Trailing stop for cryptocurrencies: the necessity of use and installation features

Gone are the days when cryptocurrency trading was simply about making money on rising prices.

Most speculative traders have long appreciated the convenience of trading on a trading platform and have transferred their transactions to a dedicated trading program.

But beginners don't always use the full functionality provided by MetaTrader or other similar software.

Trading cryptocurrency pairs is no different from trading regular currencies, allowing you to utilize all the trading platform's , including trailing stop orders.

I described this tool in detail in the article - https://time-forex.com/praktika/kak-vystavit-trejling-stop

Peculiarities of setting a trailing stop for cryptocurrencies

Technically, the process of setting a trailing stop on a cryptocurrency pair is not much different from setting one on a regular currency pair.

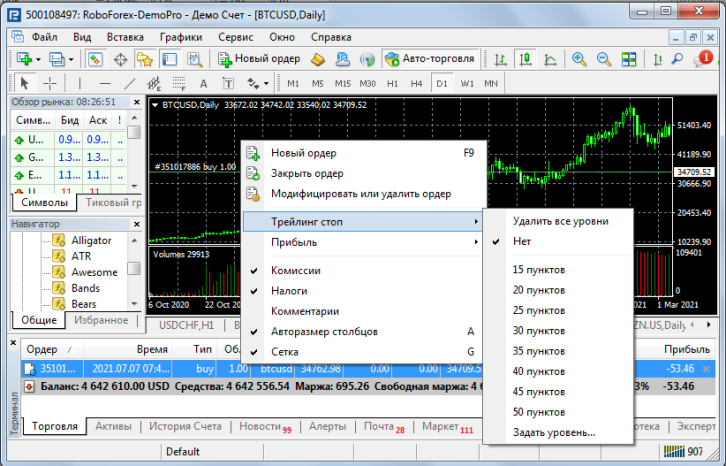

You open an order, for example, for Bitcoin, then in the Trade tab, right-click on the open order:

But here the question arises: what should the order size be? By default, we're offered between 15 and 50 points.

But if you look at Bitcoin, which has two decimal places in the quote, then 50 points here will be equal to 50 cents, that is, the order will close if the price goes against the open position by 50 cents.

It is clear that such a size is simply not applicable when trading cryptocurrencies, given the high dynamics of movement.

A trailing stop for cryptocurrencies should be set at least 1000 points; only then will the stop order not be triggered by the slightest market noise.

Well, then everything is strictly individual: we look at the size of the correction on the time frame you have chosen and set the optimal Trailing Stop value.