What is a Bitcoin ETF and what advantages does it have over regular Bitcoin?

Not long ago, there were only two options for trading cryptocurrencies: on crypto exchanges and using CFD contracts , but now the cryptocurrency ETF has appeared.

A Bitcoin ETF is an innovative financial instrument that combines the benefits of traditional exchange-traded funds with the revolutionary technology of cryptocurrencies.

An ETF, or exchange-traded fund, is a type of investment fund whose shares are traded on an exchange, like regular stocks.

Purchasing shares in this fund allows investors to participate in Bitcoin price movements without directly purchasing the cryptocurrency itself.

Cryptocurrency Arbitrage: How to Profit from Price Differences

Arbitrage is a money-making strategy that involves buying an asset in one market and simultaneously selling it in another market at a higher price.

The arbitrage scheme can also be more complex, where profit is generated through several transactions, in which one currency is first exchanged for another, and then for a third.

As a result, the participant in the transaction makes a profit due to the difference in prices on different exchanges, and not due to changes in the exchange rate over time.

Cryptocurrency arbitrage is a type of arbitrage that involves buying cryptocurrency on one exchange and simultaneously selling it on another exchange at a higher price.

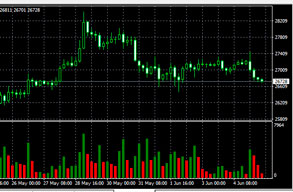

Volume indicator for cryptocurrency trading

Cryptocurrencies have long been a familiar exchange asset; they can be found on many trading platforms.

Despite the virtual nature of digital money, they lend themselves well to technical analysis, which allows various technical analysis tools .

One such tool is the volume indicator, which tracks changes in the volume of open trades for a selected asset.

Knowing how volumes change allows you to decide how strong an existing trend is or to confirm a breakout of a price level.

Cryptocurrency listings: is it worth investing in new assets?

New digital assets are created around the world almost every day, and the cost of creating your own cryptocurrency today is only a few tens of thousands of dollars.

But the newly created coin is, so to speak, money for internal use; the real value of such an asset is questionable.

In order to determine the real value of a coin and increase its popularity, a cryptocurrency listing is necessary.

Listing a cryptocurrency is the act of listing an asset on a digital exchange, after which the coin will begin to be sold and bought in accordance with market laws.

Cryptocurrency swaps and are they worth paying attention to?

When trading on the exchange, a certain commission called a swap is paid for carrying a transaction over to the next day.

Swap - in simple terms, a swap is the difference between the interest rates on a deposit in one currency and a loan in another.

This means that when you make a trade on the EUR/USD currency pair, you borrow one currency at interest, while you own the other and receive a reward in the form of interest on the deposit.

The interest rate itself is determined by the national banks' interest rates for a given currency. Learn more about swaps at https://time-forex.com/praktika/svop-fx

How to cash out cryptocurrency anonymously: the best options

Working with cryptocurrency is becoming easier and more profitable every day. Today, digital money can be exchanged for real money, withdrawn to a card, or cashed out.

If you want to remain completely anonymous, then converting your cryptocurrency into cash is your best option.

Unlike withdrawing to a card, you don't need to provide your details, so no one will count your money or ask where you got it.

The most popular options for exchanging cryptocurrency for cash are withdrawals through exchange offices or cash withdrawals from crypto ATMs.

Potential problems with cryptocurrency wallets

When working with cryptocurrencies, you simply cannot do without an application such as a cryptocurrency wallet.

Using a wallet, you can transfer or receive cryptocurrency, exchange one asset for another, and sometimes withdraw money directly to a bank card.

Most often, users prefer to work with wallets installed on their phones; this allows for greater mobility and the ability to access their funds at any time.

When using wallets, users encounter a host of problems that are best addressed in advance. This is much easier to prevent loss than to spend time trying to get it back.

Leverage Amount in Cryptocurrency Trading

Initially, cryptocurrencies were perceived only as an investment or a payment method, but gradually the volume of speculative transactions began to increase.

And after assets such as cryptocurrency pairs began to be traded on the Forex exchange, the opportunity to use leverage also appeared.

This tool was first offered by brokerage companies that handle transactions on the crypto market.

Using leverage allows you to increase your trading volumes tenfold, thereby increasing your potential profits.

