Use the PIT37 online calculator to calculate your potential tax refund without registration

If you don't want to waste time registering for online PIT37 tax return calculation services or paying accountants, you can first estimate the amount you'll be refunded.

And at the same time, you are not entirely sure that you are entitled to a refund of the income tax paid in advance for the past year.

You can use a tool like the PIT37 calculator to pre-calculate your refund amount and then proceed to actually filling out the tax return using the relevant services.

Features of using the PIT37 calculator

Often, the amount of these advances is higher than your actual tax bill for the year. Our calculator allows you to estimate your tax refund if you:

Buying an apartment in Poland with Konto Mieszkaniowe: how to save your savings

Buying a home in Poland is increasingly becoming a matter not only of income but also of time. While people are saving for a down payment, inflation and rising real estate prices gradually erode their savings.

As a result, even with regular savings, the actual affordability of an apartment may not improve. It was to address this problem that the state-run "Konto Mieszkaniowe" program was created.

The main goal of Konto Mieszkaniowe is to protect accumulated funds from inflation and rising housing prices while the future buyer prepares for the transaction.

A homeowners' account is a special savings account intended exclusively for home purchases. Funds in it cannot be used for other purposes without losing state benefits.

What is double taxation of investments and how to avoid it

Recently, governments have increasingly tightened their grip on their citizens' incomes for tax purposes, regardless of whether that income is earned domestically or abroad. This sometimes results in double taxation.

What is it: Double taxation is when the same income (for example, dividends, interest on a deposit) is taxed in two countries: where the income was received and where you live.

Why this happens: The source country automatically withholds its tax, and your country of residence, by law, also wants to tax this income.

How this is usually resolved: countries have double taxation treaties ( check whether your country and the country where you earned your income have a similar agreement ). Under these agreements, you pay "whatever is required at home," and any withholdings abroad are credited (up to a maximum of the "domestic" rate).

If you borrow more than you are allowed to borrow abroad, you can return the excess in the country where the investment was made by filing a refund request.

The spread size for company shares at different brokers

If you prefer to day trade company shares or even scalp, then the most convenient trading option is contracts for difference.

That being said, one of the most important parameters to pay attention to if you are making a large number of trades will be the fee for opening orders.

This fee can be charged as a commission or spread, calculated in dollars or pips . It all depends on the brokerage company you use to trade.

To find a more profitable option, you need to compare the commission amount that you will have to pay for opening a transaction on the stock exchange.

To make the comparison objective, we will try to convert the board size to the same unit of measurement.

Exchange opening hours for New Year's 2025 and Christmas: December 2024 and January 2025 holiday schedule

The New Year holidays are traditionally accompanied by changes in the operating hours of financial exchanges around the world.

During this period, not only are trading hours limited, but market volatility asset liquidity falls .

This is due to both a decrease in trading activity due to a reduction in the number of participants, and investors' desire to close their positions before the long weekend.

Therefore, information about how exchange operations are organized for the New Year 2025 is especially important for traders to avoid unexpected risks and plan their operations wisely.

Difinexx - payment system, wallet, and other important details

Difinexx is a multifunctional platform that combines the capabilities of a payment system and a cryptocurrency wallet, with an emphasis on security, convenience, and transaction speed.

The payment system also often acts as an intermediary between the brokerage company and the client when replenishing an account or withdrawing funds.

An example of such a company is the broker RoboForex Difinexx has recently appeared .

There is no need to undergo separate registration to carry out a transaction; simply select a cryptocurrency and enter your payment details.

Real-time online quotes for gold and silver on the exchange

Gold and silver are the most popular assets used both for investment and for making money on the stock exchange.

Gold and silver are the most popular assets used both for investment and for making money on the stock exchange.

The price of precious metals is displayed as XAU/USD for gold and XAGUSD for silver. Traditionally, prices are quoted in US dollars.

Below is an online gold and silver price chart showing the current real value of these metals:

Non-ferrous metals trading on the exchange

Futures are one of the most popular assets traded on the stock exchange today.

This category has its favorites, primarily gold and precious metals such as silver and platinum.

But in addition to precious metals, the MetaTrader trading platform also offers other assets from the metals category, which can also be used for profitable trading on the exchange.

