Why is it profitable to trade cryptocurrencies in Poland?

Cryptocurrencies have remained one of the most popular tools for earning and investing for many years due to the opportunities they offer.

Despite the risky nature of digital assets, they attract traders and long-term investors with the opportunity to achieve high returns and flexibly manage their capital.

But an important part of any trade is taxes, and here Poland offers investors significant advantages.

The tax on profits from cryptocurrencies is 19%, but it is not always necessary to pay it.

First off, yes, the tax rate on cryptocurrency profits in Poland is 19% . It falls under the category of capital gains and is reported in the PIT-38 .

Artificial Intelligence Tokens Predicted to Rise

Despite the recent pullback in the cryptocurrency market, interest in promising coins remains high.

Investors continue to seek assets that can deliver multiple growth, particularly in sectors where technology is advancing faster than others.

One such area is artificial intelligence tokens – coins that combine the capabilities of blockchain and the rapid advances of neural networks.

Artificial intelligence tokens are cryptocurrencies that power AI platforms, machine learning networks, distributed GPU clusters, and digital agents.

They are used to pay for computing power, model training, API access, data storage, and a variety of other operations. Unlike the speculative coins (memcoins) of the previous cycle, these projects are linked to real products and services, so interest in them remains strong.

Will there be a complete crypto market crash in 2026?

Cryptocurrencies are going through a challenging period. At the time of writing, the price of Bitcoin is $95,260.27, Ethereum is $3,195.23, and Solana is $138.59.

Many investors, faced with falling cryptocurrency prices, are beginning to fear that the cryptocurrency market will collapse completely.

The dot-com boom of the late 1990s and the tulip bubble of the 17th century come to mind, when assets soared in price only to collapse and depreciate. But can we say that cryptocurrencies will suffer the same fate?

What is the likelihood of a complete cryptocurrency collapse?

When we talk about a "complete collapse" of cryptocurrencies, we mean the complete devaluation and disappearance of these assets.

How to make money with cryptocurrency liquidity pools

The cryptocurrency market is rapidly growing, and with it, new passive income options are emerging. For example, participating in liquidity pools.

This is an opportunity to earn money from the regular activity of exchange users, without the need to trade daily or guess price movements.

A liquidity pool is a shared pool of cryptocurrencies that users deposit on the exchange. These funds participate in the exchange system, ensuring fast and smooth exchanges between coins.

When you add your coins to the pool, the exchange uses them for trades between users, and distributes a portion of the fees from these transactions among all liquidity providers.

Types of cryptocurrency exchanges, which are the most profitable, and where is it better to exchange cryptocurrency

One of the most popular and profitable options for exchanging cryptocurrencies is cryptocurrency exchanges.

There are several types of such platforms, each with significant differences that extend beyond the exchange fees.

There are several types of such platforms, each with significant differences that extend beyond the exchange fees.

Some exchanges are focused on classic trading between users, while others focus on instant exchange without complex interfaces and order fees.

To understand where it's truly more profitable and safer to exchange cryptocurrency, you need to understand the different types of crypto exchanges and the specific features of each.

How to use cryptocurrency averaging for maximum results

Averaging is a way to enter a position not with one purchase, but with several, in order to smooth out the impact of an unsuccessful entry moment.

In a volatile market, using such a tactic is entirely appropriate, as purchases are not always made at the lowest price, and the trader wants to correct the current situation.

Averaging cryptocurrencies allows you to partially correct the situation and often even turn the financial result into a profit.

The method doesn't eliminate risk or "cure" weak projects, but it does help you build a disciplined position in liquid coins with clear principles.

Solana: Price forecast – how much could SOL go up in price?

Predicting price peaks is just as important as understanding its "fair value." It's at these local highs that you can lock in profits.

For a volatile asset like Solana ($SOL), having a pre-planned sale plan can help keep emotions at bay.

You determine in advance the levels where the risk/reward ratio is optimal and prepare to sell at the best price.

What do we know about Solana now?

Solana's current all-time high (ATH) is approximately $294-$295, which was reached in January 2025. This is our primary target for the current cycle.

Cryptocurrency Trading Sessions: The Best Time to Trade

Cryptocurrencies are traded 24/7, without breaks or weekends. There are no formal "sessions" like on Forex or the stock market.

However, differences in market sentiment are still noticeable depending on the session during which cryptocurrency trading occurs. It's advisable to take these characteristics into account when trading.

Understanding these daily waves makes it easier to choose the right moment to enter, save on spreads, and avoid getting caught in a thin market.

Why is this happening? Most capital is concentrated among traders and funds in several time zones.