The most reliable dollar-backed stablecoins

Bitcoin is gaining ground every day, especially in the payment space, where it is gradually being replaced by stablecoins.

A stablecoin is a cryptocurrency whose exchange rate is pegged to one of the world's currencies: the dollar, euro, Swiss franc, Japanese yen, etc.

The implication is that cryptocurrency not only follows the exchange rate of a real currency, but is also backed by the corresponding currency held in bank accounts.

Today, dollar stablecoins are the most popular; they have the highest capitalization and are used for the majority of transactions.

Blockchain for stablecoins and other practical aspects of working with similar cryptocurrencies

It's been almost a year since I started working with stablecoins, a payment method and a type of cryptocurrency.

Previously, there was simply no need for this type of electronic money, but gradually this need forced me to create a cryptocurrency wallet.

While working with various cryptocurrencies, I've gained some experience that I'd like to share with those just starting to use stablecoins.

As it turns out, there are more than enough nuances in this matter, and almost all of them emerge when you start making your first transfers.

Cryptocurrency Taxation: What You Need to Know When Using Digital Money

Digital currencies are gradually becoming more and more important in our lives. Some people use cryptocurrencies exclusively for investments, while others use them for daily transactions.

However, not everyone realizes that profits made using cryptocurrencies are taxed in the same way as profits from exchange rate differences in transactions with conventional currencies.

Therefore, a letter from the tax service with a proposal to pay taxes and penalties for late payment may come as an unpleasant surprise.

It would seem that there could be no taxes here if you are not engaged in stock market speculation, but use this type of asset exclusively for your own needs.

What is 1 lot of cryptocurrency equal to? The specifics of determining trade volumes for cryptocurrency pairs on Forex

Those who have been trading on Forex for a long time have long been accustomed to the fact that 1 lot of a currency pair is equal to 100,000 units of the base currency.

But new assets, such as cryptocurrencies, are constantly appearing on the trading platform, and their list is growing every day.

Cryptocurrency pairs are traded in lots, just like other assets, but unlike standard currency pairs, 1 lot here has different values depending on the selected asset.

This point sometimes causes difficulties for beginning traders, because opening a new deal is quite difficult if you don’t know how much money it will require.

Investing in Tether Gold as an Alternative to Physical Gold

For many thousands of years, investing in gold has been considered one of the most secure investment options.

This metal served as a place to store savings during turbulent years when money lost its value and purchasing power.

But time moves on, and gradually physical gold was replaced by gold bank accounts, and with the spread of cryptocurrencies, cryptocurrencies tied to precious metals also emerged.

Today, the gold-backed cryptocurrency is Tether Gold, with the price of one coin corresponding to the price of one troy ounce.

How to determine the most liquid cryptocurrencies and why it is necessary

Despite the fact that the cryptocurrency exchange rate has dropped significantly recently, interest in transactions in digital currency remains quite high.

Some people use cryptocurrencies in their current transactions, while others consider the current decline to be the best option for investing in this asset category.

The main question facing each potential investor is: “Which cryptocurrency should I invest in?”

In our case, one of the criteria for assessing the attractiveness of an investment asset is its liquidity, which is precisely the indicator that influences the ease of working with digital currency.

Profitable and Convenient Stablecoin Storage Options

Stablecoins have recently gained immense popularity, and unlike other cryptocurrencies, their market capitalization has remained virtually unchanged.

Many of my friends, and I myself, use this type of digital money for payments and simply storing free funds.

This type of cryptocurrency is sometimes practically the only possible option for transferring money abroad without unnecessary formalities and in any amount.

The question remains, however, where is the best place to store your stablecoins? Three options are currently available: a crypto wallet, a cryptocurrency exchange, and an international broker deposit.

Cheap cryptocurrencies, bright earnings prospects, or wasted money

Many of us have regretted more than once that we didn't buy a couple of bitcoins at 3 cents apiece and missed out on the opportunity to make good money.

But it's not all bad. With the emergence of new, cheap cryptocurrencies, there's also the chance for record profits. Who knows, perhaps one of the altcoins will follow Bitcoin's lead and rise in price several thousandfold.

Surprisingly, this has happened more than once; for example, Ethereum was once worth less than 1 US dollar, and now its price is 4 thousand.

