Using pending orders when trading cryptocurrency

Trading using a pending order strategy has long been one of my favorite options.

A pending order is a buy or sell order entered into the trader's trading platform that is executed as soon as the price reaches the level you specify.

This strategy has numerous advantages, one of the main ones being that you don't have to constantly sit at your computer screen waiting for the right moment.

This means you don't have to wait for the currency to fall or rise in price; you simply enter the price you want to sell or buy the selected asset.

Cryptocurrency trading using pending orders becomes more efficient.

• Firstly, all operations are carried out in the trader’s terminal - http://time-forex.com/praktika/terminal-trejdera which, unlike other options, still has the option of insuring against risk if the price changes direction.

• Secondly, you should use a broker who has the ability to trade cryptocurrency as an intermediary - http://time-forex.com/kriptovaluty/brokery-kriptovalut

Once you've opened an account with your chosen broker and downloaded and installed the MetaTrader terminal, you can begin planning your trade.

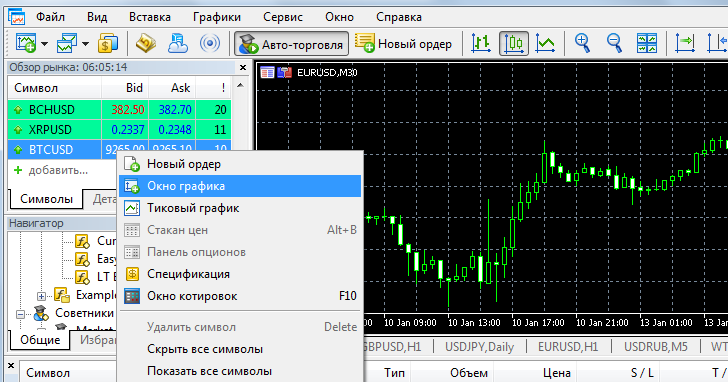

1. First, find the desired cryptocurrency pair in the "Market Watch" window. In our case, it will be Bitcoin/US Dollar, designated as BTCUSD, and add a chart window:

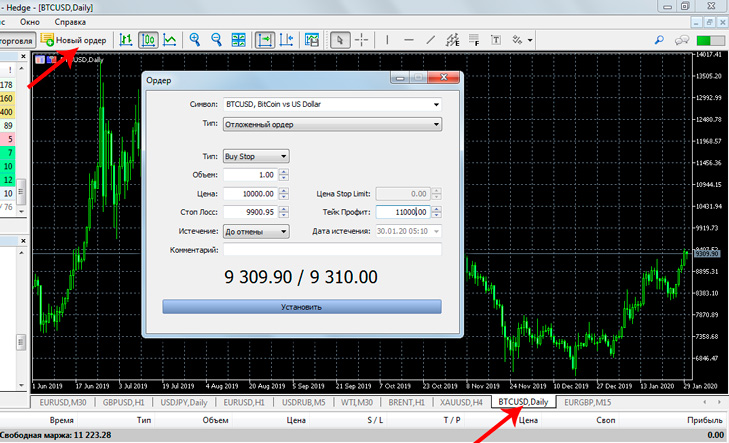

2. Then, in the currency pairs tab, open our BTCUSD chart, click the "New Order" button on the top panel, and make all the necessary settings:

2. Then, in the currency pairs tab, open our BTCUSD chart, click the "New Order" button on the top panel, and make all the necessary settings:

In our case, the price is at $9,310 per Bitcoin, and we want to buy the cryptocurrency at $10,000 per unit, as there's a high probability the price will continue to rise.

In our case, the price is at $9,310 per Bitcoin, and we want to buy the cryptocurrency at $10,000 per unit, as there's a high probability the price will continue to rise.

In the settings, we'll select:

- Order Type – Buy Stop, which is an order to buy at a set price

- Volume – the amount of Bitcoin you plan to buy -

Price – at which the trade will open

- Stop Loss – a safety order that will close the trade if the price starts to fall

- Take Profit – the price at which the trade will close with a profit.

Once all the settings are selected, click "Set" and you'll see:

Two lines have appeared on the BTCUSD chart, representing our order: the green dotted line is the trigger price, and the red dotted line is the Stop Loss .

Two lines have appeared on the BTCUSD chart, representing our order: the green dotted line is the trigger price, and the red dotted line is the Stop Loss .

Additionally, the order and your account details are displayed at the bottom of the terminal. If you hover your mouse over this order, right-click, and select "Edit or Delete," you'll be able to edit the pending order—delete, change the volume, or modify stops. You can also limit the order's validity, for example, to one week.

Now all you have to do is wait for the price to reach the set level and trigger your pending order. You don't even need to leave your computer on; the order will execute even if the trader's trading terminal is turned off.