Asia opens early in the morning, Europe and London in the afternoon, and the US and Canada in the afternoon and late evening. It's these inclusions and overlaps that create the "windows" during which trades are executed faster and technical analysis signals appear clearer.

Where is the best place to trade cryptocurrency: fees, taxes, verification

Cryptocurrency trading has long ceased to be something unusual—it is now accessible to almost everyone.

But choosing the platform where you will buy and sell cryptocurrency is of key importance, so this issue should be approached with the utmost seriousness.

The right choice affects not only your income, but also your security, commission size, withdrawal options, and even whether you'll face tax issues later.

Some platforms are convenient but expensive. Others are profitable but require complex verification. At the initial stage, it's important to figure out which is the most profitable and easiest to trade.

How to buy cryptocurrency with cash

Purchasing cryptocurrency with cash is a method that remains relevant even in the age of digital payments.

It can be particularly convenient in countries with limited access to banking services, when you want to remain anonymous, or when you cannot use a card or online banking.

This approach is often chosen by users who want to avoid blocking and restrictions that often arise when trading on crypto exchanges.

Furthermore, cash transactions can be faster than bank transfers. However, before proceeding with the purchase, you'll need to have a crypto wallet to which the funds will be deposited.

Stablecoin USD1 cryptocurrency from World Liberty Financial USD

USD1 is a stablecoin from World Liberty Financial, launched in March 2025, not to be confused with the $WLFI token issued by the same company.

The USD1 stablecoin is fully backed by US dollars, short-term Treasury bonds, and cash equivalents, with reserves held by BitGo and regularly audited.

Zach Witkoff, co-founder of World Liberty Financial and stepson of Steve Witkoff, the US Special Representative for the Middle East, played a key role in launching the project.

Donald Trump and his family members played an active role in the development and promotion of the stablecoin, acting as strategic partners of the project.

Cryptocurrency trading volumes as the main confirmation of the trend

Trading volume is a fundamental indicator of the strength of a trend in the cryptocurrency market. It reflects real interest in an asset: how many users are currently buying or selling.

Without volume support, any price movement could be false or a result of market manipulation.

It is especially important not just to see the total volume, but to understand what portion of it is accounted for by purchases and what portion is accounted for by sales.

This information gives a real idea of who is currently in control of the market - the bulls or the bears.

If the trend is upward but volumes are falling, it's time to be wary. However, if rising prices are followed by rising volumes, especially buy trades, this is a sign that the trend is being confirmed by market activity.

Solana Cryptocurrency: Prospects and Price Predictions

Solana (SOL) is a high-performance blockchain platform designed for building scalable decentralized applications (dApps) and services.

It attracts the attention of investors due to its unique architecture, which combines transaction processing speed with low fees.

Solana uses an innovative Proof of History (PoH) algorithm that enables impressive network performance.

Since its launch in 2020, Solana has demonstrated steady growth and is actively being implemented into various areas of the digital economy.

Due to its growing popularity and strong community support, Solana has already become one of the leading cryptocurrency platforms. Today, it ranks sixth by market capitalization among tens of thousands of other tokens.

Buying, exchanging, and withdrawing cryptocurrency through Revolut: pros and cons

In recent years, online banking platform Revolut has become a popular platform not only for banking but also for cryptocurrency transactions.

It's important to understand, however, that Revolut is not a fully-fledged crypto exchange, but rather a limited-function intermediary.

It's important to understand, however, that Revolut is not a fully-fledged crypto exchange, but rather a limited-function intermediary.

In essence, Revolut has practically everything you need to fully work with cryptocurrencies – the ability to buy, exchange, transfer, receive, and sell digital assets.

This means you can buy cryptocurrency with fiat money in just a few seconds, directly from your banking app.

Let's take a look at how exactly buying, exchanging, and withdrawing cryptocurrency through Revolut works, as well as what fees you can expect.

How to reduce risks when trading cryptocurrency

Cryptocurrencies have long since surpassed some traditional assets in popularity and have confidently taken one of the top spots in terms of transaction volume.

Unlike other assets, trading cryptocurrencies, in addition to exchange rate risks, entails a number of other problems, and it is important to know how to minimize them.

However, some risks associated with using cryptocurrencies can only be identified during the process, so I'll try to share what I've encountered in my work.

Sometimes, a few simple steps can reduce most of the risks listed below to virtually zero and save money.

Cryptocurrency commission size, exchange, or broker

For several years now, cryptocurrencies have been among the top not only most traded assets, but also among the most profitable.

Successful trades bring investors record profits, sometimes measured in hundreds of percent. Therefore, few people consider the fees charged when trading cryptocurrencies.

