Australian Retail Sales: Impact on the AUD/USD Currency Pair

Retail sales volumes are directly correlated with the Australian dollar's exchange rate. This indicator allows traders to easily assess the state of the Australian economy, its growth dynamics, or, paradoxically, its deterioration.

indicator allows traders to easily assess the state of the Australian economy, its growth dynamics, or, paradoxically, its deterioration.

The index compiles data on all retail sales from various store owners and retail outlets, including both small businesses and large retail chains.

What can retail sales volume data tell us?

Primarily, it tells us how much money the country's citizens have. If citizens are actively purchasing goods and retail turnover isn't declining, but rather increasing, this indicates that people are earning money, have strong government support, and a healthy economic climate, which contributes to higher social standards and overall well-being.

You can continue the chain of increased tax collection, budget expansion, and strengthening of the country's economy, but this is not so important, because understanding from sales that people are getting richer, you can easily apply this news in trading and interpret it without any problems.

To understand how news affects chart movement, let's look at the results for the last four months. News is released monthly, specifically at the beginning of each new month.

A historical study of the distance traveled when the AUD/CAD Retail Volume was released will help us identify a possible trading strategy and estimate its effectiveness.

Why was this pair chosen? Its low spread , averaging three pips, makes it the most commonly used pair when using fundamental analysis on the AUD.

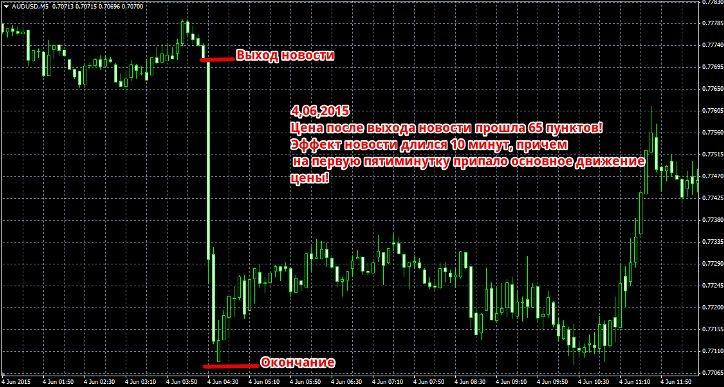

On June 4, 2015, most analysts were optimistic about a possible increase in retail sales, predicting a 0.4 percent increase. In reality, the news came out with a negative figure of 0.0 percent, even lower than the previous month's 0.2 percent. Therefore, based on this data, the AUD/USD should plummet. You can see the true picture of what's happening in the image below:

The chart shows that after the news was released, the price quickly plummeted 65 points. The news's impact lasted only ten minutes, with the first five minutes accounting for most of the price movement.

This indicates high volatility and dashed market participants' expectations. After the news was released, the price entered a multi-hour sideways movement, after which a return to its original levels was observed.

On July 3, 2015, the release of retail sales data also defied all investor and market expectations. However, unlike the previous figure, this one was higher than the previous one, but significantly lower than experts had predicted. Therefore, it was clear that the AUD/USD pair would head lower. An example can be seen below:

The news truly delivered a strong performance, sending the price down 105 pips. It's worth noting that after the price had moved 50 pips, traders began to have doubts, which were evident in a minor pullback and sideways movement. However, a couple of hours later, the chart moved downwards with renewed vigor. The impact of the retail sales data release lasted for nine hours.

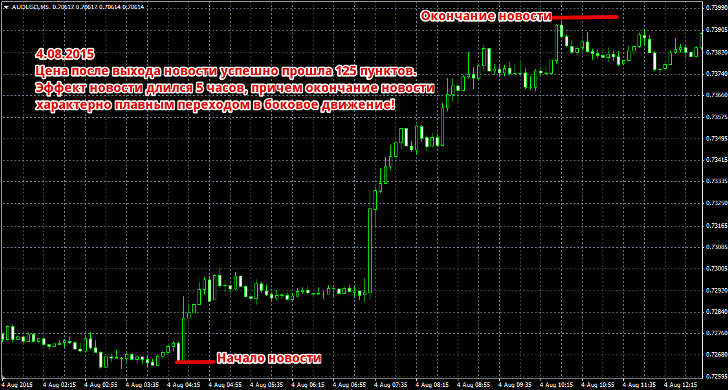

On August 4, 2015, a significant increase in retail sales was observed, reaching 0.7 percent, compared to the previous figure of 0.4 percent. Therefore, according to the laws of economics, a strong strengthening of the Australian dollar would have been expected, which would have been reflected in a rise in the AUD/USD currency pair. An example can be seen in the image below:

The market reacted as expected, so the price easily covered the 125-point gap. It's worth noting that the news's impact lasted for five hours, and its final impact resulted in a smooth transition to flat trading.

On September 3, 2015, more negative retail sales data was released. While the forecast was for a drop from 0.6 percent to 0.4 percent, the actual figure was -0.1 percent. Based on this poor data, one might expect the AUD/USD pair to plummet. You can see the actual market reaction in the image below:

Although the overall impact of the news lasted for 4 hours and 25 minutes, the main price movement occurred in the first five minutes. Following the release of the data, the price successfully crossed 45 and, after the move ended, entered a broad, multi-hour flat .

Although the overall impact of the news lasted for 4 hours and 25 minutes, the main price movement occurred in the first five minutes. Following the release of the data, the price successfully crossed 45 and, after the move ended, entered a broad, multi-hour flat .

To summarize, the reaction to the news is extremely varied, and the distance the price moves after the news release also varies considerably, from 45 to 120 points. However, you can see that the price reacts immediately to the release of indicators, so in the four examples, you won't see the chart move against the news.

This primarily tells us that large players are not having the courage to try to enter against the crowd and knock out some of the players with small stops, so trading with this news is less risky than with many others.

In terms of numbers, a rough calculation based on the minimum distance traveled by the price yields the following figures: 45 + 45 + 45 + 45 = 180 points of profit. Remember, trading on the news requires a broker with high order execution and no requotes !