News and its anticipation in stock trading.

Almost every trader is familiar with the news trading strategy, which involves opening trades immediately after a news release.

a news release.

But not everyone knows that sometimes the market reacts more strongly to anticipation than to the news itself, and exploiting this aspect in trading yields much greater profits than trading after the news release.

Therefore, when conducting fundamental market analysis, it's important to consider not only events that have already occurred but also those yet to come.

There are also public and hidden factors that should be considered when planning your trades on a given currency pair. Only then will you be able to reduce the number of errors when opening positions.

• News trading typically follows a fairly simple pattern: after the latest news release, its impact on the currency is analyzed, and if the impact is positive, a buy trade is opened; if negative, a sell trade is opened.

Australian Retail Sales: Impact on the AUD/USD Currency Pair

Retail sales volumes are directly correlated with the Australian dollar's exchange rate. This indicator allows traders to easily assess the state of the Australian economy, its growth dynamics, or, paradoxically, its deterioration.

indicator allows traders to easily assess the state of the Australian economy, its growth dynamics, or, paradoxically, its deterioration.

The index compiles data on all retail sales from various store owners and retail outlets, including both small businesses and large retail chains.

What can retail sales volume data tell us?

Primarily, it tells us how much money the country's citizens have. If citizens are actively purchasing goods and retail turnover isn't declining, but rather increasing, this indicates that people are earning money, have strong government support, and a healthy economic climate, which contributes to higher social standards and overall well-being.

Factors influencing exchange rates

If you learn to identify what influences exchange rates, you can consider yourself practically successful in Forex trading.

After all, this aspect is the foundation of currency trading: simply knowing which events will trigger a price increase, and which news will trigger a rise in the exchange rate.

The main thing is to correctly determine the weight of the event that has occurred and the degree of its influence on the trend.

Factors influencing the exchange rate are nothing more than the appearance in the press of reports about changes in the economic or financial situation that, to one degree or another, concern a specific currency.

In other words, these are fundamental factors that are closely related to a particular currency and put pressure on its price.

news trading strategies are based on tracking them .

Canadian Employment Changes: Impact on USDCAD

Employment is an indicator of the well-being of a country's economy, its good investment climate and the health of the economy as a whole.

investment climate and the health of the economy as a whole.

Fundamental financial analysis should always take into account employment data, as it also affects the Canadian dollar exchange rate.

In fact, the logic for a trader and investor when this indicator is released should be very simple.

The more people are employed, the less unemployment benefits need to be paid, and as a result, the burden on the country's main budget is reduced.

It's also worth remembering that the more people employed, the greater the percentage of taxes the state will collect, which directly leads to a stronger economy, higher social standards, and the development of the state in various sectors.

Types of fundamental news.

Even if you don't trade news, it's helpful to know the different types of fundamental news and how they influence fundamental market analysis.

And, depending on this classification, how they affect the exchange rates of the currencies being studied.

First of all, all news can be roughly divided into two categories: random and expected. Random news occurs spontaneously, unplanned, while expected news is released on a schedule.

You can find an analog of such a schedule by studying the Forex calendar .

Each news item, in addition to its release time, has several additional parameters.

US Consumer Confidence Index: Impact on USDCHF

The people's confidence in the stable growth of the state's economy and satisfaction with the current situation within the country is a good sign of confident growth and stability for any economy in the world.

with the current situation within the country is a good sign of confident growth and stability for any economy in the world.

There are many myths surrounding the US Consumer Confidence Index, the main one being that the release of this index has no impact whatsoever on the US dollar exchange rate.

The US Consumer Confidence Index is measured through a standard survey of 5,000 households, who express their opinions on the current state of the economy and share their thoughts on the future.

Simply put, the confidence index allows us to see how much the average consumer trusts and believes in the stability of their country's economy. Therefore, it's important to keep this in mind when conducting fundamental analysis on Forex.

Pending Sales Index in the Real Estate Market. Impact of the News on the EUR/USD Currency Pair

The real estate market has always had a significant impact on the national currency exchange rate. Many traders ignore this data when conducting fundamental analysis on Forex.

traders ignore this data when conducting fundamental analysis on Forex.

Considering that real estate and the dollar exchange rate are completely distant matters, since such a small indicator for the US cannot in any way influence the world currency.

In fact, this is a big misconception, which can be argued with simple common sense.

Let's say you're an ordinary citizen and you want to buy an apartment, but due to a lack of money, you simply can't do it, just like the rest of our country.

In many ways, it's not even your fault; you can work hard for years and still not raise the money for your dream.

First of all, this speaks of the country’s weakness, its low wages and weak economy as a whole.

Consumer Price Index: Impact of the News Release on the GBP/USD Currency Pair

Every novice trader who decides to trade using fundamental analysis on Forex faces the problem of simply not knowing how a particular piece of news can impact the market, how far the price moves on average after the news is released, and why the market sometimes doesn't react to it.

faces the problem of simply not knowing how a particular piece of news can impact the market, how far the price moves on average after the news is released, and why the market sometimes doesn't react to it.

Many websites write on their pages about the importance of fundamental indicators and that they can be traded, but unfortunately, practical information on how to apply a particular piece of news is almost impossible to find.

I had to face this problem too, so I decided to conduct my own analysis and some mathematical calculations.

Using Fundamental Analysis in Practical Forex Trading

Forex trading is based on two methods of market analysis: technical and fundamental analysis. While the latter seems simpler to apply, it raises many questions.

At first glance, it seems simpler to simply open a trade in the direction of the trend after a news release. However, in reality, the market doesn't always behave correctly, and prices move irrationally.

Therefore, if you want to trade forex most effectively, you should follow a few simple rules for opening and closing trades, taking into account fundamental factors.

Market entry and fundamental analysis

The key to Forex trading has always been entering the market, but this requires not only choosing the right trade direction but also taking into account the risk of a trend reversal.

There is no point in closing a position just before the release of important news, since if this news causes a trend reversal, the trade will close with a loss.

How various economic indicators affect the exchange rate

Currencies react quite sensitively to changes in the economic indicators of the issuing country; sometimes, after a news release, a currency pair can move several dozen pips in a matter of minutes.

Therefore, it's important to know what might follow a change in the key interest rate or an increase in unemployment; there aren't many key indicators that actually influence the exchange rate.

When conducting fundamental market analysis, it's important to understand the relationship between these changes and the currency's reaction to them.

In addition, it is necessary to take into account the capacity in which the analyzed monetary unit is included in the currency pair.

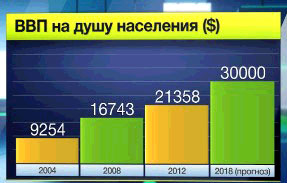

The impact of GDP on the exchange rate.

GDP, or Gross Domestic Product, is one of the most important economic indicators characterizing a country's economic performance. GDP is the total amount of goods and services produced domestically, expressed in monetary terms.

a country's economic performance. GDP is the total amount of goods and services produced domestically, expressed in monetary terms.

The higher the value of this indicator, the more optimistic the forecasts for economic growth in a given country.

Analysis of GDP dynamics, which is compared with values from previous years, is particularly important.

Positive GDP dynamics serve as the basis for strengthening the national currency and play a significant role in attracting foreign investment. For this reason, some countries use certain methods to artificially inflate GDP.

Page 2 of 2

- To the beginning

- Back

- 1

- 2

- Forward

- To the end