After all, what role do a couple of percent play if you earned several hundred of these percent on the transaction?.

But this approach is only valid if you are making long-term or medium-term trades and are not using leverage .

This can be easily verified with a simple example: a $10,000 trade with 1:10 leverage and a 0.1% commission. In this case, you'd pay $100 in commission per trade, and 10 such trades would total $1,000.

What is cryptocurrency AML verification and what are the potential risks?

Today, I want to explain in simple terms what cryptocurrency AML verification is, why it's important, and how to avoid unpleasant consequences if your wallet fails the check.

AML (Anti-Money Laundering) is translated from English as “the fight against money laundering,” in our case, the fight against money laundering obtained in the form of cryptocurrency.

Essentially, this is a check of cryptocurrency wallets and transactions for connections to illegal activities, such as fraud, hacking, or the sale of prohibited goods.

The most annoying thing is that you don't have to sell drugs or engage in other illegal activities to have your wallet blacklisted by the AML.

It's enough to top up your wallet or exchange cryptocurrency through an untrustworthy service, and you'll end up on the AML list.

Bitcoin or Ethereum: Which to Choose for Investing and Mining?

The cryptocurrency market offers a variety of assets, but Bitcoin and Ethereum remain key choices for investors.

One acts as digital gold with a limited supply, the other as a platform for smart contracts and decentralized applications.

Bitcoin is attractive due to its stability, while Ethereum is attractive due to its technological capabilities and great potential for future growth.

At the same time, mining requires significant investment, while ETH can no longer be mined after the transition to PoS.

Algorand is a cryptocurrency that can maximize your profits

Lately, there has been a lot of talk online about the phenomenon of the Ripple cryptocurrency, which has quickly risen to third place in terms of market capitalization among other tokens.

But besides XRP, there are other cryptocurrencies with similar applications, but not as well-known, for example, Algorand.

Algorand is an innovative blockchain platform and ALGO cryptocurrency that is actively developing as one of the alternatives to Ripple (XRP).

While both cryptocurrencies offer solutions for fast and inexpensive transactions, ALGO has unique advantages that make it a more promising choice.

Cryptocurrency in Kazakhstan, cryptocurrency laws, and how to buy or sell digital assets

Cryptocurrency has revolutionized the world of financial technology, and Kazakhstan is no exception. The country's citizens have long been active participants in the digital market.

Below, we'll explain what the law says about cryptocurrency, where you can buy cryptocurrency in Kazakhstan, and whether you need to pay taxes on profits from trading these assets.

1. Is cryptocurrency allowed in Kazakhstan?

For a long time, the status of cryptocurrencies in Kazakhstan remained ambiguous. While cryptocurrency is not currently considered legal tender, buying, selling, and exchanging cryptocurrency is entirely legal.

The Best Cryptocurrency Brokers of 2025 with Lowest Commissions

Cryptocurrency trading is increasingly gaining popularity. Making money on the rapid exchange rate is quite easy; the key is to choose the right trading method.

Currently, the fastest, most convenient, and therefore most profitable way is trading through a trader's terminal.

The advantages of this method are obvious, but we'll discuss them at the end of this article.

Today, we'll discuss cryptocurrency brokers that allow trading with leverage.

To find the most suitable company, you should compare trading conditions and the list of available instruments.

The Right Combination of Investing and Trading When Trading Cryptocurrencies

If you're involved in investing, you've probably experienced the feeling of regret after selling an asset and it continued to rise.

Such situations are especially common when trading cryptocurrencies, as unlike conventional currencies, these assets can grow not just by a few percent, but by several times.

A great example is Ripple. After the coin rose from $0.50 to $1.20, many investors locked in profits by selling. But just a few weeks later, XRP surged and reached $2.90 per coin.

The record growth has made everyone who previously got rid of such a promising asset and sold their existing cryptocurrency regret it.

Cryptocurrency coin burning and how it affects token prices

As is well known, one of the main factors influencing the value of an asset is its supply. In the case of cryptocurrencies, this refers to the number of coins available on the market.

It's easy to notice a consistent pattern: the fewer coins in circulation, the more expensive the cryptocurrency becomes.

For example, at the moment, there are 19.7 million bitcoins in circulation at a price of $63,000, but the same Shiba coins are in circulation at 14.5 billion and are worth only $0.00002.

To influence the price of an asset, developers often conduct coin burns, removing millions or even billions of tokens from circulation.

How to Create Your Own Cryptocurrency: A Step-by-Step Guide and Cost Analysis

Cryptocurrencies continue to be a popular tool for innovation in finance, technology, and business.

Many companies and startups are considering creating their own cryptocurrency to attract investment or create new financial models.

