How to set a trailing stop and what this order represents

A trailing stop allows you to maximize your profits from the current trend by moving your stop loss along with the price movement and only closing your position if the trend reverses.

along with the price movement and only closing your position if the trend reverses.

That is, if the price moved 200 points in the desired direction, you will take all 200 minus the trailing stop size.

In fact, this is a floating stop loss, which is used in cases where you cannot control the trade at all times.

It's important to remember, however, that unlike the latter, this order only works when the trader's terminal is turned on, and if you turn off the terminal or computer, it will stop working.

The purpose of this tool is to close a profitable position with a profit and prevent a correction from completely destroying the positive financial result of the transaction.

How do I set a trailing stop? This order is placed in the trader's terminal after you've opened a position and begun trading. There are some nuances to working with this stop order, which I'll describe below.

How does a trailing stop work?

Trailing Stop works quite simply: you open an order in the desired direction, then set the trading stop slightly larger than the correction amount, so that it doesn't trigger prematurely.

In some trading terminals, the minimum value of this order is 15 points.

Once the price enters the breakeven area and your profit is more than 15 pips, a stop order is automatically placed on the chart.

The whole process can be understood more clearly using a real example.

You opened a long position on the EURUSD currency pair at 1.2510 and then set a trailing stop at 20 pips.

The price rose by 40 points to 1.2550, our order was triggered and stopped at 1.2535, securing 25 points of profit.

There are two possible scenarios for how events will develop.

The first option is that the price has moved even further to 1.2590 and our order is already at 1.2575, the fixed profit is 65 points.

The second option is that the trend has reversed, in which case the position will open at a price of 1.2535, bringing us 25 points of profit.

This option works well during a fast trend and sharp price jumps in the direction of the main trend.

Setting up a Trailing Stop

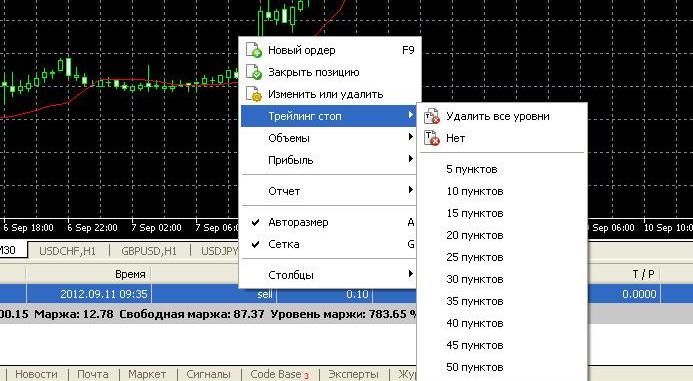

Everything is quite simple here, just open an order, then right-click on the open position. A menu similar to the one in the picture should open. Then select the size you need and you're done.

If you like this loss control option, and Trailing Stop is truly worth considering, but you can't keep your computer on all the time, it's better to rent a virtual server for your trading terminal. This way, your trading terminal will operate autonomously.

The issuance process can be automated using special scripts:

- Trailing Master script - http://time-forex.com/skripty/trailing-master

- TrailinRobot - http://time-forex.com/skripty/trailin-robot

It should be noted that some scripts allow you to solve the problem of removing a trailing stop after disabling the trading platform, meaning there is no need to purchase a virtual server.

An alternative to a trailing stop is to manually move the stop-loss to the break-even zone, but unlike the previous solution, this requires constant monitoring of the open trade.

To avoid having to keep your computer on all the time, and an open position may last for more than one day, it is best to use a virtual server for work.

It costs no more than $10 per month, and some brokers even offer such servers to their clients as a bonus. Once you install the trading platform on the server, the trailing stop will no longer be triggered regardless of whether your home computer is turned on or off.

Similar servers can also be used to run trading robots.