At the same time, there are also cryptocurrencies that have risen in price quite recently. For example, Polygon, which cost $0.03 at the beginning of the year, has increased in price by 75,000 times in a year and is now worth $2,270.

How to use leverage in cryptocurrency and what types there are

Cryptocurrencies are currently the most volatile exchange asset on the forex market.

Due to the high speed of trend movement, cryptocurrency prices can change by tens of percent in a single day, bringing traders a significant profit.

But even this dynamic exchange rate may not be enough to achieve your goals, so leverage should be used for cryptocurrencies.

That is, to increase the volume of a future transaction using borrowed funds provided by a brokerage company, and therefore to increase the amount of potential earnings.

What is a cryptocurrency pump and dump and how to identify it?

The concept of pump and dump has long been familiar to those involved in stock trading or investments.

Pumps and dumps are methods of influencing the price of market assets. Pump means to pump up or speculate on a rise, and dump means to dump or speculate on a fall.

At their core, these two methods are an attempt to artificially influence the price of securities, cryptocurrencies, futures, or other assets.

That is, this influence can be assessed as a method of market manipulation, as a result of which the rate will change in the desired direction.

Trailing stop for cryptocurrencies: the necessity of use and installation features

Gone are the days when cryptocurrency trading was simply about making money on rising prices.

Most speculative traders have long appreciated the convenience of trading on a trading platform and have transferred their transactions to a dedicated trading program.

But beginners don't always use the full functionality provided by MetaTrader or other similar software.

Trading cryptocurrency pairs is no different from trading regular currencies, allowing you to utilize all the trading platform's , including trailing stop orders.

Trading volumes as an aid in cryptocurrency trading

One of the most important things about trading cryptocurrencies is that even in this unusual market, standard market laws apply.

Here you can also apply strategies that are successfully used on currency pairs and conduct technical analysis using indicators.

There are many indicators that characterize the trend, one of the most striking of which is the total volume of transactions carried out.

That is, the amount of transactions concluded during a certain period of time - an hour, a day, a week.

How to Reduce Risk When Trading Cryptocurrency

Thanks to the popularity of the cryptocurrency market, trading this asset only vaguely resembles classic stock exchange trading.

The main strategy of market participants here is based on the principle: buy when the price rises and sell when it falls.

There's no technical analysis or risk-reduction tactics involved; the process often resembles buying and selling currency at a regular exchange office.

The consequences of such behavior were evident to many during the recent collapse of the virtual currency market, when many cryptocurrencies fell in price by almost half.

Cryptocurrency indicators, market analysis, and trend detection

The cryptocurrency craze, which has captivated a huge number of people, has once again proven that the market simply cannot tolerate unprofessional and superficial traders.

The enormous hype surrounding record growth, spread by the media and on various YouTube channels and bloggers, attracted a huge number of ordinary people to the market.

Information poured in from all sources about the need to buy cryptocurrency.

The most interesting thing is that people couldn't even imagine that the cryptocurrency market could move in any direction other than upward.

Indeed, almost everyone managed to profit from the hype, but no one is talking about how many lost huge amounts of money after the market suddenly reversed course.

In reality, cryptocurrencies are practically no different from any other trading asset whose movement traders speculate on.

When to Buy Cryptocurrency: The Best Time to Buy Bitcoin and Altcoins

The cryptocurrency market has been growing steadily lately, and it seems like it doesn't matter when you buy cryptocurrency; you'll win either way.

Often, investors actively begin buying cryptocurrency at the peak of growth, after it has already reached its next maximum.

But in reality, a spontaneous purchase at the wrong time can not only fail to bring profit, but can even lead to significant losses.

Therefore, before making a trade, it is recommended to first conduct a small market analysis and determine the most successful points for opening a trade.

This is not at all difficult to do, as cryptocurrencies have been moving according to a certain pattern lately; all you need to do is analyze the movement chart of the selected asset.

Cryptocurrency Scalping: Strategy and Best Cryptocurrencies for Scalping

The scalping trading strategy involves profiting from short-term trades held for no more than a few minutes.

The key factors determining the feasibility of this strategy are high liquidity, leverage, and the ability to quickly open and close positions.

This is why cryptocurrency scalping is most effective when using a trading platform.