If you've noticed, almost every broker's trading platform now offers non-ferrous metals, such as copper, nickel, aluminum, and zinc, in addition to precious metals.

The MetaTrader 5 news feed: its advantages and disadvantages

The MetaTrader 5 trading platform , developed by MetaQuotes Software, is one of the most popular and functional tools for online trading in the world of financial markets.

One of the key elements of successful trading is promptly receiving market news and economic data that can have a significant impact on pricing.

The importance of news for trading cannot be overstated, as it can trigger volatility and provide trading opportunities. MetaTrader 5 comes with a built-in news feed.

This feature allows traders to stay up-to-date with the latest news without having to leave the trading platform. This allows for immediate response to news signals and the adaptation of trading strategies in real time.

The S&P 500 Stock Index and How to Trade It

The S&P 500 stock index is one of the most important and recognized indicators of the state of the American economy and stock market.

It includes 500 leading US companies with the largest capitalization, S&P (Standard & Poor's) these tools create a complete picture of the state of American business.

The Standard & Poor's index is used by financial analysts to assess a country's economy and by traders to profit from fluctuations in its price.

The S&P 500 trades from 9:30 a.m. to 4:00 p.m. Eastern Standard Time (EST), Monday through Friday.

Gold swap: how big is it and how does it affect the outcome of a transaction?

When trading gold on the exchange, there are two types of commissions: the spread, which is charged when opening a trade, and the swap, which is charged when carrying a position over to the next day.

That is, if you make a purchase of gold today and close the deal only tomorrow, then a certain amount will be debited from your account to carry the position over to the next day.

The amount of the swap charged directly depends on the transaction amount, the interest rate, and the brokerage company through which you opened it.

If your trade is not closed on a weekend or holiday, you will still pay Swap for those days, even though the exchanges are closed.

Regulations for trading operations on the exchange, a document on which much depends

You already know that the non-trading regulations govern the financial relations between the client and the broker, as well as the rules for using the trader's personal account.

It is logical that there is a document regulating the implementation of exchange transactions, including other important issues directly related to trading.

Such a document is the "Trading Operations Regulations," which can be found on the website of any brokerage company or in the trader's personal account.

Since the document outlines the basic rules for opening and maintaining orders, familiarization with it is a mandatory step before opening trades on a real account.

What you need to know about a broker's regulations that govern non-trading operations

You already know that the main document regulating the relationship between a trader and a brokerage company is the client agreement .

However, this document includes only the basic provisions and a description of the rights and obligations of the parties, that is, what is not directly related to the implementation of transactions.

All important points are described in more detail in two documents: the regulations for non-trading operations and the regulations for trading operations.

Therefore, before opening your first trade on a real account, it is advisable to study these two important documents and only then begin trading.

What is a broker's "Client Agreement"?

Unfortunately, most of us have become accustomed to automatically agreeing to any regulatory documents when registering on a website, simply by checking a box in the right place.

Almost no one reads the registration conditions or additional documents that regulate the company's activities.

However, it would still be useful to have an idea of the document on the basis of which your trading on the exchange will be carried out.

One of these important documents is the “Client Agreement”, which is present in every brokerage company.

What is 1 lot of gold equal to, and other important indicators when trading on the stock exchange?

For thousands of years, gold has been one of the most popular assets; the precious metal is widely used for investment and as a guarantee of currency security.

In everyday life, we are accustomed to the fact that the measure of weight of precious metal is grams, kilograms and tons.

But on the exchange, the weight of gold is measured in troy ounces and standard lots; these are the units of measurement used in quotes and exchange transactions.

What is one troy ounce and how is it calculated? - https://time-forex.com/info/troy-ounce

To trade gold professionally, you need to know concepts such as quote, lot, point, spread, and swap.

Troy ounce and its measurement, application in stock trading

The Trinity ounce is a unit of mass used in weighing a wide variety of materials.

1 Trinity ounce is equivalent to 31.1034768 grams, and this is the unit officially used to convert ounces into our usual units of weight and vice versa.

It can be said that one kilogram contains 32.15074656862798 troy ounces or one ounce, in percentage terms, is about 3.11% of 1 kilogram.

