Cryptocurrency arbitrage and whether it's worth using

Arbitrage trading of any financial instrument is the most attractive way to earn money in decentralized markets.

This tactic is especially popular among traders trading popular cryptocurrencies on Forex.

Although quotes for liquid currency pairs are provided by the Chicago Futures Exchange, they can vary significantly

brokers The acceptable margin of error varies within 10 pips. Experienced traders can effectively exploit this in short-term trading.

Cryptocurrency trading is developing rapidly, but the prices of digital financial instruments remain unregulated by government or other competent authorities.

The lack of price regulation on cryptocurrencies results in extremely high volatility in these instruments, which can reach several thousand points per day.

A successful trade can allow a trader to double their initial investment or lose a large portion of their capital.

A successful trade can allow a trader to double their initial investment or lose a large portion of their capital.

Furthermore, altcoins are virtually immune to conventional analytical methods for predicting their potential value. Therefore, trading cryptocurrencies is extremely risky, even without leverage.

These factors explain the popularity of arbitrage trading strategies , as they offer minimal or no risk. What is the essence of arbitrage, and is it worthwhile to use this method in practice?

Reasoned answers will be presented below. Beginning traders and interested users are encouraged to read this material in its entirety.

What is arbitration and how to make money from it?

The decentralized nature of the cryptocurrency market has created fertile ground for the emergence and rapid development of numerous specialized trading platforms in Asia, the EU, and the US.

It's worth noting that the price of a particular altcoin on one exchange can differ significantly from its price on another.

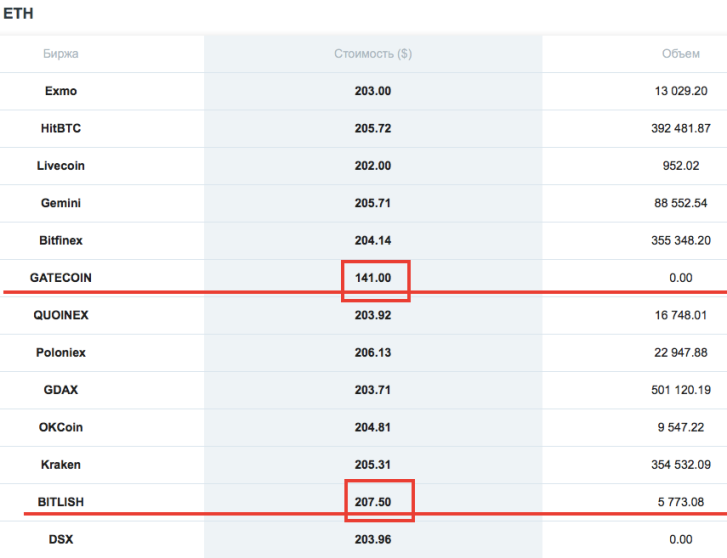

For example, it's recommended to look at the current ETH (Ethereum) exchange rate:

Such information summaries are published and regularly updated on specialized websites and are available for free review. The maximum price for Ethereum on the BitLish platform is $207.5 per coin.

Such information summaries are published and regularly updated on specialized websites and are available for free review. The maximum price for Ethereum on the BitLish platform is $207.5 per coin.

Trading volume is over 5,000 altcoins per day, which is significantly below average. The minimum price is $141 per coin on the GateCoin exchange. This price is due to the complete lack of trading volume.

It's worth noting that such a price range is extremely rare. On average, the difference does not exceed $10. This figure should be used as a starting point for calculations.

The mechanism for earning money is quite simple: buy low and sell high on a second platform, profiting from the price difference. In reality, it's not that simple. Arbitrage trading is complicated in practice by a number of factors:

exchange and exchange service fees for each transaction (purchase of cryptocurrency on one platform, withdrawal to a wallet, deposit on another platform, sale of altcoins, and withdrawal of fiat funds).

Not all specialized exchanges allow fiat deposits and withdrawals.

Commission fees are the main problem with arbitrage trading:

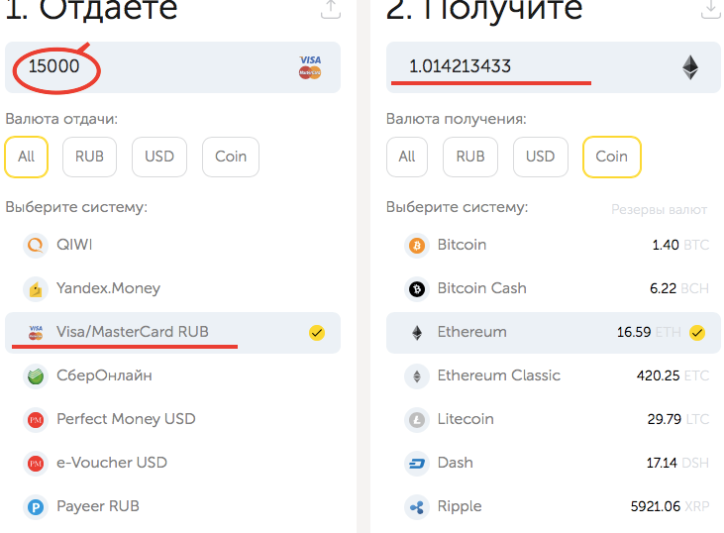

The market value of Ethereum at the time of writing is approximately 12,600 RUR. However, on an exchange with the most favorable fees, 1 ETH can be purchased for 15,000 RUR, significantly exceeding the altcoin's exchange price.

The market value of Ethereum at the time of writing is approximately 12,600 RUR. However, on an exchange with the most favorable fees, 1 ETH can be purchased for 15,000 RUR, significantly exceeding the altcoin's exchange price.

Add to this the 0.1 ETH exchange fee for transactions. Therefore, even if you manage to earn 10 USD (650 RUR) selling ETH, this profit doesn't even cover half of the commission costs.

Conclusion:

Based on objective data, it's logical to conclude that earning money through cryptocurrency arbitrage trading is no longer viable. All profits will be used to offset commission costs.

It's recommended to consider purchasing altcoins exclusively as passive , long-term investments.