Ripple trading strategy.

The cryptocurrency market is gradually shifting from spontaneously organized exchanges to interbank platforms, otherwise known as forex.

This means not only increasing trading volumes, but also using the latest advances in trading and the availability of leverage.

The Ripple cryptocurrency itself is highly popular, which gives us hope that the spread on the XRPUSD currency pair will not be high.

Until recently, the main strategy for investors in this type of asset was to buy and wait for growth, followed by selling; now the situation and opportunities have changed somewhat.

Trading Ripple in the trader's terminal.

- Choosing a broker that allows you to trade Ripple - http://time-forex.com/kriptovaluty/brokery-kriptovalut

- Next, register, download the trading terminal, or use the online platform as in the example - http://time-forex.com/sovet/platform-kripto

- Analyzing the graph

- We decide on a strategy for opening transactions.

- We place orders.

- We make a profit.

You can find information on how to choose a broker and how to work with a professional trading platform using the links above, so let's take a closer look at the strategy itself.

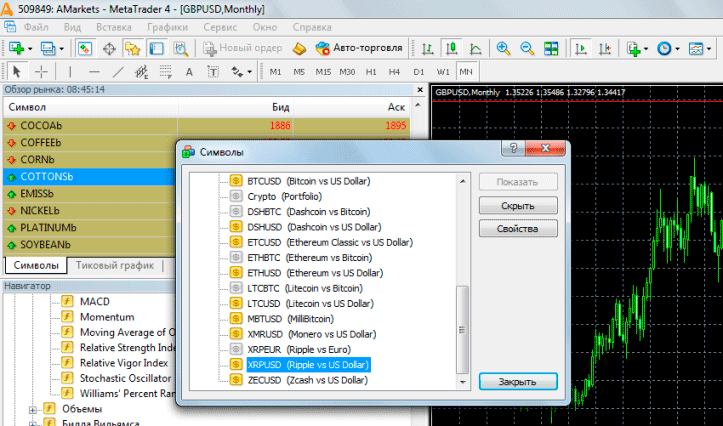

Adding a graph.

In the trader's trading terminal, using the "Market Watch" window, select the XRPUSD symbol. If this currency pair is not in the list of symbols, add it - hover the cursor over the Market Watch window, right-click, select symbols, and select XRPUSD.

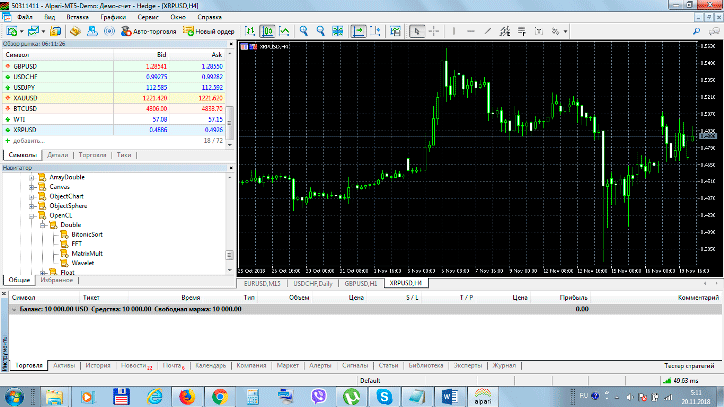

After this, we add a chart window where we will see the movement of the XRPUSD currency pair exchange rate - hover the cursor over the desired currency pair, right-click and select "Chart Window".

On the chart, select the hourly time frame and adjust the scale so that our field of view covers a period of one week.

Add the Stochastic indicator and trade using its indicators. Read more about trading with the Stochastic here - http://time-forex.com/strategy/strategiy-stohastik

This is one of the simplest strategies for a beginner trader and is perfect for Ripple. Buy trades are opened when the indicator exits the lower zone, and sell trades are opened when the indicator lines exit the upper zone.

As an alternative to this strategy, you can use pending orders. For example, if the Ripple price is currently 48 cents, we place a pending buy order that will trigger after the price reaches 50 cents and close with a profit of 52 cents.

In this way, we plan to receive a 4% profit, and using leverage we can increase this percentage several times.

If you have any questions, you will find the answers in the section - http://time-forex.com/kriptovaluty