This process requires not only technical skills, but also an understanding of the business model, legal regulations, and potential costs.

In this article, we'll look at how to create your own cryptocurrency, how much it might cost, and whether it's worth it.

Bitget Token Cryptocurrency: An Undeservedly Overlooked Asset

Almost every day, you can find recommendations to buy one cryptocurrency or another in the news, with the authors of such articles predicting the meteoric rise of otherwise unremarkable assets.

But at the same time, some rather interesting altcoins remain unnoticed, despite having a much greater chance of growth than various meme coins.

One such cryptocurrency is Bitget Token, which is currently a rather undervalued cryptocurrency.

Bitget Token (BGB) is the native utility token of Bitget, a centralized cryptocurrency exchange founded in 2018.

Pre-market cryptocurrency earnings: why it's not a 100% guarantee of profit

For some reason, it's generally accepted that almost all cryptocurrencies are rapidly increasing in price, so it's advisable to be one of the first to buy a new coin.

But I already described how easy it is to lose money on the cryptocurrency listing in my previous article - https://time-forex.com/kriptovaluty/cryptocurrency-listing

Not all cryptocurrencies rise in price immediately after listing, and even if they do, it's technically difficult to buy crypto at the best price.

For this reason, buying cryptocurrency before it officially goes public, known as the Premarket, is becoming increasingly popular among investors.

How to predict the price of a cryptocurrency based on its market capitalization

The most interesting investments are long-term investments in new cryptocurrencies; this is how you can increase your capital by a hundred, or even a thousand times.

Everyone remembers the story of Bitcoin, when the first cryptocurrency rose in price from $0.03 to tens of thousands of US dollars in just a few years.

It would seem that if you buy any inexpensive cryptocurrency now, in a few years its price will also rise to thousands of dollars.

But everyone has already seen that not every new coin follows Bitcoin's path; some cryptocurrencies, on the contrary, fall in price to zero and even undergo delisting.

Therefore, it takes a little effort to choose the right asset with the potential to generate thousands of percent profit in the coming years.

What is a cryptocurrency listing and how can you lose money on it?

When you start looking into the cryptocurrency market, you initially get the impression that only the laziest people don't make money on it.

Some engage in arbitrage on various exchanges, others play on the cryptocurrency rate, and still others make money on listings.

Listing a cryptocurrency is the process of adding an asset to a cryptocurrency exchange, where traders can buy and sell the coin using other cryptocurrencies or fiat currencies. This means that after listing, it will be easy to buy or sell the new coin at the market price.

Before a cryptocurrency goes on sale, its price is rather arbitrary, and it's difficult to predict how much a new coin will actually cost.

What is cryptocurrency farming and how much can you earn?

Passive income has always been one of the most discussed topics; every investor wants to get maximum profit from their investments with minimal risk.

Thanks to cryptocurrency, new options for passive income are emerging every day, one of which is cryptocurrency farming.

I became interested in this topic myself, and I decided to check how much you could earn by farming on the listing of a new cryptocurrency.

But first, let's try to figure out what this new type of income is and whether it's really worth pursuing.

Cryptocurrency farming is a relatively new, but rapidly gaining popularity, way to earn money in the digital asset sector.

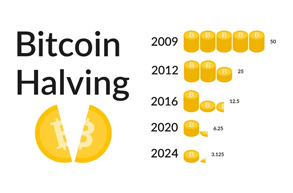

What is halving and how does it affect the price of cryptocurrencies?

Halving is an event in the cryptocurrency world that reduces the amount of new coins generated and awarded to miners for mining a new block in the blockchain.

This event occurs at regular intervals and is a built-in deflation mechanism for many cryptocurrencies, including Bitcoin.

Halving directly impacts the price of cryptocurrencies because it reduces the rate at which the supply of coins increases, which, given stable demand, can cause the price to rise.

If we talk about the most popular cryptocurrency, Bitcoin, Bitcoin halvings occur every 210,000 blocks, that is, approximately once every four years.

Cryptocurrency hedging strategy: two options to eliminate exchange rate risks

One of the strategies for hedging currency pairs is a strategy based on the inverse correlation of these assets.

upward at the same time, while the other is trending downward.

For example, currency pairs such as EURUSD and GBPUSD have an opposite correlation, which means that when the price of EURUSD rises, the value of the GBPUSD pair will fall. By making two transactions in the same direction, you can practically hedge your position.

Moreover, if you choose currency pairs wisely , to earn on positive swaps without worrying about exchange rate changes.

Page 1 of 3

- To the beginning

- Back

- 1

- 2

- 3

- Forward

- To the end