What is market capitalization and what role does it play in cryptocurrency trading?

If you want to make a stable income on the stock exchange, you should understand that stock trading is more than just buying when the price rises and selling when it falls.

In order to make a successful trade, you need to consider not only the existing trend, but also the factors that confirm it.

One of these factors is the market capitalization of an asset, and it does not matter what kind of asset it is: company shares or cryptocurrencies.

The easiest way to understand the essence of capitalization is through the example of securities, or, to be more precise, the company that issued them.

For example, if a company has 1,000 shares in circulation on the stock exchange at a price of $100, then the market value of the company as a whole is $100,000.

It is generally accepted that the higher the capitalization ratio, the larger and more reputable the company, and the more confidence investors have in it.

In reality, however, market capitalization does not always reflect the true state of affairs and can be artificially inflated through stock market manipulation.

The concept of capitalization does not apply to currencies, but cryptocurrencies operate on a slightly different principle and have their own level of capitalization.

The Impact of Capitalization on the Value and Popularity of Cryptocurrencies

Cryptocurrencies are essentially more like securities than traditional currencies; their number in circulation is strictly defined, and the market value of one coin determines the overall capitalization of the asset as a whole.

Professional stock market investors rarely consider this indicator in their calculations, but with cryptocurrencies, things are completely different:

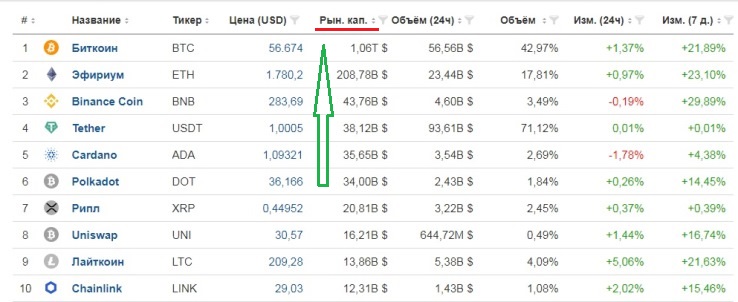

It just so happens that most crypto exchanges and analytical sites sort assets by capitalization.

This means that assets with a higher total value are at the top of the list, which means they have higher liquidity and, as a result, lower transaction fees.

The second point is the notional capitalization levels, after which the cryptocurrency continues to grow, attracting the interest of new investors. One trillion for Bitcoin is an example.

In turn, a decrease in capitalization always confirms a downward trend and encourages traders to sell.

It's clear that this factor plays only a supporting role and is more of an emotional nature, but it's still advisable to consider the capitalization of cryptocurrencies when planning your transactions.

Useful information for trading cryptocurrencies - https://time-forex.com/kriptovaluty