they take data on manufacturers' costs for materials, semi-finished products, and components.

Japan Industrial Production: Impact on USD/JPY

Industry is the engine and heart of any country's economy. Unlike many other countries, Japan is heavily dependent on the development and stability of its industrial sector, as the number of factories involved in industrial production is enormous.

many other countries, Japan is heavily dependent on the development and stability of its industrial sector, as the number of factories involved in industrial production is enormous.

Just look at the brand names of Japanese automobile manufacturers, special-purpose vehicles, and various industrial equipment that are supplied to all corners of the world.

Economic policy in Japan is also aimed at developing the industrial sector and supporting the industry as a whole, since the Central Bank of Japan deliberately understates the national currency in order to make industrial goods competitive and gain a price advantage over producers in other countries.

Page 1 of 2

- To the beginning

- Back

- 1

- 2

- Forward

- To the end