Blockchain for stablecoins and other practical aspects of working with similar cryptocurrencies

It's been almost a year since I started working with stablecoins, a payment method and a type of cryptocurrency.

Previously, there was simply no need for this type of electronic money, but gradually this need forced me to create a cryptocurrency wallet.

While working with various cryptocurrencies, I've gained some experience that I'd like to share with those just starting to use stablecoins.

As it turns out, there are more than enough nuances in this matter, and almost all of them emerge when you start making your first transfers.

Wallets – there are quite a few of them available today, ranging from the simplest versions for computers and phones to the most secure hardware crypto wallets.

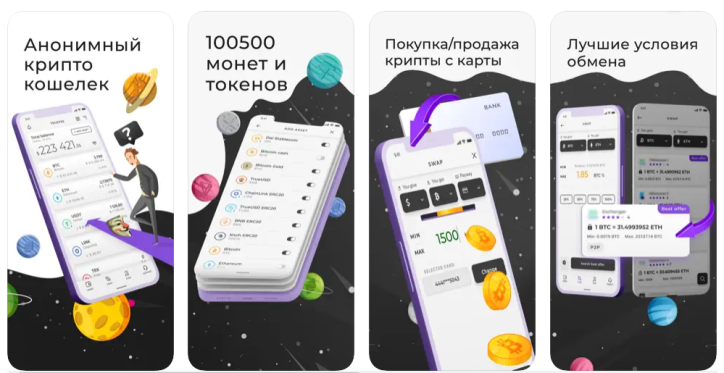

I settled on one of the simplest options: Trustee Wallet, a crypto wallet for smartphones:

The app is no different from hundreds of other similar apps for phones; it allows you to exchange, buy, and sell cryptocurrency, and withdraw it to cards or electronic payment systems.

I personally only use stablecoins for transactions: I receive, pay, and sometimes withdraw via exchange to my bank card. The fee for sending stablecoins averages 0.5% to 0.7%, which is quite acceptable for me.

In this case, the passphrase must be stored in an accessible place, but away from your phone, for example on a password-protected flash drive or in a specially created cloud in a password-protected archive.

The blockchain on which the chosen stablecoin is based. It was an unpleasant surprise to me that stablecoins are not fully independent cryptocurrencies:

To receive a transfer in certain stablecoins, you must first deposit $100 in the underlying cryptocurrency whose blockchain is used. This is because this cryptocurrency will be used to deduct the fee when sending stablecoins.

Most of the popular stablecoins today are based on Ethereum, Bitcoin, and Tron. Other options exist, but these are currently the most common. This means they're easier to use for invoicing and payment.

I use Tether (USDT TRC20) on Tron and Binance USD (BUCD ERC20) on Ethereum, a habit of not putting all my eggs in one basket.

For the same reason, Tether is stored in Trustee Wallet, and Binance USD is stored in a Binance . The latter is also because Binance offers a plastic card for real-world purchases with instant exchange for the currency of your choice.

I have to use stablecoins mainly when dealing with brokers , when I need to top up a trader's account or, conversely, withdraw profits.