What is futures expiration?

The creation of futures contracts revolutionized the exchange. Their original purpose was to create a completely new financial relationship between buyer and seller.

A futures contract allowed entrepreneurs to negotiate future deliveries of products at a pre-determined price by a specific date.

This innovation on the commodity exchange made the relationship between the parties transparent, while the exchange simultaneously acted as a guarantor of contract execution.

Naturally, over time and with the active development of the exchange, so-called cash-settled futures emerged in parallel with the delivery futures (which are still present on the commodity exchange).

The primary purpose of these contracts is speculative trading and hedging risks associated with the underlying asset. However, the only thing these two different types of contracts still have in common is the expiration of futures.

If we talk about a delivery futures contract on a commodity exchange, it is on this day that the delivery of the goods and their payment at a pre-agreed price takes place.

It's important to understand that the expiration of a cash-settled futures contract, specifically a speculative one, is somewhat different from a commodity one, namely, on a certain day, trading on the asset ceases and the asset itself is withdrawn from the market.

That's why, to avoid being automatically closed at a price that's unfavorable for the trader, it's important to clearly know the expiration date of your chosen contract.

Determining the expiration time of a futures contract

Futures contracts typically expire four times a year, namely quarterly.

However, it is worth understanding that on different exchanges and depending on the futures contract itself, expiration may differ slightly.

This is why it is very important to learn how to read this information directly from the name of the futures contract.

As an example, we will consider the September Brent crude oil futures contract, which can be traded at InstaForex.

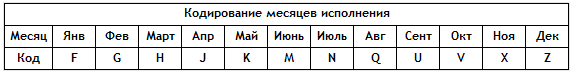

So, when adding this asset, you might see a name like #XBZU7. The first three letters #XBZ represent the underlying asset, in our case Brent crude oil, while the remaining two letters indicate the futures expiration month and year.

So, the penultimate letter F indicates the month of January, G – February, H – March, J – April, K – May, M – June, N – July, Q – August, U – September, V – October, X – November, Z – December.

Therefore, it's important to understand that the months in the futures contract are designated using the first letters of the month names in English. The last digit indicates the contract year: 6 means 2016, 7 means 2017, and so on.

More detailed information on the exact expiration date of a futures contract can be easily found on the official website of the exchange where you trade the futures contract, or on your broker's page in the contract specifications section.

The impact of futures expiration on price movement

The price movement of a futures contract, as a derivative asset, is almost always identical to the price movement of the underlying asset, namely a stock, index, or any other security.

It is this feature of futures that traders use to hedge risks that arise when trading the underlying asset.

However, in the final weeks before expiration, the price movements of the futures and the underlying asset begin to diverge, and volatility itself slows down significantly.

This is caused by the fact that as expiration approaches, traders begin to lock in their positions at a more favorable price and move on to the next futures contract for the same asset, but with a different expiration time.

This factor must be taken into account in your trading, since strategies based on spreads and correlations can lead to huge losses at this point.

In conclusion, it is worth noting that any futures trader must know the contract expiration time, since market activity directly depends on it.

It's also worth understanding that at expiration, the transaction will be automatically closed by the broker at the market price, so not taking this into account can lead to unexpected losses.