In stock trading, this unit of measurement is used when trading assets such as gold, silver, platinum and palladium.

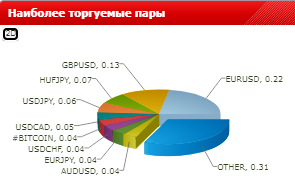

Forex currency pair popularity statistics

The psychology of decision-making for most people is based on the principle that if others are doing it, it means it is right and beneficial.

Surprisingly, this approach produces excellent results in most cases, and this also applies to choosing a currency pair for exchange trading.

As a rule, the most popular asset has the highest liquidity, which means that when opening trades using it, the smallest spread is charged.

Calculating the most popular currency pair is quite simple: just compare the spread and commission values and find the asset with the lowest rate.

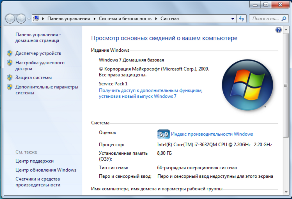

System requirements for stable operation of the MetaTrader trading platform

When working with a computer, the biggest problem is when programs you use freeze or crash.

The main reason for such failures is the lack of computer resources that can be allocated to a specific program.

While in most cases a software failure is simply a nuisance, in the case of trading software it can result in financial losses.

Therefore, it is so important to know what requirements the MetaTreder trading platform places on the resources of the computer used.

Why do you need an MQL5 account in MetaTrader and is it worth registering?

Today, one of the most popular programs for stock trading is the MetaTrader trading platform, versions 4 and 5.

Metatrader has gained particular popularity not only due to its wide functionality and the ability to create new scripts.

But also because the trading platform, in addition to its main function of organizing trading, also represents a community of traders.

Newcomers often don't understand why they need to register an account in the mql5 community, since everything works as is. Therefore, we'll try to understand the benefits of such registration and how it works.

MetaTrader 5 User Guide: Everything you need to know about the MT5 trading platform

Lately, most people prefer to learn new software intuitively.

That is, without using instructions or a user manual, while reading the instructions before working with the program allows you to more fully explore its capabilities.

The MetaTrader 5 trading platform is one of the most popular trading software. Knowing all the nuances of working with MT5 will allow you to use this program as effectively as possible.

There are two options for accessing the MT5 user manual: access the help by simply pressing "F1" while the trading platform is running, or download the Russian-language instructions at the end of this article if your platform has a version in another language.

Essential information for Forex trading

Information has always been the foundation of successful trading. In some cases, the success of a trade depends entirely on having the necessary information.

In the course of their work, a trader must analyze changes in exchange rates, be prepared for news, and calculate various transaction parameters.

Currently, there are quite a few sources that provide all the necessary information for Forex trading.

These include various informers, event calendars, calculators for calculating important indicators, graphs, and other useful tools.

A universal Forex holiday calendar with country selection and for any year

As has been said many times, holidays always play a major role on any exchange, including Forex.

This is primarily due to the fact that market liquidity , and with this comes a widening of spreads and an increase in other commissions.

In addition to the fact that you will have to pay an additional swap for all holidays, the opening of trading sessions after a long break is often marked by price gaps.

And there is no need to explain to anyone what the consequences of price gaps against an open position are.

Therefore, most traders always try to take into account the availability of a day off on a particular exchange when planning their trades.

Stock exchange commissions for trading securities: how much will you have to pay the broker?

Stock trading has always been a highly profitable endeavor, and with high profits come high commissions and fees.

If you decide to trade company shares, be prepared to pay for opening and maintaining trades, and there may be other fees as well.

Part of these fees are charged by the stock exchange, and the rest is collected by the broker, who organizes the trading process.

It simply cannot be otherwise, and even if it is, you're likely dealing with scammers who will be paying you your deposit.

Today, stock exchange commissions consist of several fees, the amount of which depends on the selected asset and the size of the trade.

The best free trading training for beginners from professionals

Becoming a professional in any field requires study, and if that field involves making money on the stock exchange, you need to study twice as much. Some people like to search for the necessary information online, others prefer reading books about trading , but specialized courses are the most effective option.

