How to use leverage in cryptocurrency and what types there are

Cryptocurrencies are currently the most volatile exchange asset on the forex market.

Due to the high speed of trend movement, cryptocurrency prices can change by tens of percent in a single day, bringing traders a significant profit.

But even this dynamic exchange rate may not be enough to achieve your goals, so leverage should be used for cryptocurrencies.

That is, to increase the volume of a future transaction using borrowed funds provided by a brokerage company, and therefore to increase the amount of potential earnings.

Since virtual currency trading is already highly volatile, leverage in this market segment is correspondingly low:

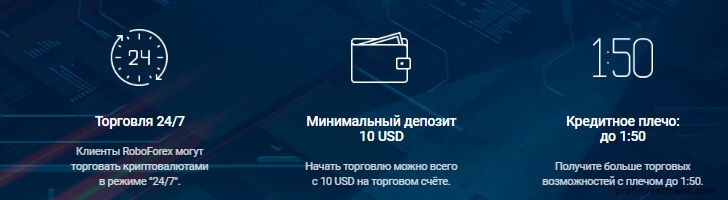

• RoboForex – 1:50, which means you can open a trade 50 times larger than your deposit.

• Alpari – 1:10 on ECN accounts 1:10

• AMarkets – 1:5, 11 cryptocurrency pairs available for trading

• ForexClub – 1:5 over 45 cryptocurrency pairs

Ultimately, depending on the brokerage company you choose, you can get leverage for cryptocurrencies ranging from 1:5 to 1:50, which is sufficient for trading strategies such as pipsing and scalping.

Features of using the shoulder

First of all, it should be noted that margin trading in cryptocurrencies should only be carried out under constant supervision by the trader, as the price of a cryptocurrency pair can change by tens of percent in just a couple of hours, and even by hundreds of percent when taking leverage into account.

This means that using leverage for cryptocurrencies, you will lose your entire deposit if the price changes against your position by just 10%.

stop loss for Bitcoin is required for each open transaction , and the transaction itself is constantly monitored by the trader.

In this case, you should plan only short-term transactions because even if you guessed the direction of price movement, corrective movements of the trend may lead.