This software allows you to open and close trades with a single click, with a preset volume, and also offers the ability to automate the process.

Another advantage of using a trading platform is that it allows you to use leverage provided by your broker.

The best platforms for trading cryptocurrency, including Bitcoin

Over the past couple of years, cryptocurrencies have been perceived not only as an investment but also as a profitable asset for trading.

Many investors who initially simply bought Bitcoin and waited for the price to rise have now switched to speculative trading.

As we know, the most convenient way to conduct speculative transactions is through a dedicated program, as conventional crypto exchanges do not offer such capabilities – trades in both directions, pending orders, technical analysis, and automated trading.

Therefore, it is advisable to know which cryptocurrency trading platforms will make this process more efficient.

The most volatile cryptocurrencies where you can make good money

Most traders who earn money on cryptocurrencies have long been convinced that the best option for trading this asset is to use a trading platform .

The trading platform not only expands technical trading capabilities but also provides the ability to apply leverage.

However, the leverage offered by brokers for cryptocurrency pairs rarely exceeds 1:5, so for highly profitable trading, it's best to choose the most volatile cryptocurrencies.

Due to the high price movement dynamics, you can earn up to 100% per day even with leverage of 1:5.

In 2021, this market segment became the leader in terms of trend speed, but to achieve stable earnings, the chosen asset must have not only high volatility but also good liquidity.

Take profit for cryptocurrencies: the best way to take profits on time

Trading cryptocurrencies through a professional trading platform is not only more profitable, but also more convenient.

In addition to significantly lower overhead costs and commissions, the platform also allows you to use stop orders—stop loss and take profit.

We discussed how to prevent large losses using stop losses in an article on this page - https://time-forex.com/kriptovaluty/stop-loss-dlya-bitkoina

But besides losses, there is also profit, which must be secured in time by closing the existing transaction.

We've all experienced the situation when we wake up in the morning and discover that the price of the cryptocurrency we bought rose to its highest level overnight, only to fall again by the morning.

What is market capitalization and what role does it play in cryptocurrency trading?

If you want to make a stable income on the stock exchange, you should understand that stock trading is more than just buying when the price rises and selling when it falls.

In order to make a successful trade, you need to consider not only the existing trend, but also the factors that confirm it.

One of these factors is the market capitalization of an asset, and it does not matter what kind of asset it is: company shares or cryptocurrencies.

The easiest way to understand the essence of capitalization is through the example of securities, or, to be more precise, the company that issued them.

For example, if a company has 1,000 shares in circulation on the stock exchange at a price of $100, then the market value of the company as a whole is $100,000.

The most popular cryptocurrencies for earning and investing in 2021

There's no doubt that cryptocurrencies are now one of the most attractive assets for making money. No matter how long this form of money lasts, you can make money buying and selling them today and now.

No matter how long this form of money lasts, you can make money buying and selling them today and now.

The only thing left to do is figure out where to focus your attention, as jumping between different assets can lead to disappointing results, and not all altcoins are suitable for trading effectively.

Let's try to figure out which are the most popular and liquid cryptocurrencies suitable for making money in 2021.

Currently, there are several favorites that can be traded for a lot, or even a lot, of profit.

Free cryptocurrency signals based on technical analysis

Currently, cryptocurrency trading is, in most cases, a chaotic process.

Market participants begin buying digital currencies en masse when they see an upward trend and rush to sell as soon as signs of a price decline appear.

However, cryptocurrencies, like other traditional currencies, lend themselves well to technical analysis, which can significantly improve the efficiency of trades

and make the trading process more streamlined and, therefore, profitable.

As with other exchange-traded assets, the most important factor here is the timing of trades and their completion at the most favorable price.

What is Tether cryptocurrency and can you make money with it?

We've become accustomed to the fact that most people perceive cryptocurrencies solely as a source of investment or as an asset for quick profits.

But this is only one of the opportunities offered by digital money; in fact, this type of currency was created for other purposes.

Bitcoin's primary goal was to provide complete anonymity, preserving the identity of the token owner.

This payment method was intended to be used for goods and services when the counterparty wishes to conceal their identity.

This approach allows for concealing income and avoiding taxes, as in many countries, tax authorities monitor not only income but also expenses.

Page 2 of 3