Bitcoin or Ethereum: Which to Choose for Investing and Mining?

The cryptocurrency market offers a variety of assets, but Bitcoin and Ethereum remain key choices for investors.

One acts as digital gold with a limited supply, the other as a platform for smart contracts and decentralized applications.

Bitcoin is attractive due to its stability, while Ethereum is attractive due to its technological capabilities and great potential for future growth.

At the same time, mining requires significant investment, while ETH can no longer be mined after the transition to PoS.

Capitalization and fundamental differences

When Bitcoin first emerged in 2009, no one could have predicted that it would become a financial phenomenon comparable to gold. Today, its market capitalization is approximately $1.9 trillion, making BTC the most secure cryptoasset.

On the other hand, Ethereum, launched in 2015, gained popularity thanks to smart contracts, which became the foundation for the entire DeFi, NFT, and Web3 industries. Its market capitalization currently stands at $318 billion.

Bitcoin's limited supply makes it analogous to gold, while Ethereum functions as a digital platform for applications. If BTC is a safe deposit box where investors store value, ETH is an entire economy where money works and generates value.

Which cryptocurrency is best for investment?

Bitcoin, thanks to its strict supply limit of 21 million coins, remains the primary inflation hedge. This is why large funds and institutional investors include it in their portfolios, viewing BTC as a safe haven.

Ethereum, for its part, has won the technology race. Its transition to Proof-of-Stake (PoS) and coin burn mechanism have made it a deflationary asset, potentially increasing its value.

Bitcoin is preferred by conservative investors who expect stable growth in value, while Ethereum is chosen by those who believe in the development of digital finance and Web3.

Which is better to mine: Bitcoin or Ethereum?

When Ethereum abandoned Proof-of-Work in favor of Proof-of-Stake, traditional ETH mining became a thing of the past.

Now, cryptocurrency can only be mined on the Bitcoin network, but mining difficulty is increasing, and the block reward is reduced every four years (halving).

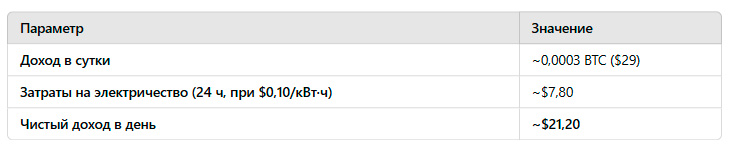

To understand how profitable it was to mine Bitcoin, let's take one of the most popular ASIC devices - Antminer S19 Pro (110 TH/s, 3250 W).

The Bitcoin network's difficulty continues to increase, reducing mining profitability, especially for individuals. Furthermore, if electricity costs continue to rise, this will also impact profits.

However, BTC remains the only major cryptocurrency that can be mined using traditional methods.

Which to choose: Bitcoin or Ethereum?

Bitcoin offers reliability and scarcity, acting like digital gold , and its market is less susceptible to manipulation. Ethereum, on the other hand, offers flexibility and innovation, allowing investors to not just store but also profit from digital finance.

- If you're looking for a stable asset to store value, choose Bitcoin.

- If you believe in technology development, DeFi, and Web3, Ethereum may provide more profit in the long term.

- Bitcoin remains the only option for mining, but it requires expensive equipment. Monero (XMR), which can be mined on both CPUs and GPUs, and Kaspa (KAS), which is efficient for video cards, are profitable alternatives.

Also promising are Alephium (ALPH) and Ergo (ERG), which continue to develop after Ethereum abandoned PoW.

Ultimately, the ideal strategy is diversification. By combining investments in BTC and ETH, you can take advantage of their strengths.