Some people like to search for the necessary information online, others prefer reading books about trading , but specialized courses are the most effective option.

However, there's a common misconception among beginning investors that good courses are expensive and that a single lesson will cost at least a couple dozen dollars.

But in fact, there are free trading training programs for beginners that will help you acquire the necessary trading skills.

Moreover, unlike various expensive courses taught by rather dubious individuals, here you'll receive not only free but also high-quality trading training.

Swap size for currencies, stocks, futures and other exchange assets

For those trading within a single day, the swap rate isn't particularly important, as this fee is charged as a fee for rolling over a position.

If you open and close trades on the same date, you're only charged the spread, and no swap is charged.

It's a different story if you prefer to hold a position for several days or even months, where this parameter can play a significant role.

Furthermore, there's a strategy called carry trading, which allows you to profit from the difference in interest rates.

Therefore, in this case, it's a good idea to know the swap rate to take this figure into account when calculating your financial results or planning your trading strategy.

Forex trading hours on May 1st and other May holidays

This year, May 1st falls on a Friday, so many traders are wondering how the exchange will operate on that day.

Furthermore, May includes numerous other equally significant holidays that may impact Forex trading.

Therefore, be prepared for surprises and close existing trades promptly to avoid paying extra fees for carrying positions over the weekend.

In May 2020, exchange trading will be closed or limited on the following days:

On May 1st, 2020 , trading will be closed for ruble assets; trades for other currency pairs and assets will continue as usual .

Trading will resume in full without restrictions only on May 4, 2020.

An economic calendar for trading the news and more

News is incredibly important in stock trading, as it influences the price of virtually all traded assets.

Numerous strategies rely on news , and it should also be taken into account when planning new trades and managing existing positions.

Therefore, it's crucial to know about upcoming events in advance and react promptly to their release.

The release times of many upcoming news events are known in advance and displayed in a useful tool called an economic calendar.

Our website already offers one version - http://time-forex.com/kalendar , but it's always good to have an accessible alternative.

We provide funds to traders for Forex trading

There is a category of traders who have been making consistent profits on Forex for years. Their earnings are not large, but they are stable.

Their main problem is a lack of funds to increase trading volumes, as increasing this figure through leverage would disrupt the entire trading system.

You're about to register a PAMM account and act as a manager, but then you receive a call with a tempting offer: "We'll provide funds to a trader for Forex trading."

It's tempting because it allows you to receive initial capital immediately and avoids the need to spend years building a reputation for PAMM accounts.

What can be seen in the account history of a trader's trading terminal?

A trading platform is a multifunctional tool for conducting financial transactions on exchange and over-the-counter markets.

Despite the diversity of software, all terminals can be roughly divided into two categories:

- Trading.

- Analytical.

Few beginning traders have heard of the second group of terminals for making money in financial markets.

They differ from the more well-known ones by their variety of integrated analytical tools, which are not provided by trading platform developers.

Analytical terminals are used by traders solely to assess the current market situation.

Forex instruments specification.

The trader's terminal has long been a familiar program for everyone who trades on Forex; it's an excellent assistant with a truly vast range of features.

This versatility often prevents the terminal from being used to its full potential; most traders simply don't know all the features of this program.

They use the platform only for opening orders and performing technical analysis, forgetting about its other capabilities.

swap amount for a currency pair on our broker's website or tried to find out the minimum volume for Bitcoin?

The best books on trading

The phrase "The stock exchange is accessible to everyone" perfectly describes the current state of affairs, as anyone can pick up a tablet or sit down at a computer monitor and start trading on the stock exchange.

However, beginners often confuse accessibility to financial markets with earning money from them, as simply opening trades and buying currency or stocks isn't enough to earn money.

The problem is that many people don't even realize that "trader" isn't just a fancy word or definition; it's a profession that takes years to learn!

There are many ways to learn to trade today. These include video tutorials, helpful articles on websites, various web binaries, and even in-person meetings with instructors who know how to trade.

Moreover, in practice, it makes no difference whether the training is paid or free, because everything will really depend only on your ability to acquire knowledge and implement it in practice.

Page 1 of 3

- To the beginning

- Back

- 1

- 2

- 3

- Forward

- To the end