Non-ferrous metals trading on the exchange

Futures are one of the most popular assets traded on the stock exchange today.

This category has its favorites, primarily gold and precious metals such as silver and platinum.

But in addition to precious metals, the MetaTrader trading platform also offers other assets from the metals category, which can also be used for profitable trading on the exchange.

If you've noticed, almost every broker's trading platform now offers non-ferrous metals, such as copper, nickel, aluminum, and zinc, in addition to precious metals.

Terms of trade for copper, nickel, aluminum and zinc

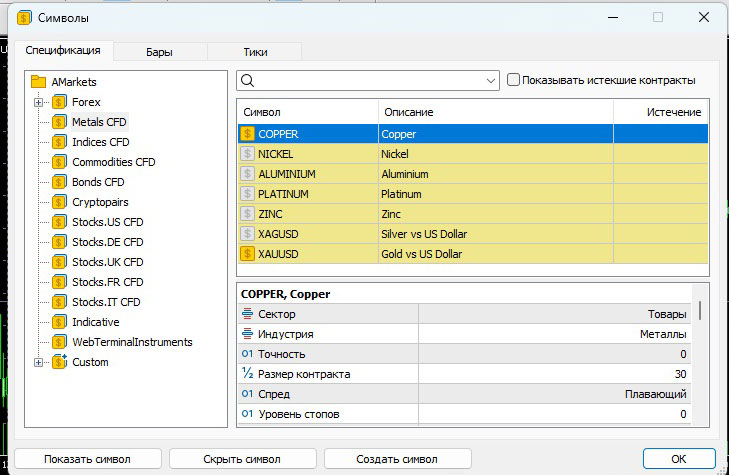

To start trading non-ferrous metals, you first need to add them to the " Market Watch " window. To do this, right-click and select "Symbols" from the drop-down menu. Then, in the Metals folder, activate the asset you need:

A detailed description of adding new assets to the Market Watch window is provided in the article - https://time-forex.com/vopros/dobawit-aktiw

Once the desired non-ferrous metal has appeared in the market overview, it is advisable to add it to the chart; this will allow you to conduct a technical analysis of the existing trend:

The price of non-ferrous metals is measured in US dollars per ton, with each asset having its own lot size.

1 lot of copper is equal to 30 tons

1 lot of nickel – 10 tons

1 lot of aluminum – 50 tons

1 lot of zinc – 50 tons

For trading, it is advisable to choose the MetaTrader 5 , since the fourth version sometimes lacks such assets.

Non-ferrous metals are traded on the following global exchanges:

- Copper: LME (London Metal Exchange), COMEX (Chicago Mercantile Exchange)

- Nickel: LME, SHFE (Shanghai Futures Exchange)

- Aluminum: LME, LME (London Metal Exchange), SHFE

- Zinc: LME, LME (London Metal Exchange), SHFE

In this case, futures contracts with a fixed delivery date are used; in order to avoid constantly monitoring the contract expiration date, it is recommended to choose non-ferrous metals for earnings, which are traded using CFDs .

CFDs on metals are a simpler and more convenient way to trade futures.

Non-ferrous Metals Trading Strategy

Trading strategies are mainly based on news that reflect factors influencing the price of non-ferrous metals.

In this case, the factors causing changes in the price of non-ferrous metals may be:

Supply and demand:

- Copper: Used in electronics, energy, construction and manufacturing.

- Nickel: Used in the production of stainless steel, batteries and electric vehicles.

- Aluminum: Main applications are construction, aviation and packaging.

- Zinc: Used in galvanizing, battery production, tire production and some other industries.

Economic forces:

- Global growth: Increases demand for metals.

- Inflation: May lead to higher metal prices.

- Economic crisis: Reduces demand for non-ferrous metals and causes prices to fall.

Geopolitical factors:

- Wars: Can disrupt metal supplies if they affect producing countries.

- Sanctions: increase prices and provoke shortages.

- Trade wars: May lead to fluctuations in metal prices.

For trading non-ferrous and precious metals, we recommend using the following brokerage companies: https://time-forex.com/vsebrokery/brokery-zoloto-serebro