Upward trend in trading and how to determine it

The price movement of a currency pair always has its own direction, which is the basis for choosing between short or long transactions.

If the base currency rate only rises over a certain period of time, we can talk about the presence of an upward trend in Forex.

An uptrend is an increase in the price of a currency pair over a certain period of time. It is formally believed that in such a situation, each subsequent minimum and maximum price will be higher than the previous one.

For example, the price of the EUR/USD currency pair first rose to 1.1215, then fell to 1.1200, and then rose again to 1.1220 dollars per euro.

In other markets, an upward market trend implies an increase in the price of the underlying asset; for example, in the stock market, this would be an increase in the price of securities.

price highs and lows not always perfectly aligned. Sometimes, the price may make a sharp downward movement or rise only slightly, but the main thing is that the overall trend is maintained.

An upward trend is based on two factors: the first is fundamental, and the second is technical. These two factors are closely related and therefore should be considered together.

The fundamental factor is the release of positive news for the base currency . It is the news of an improving economic situation that causes the price of a currency to rise relative to other currencies and initiates an upward trend.

The basis for this growth is an increase in demand and the number of purchase transactions, along with a decrease in supply—these two key indicators, as we know, shape the market price.

In addition to a strengthening base currency, an upward trend can also lead to a weakening of the quoted currency. For example, news of instability in the US financial system will impact the US dollar, while the euro will remain stable. As a result, we could see an increase in the price of the EUR/USD currency pair. However, no positive changes have been reported in EU countries.

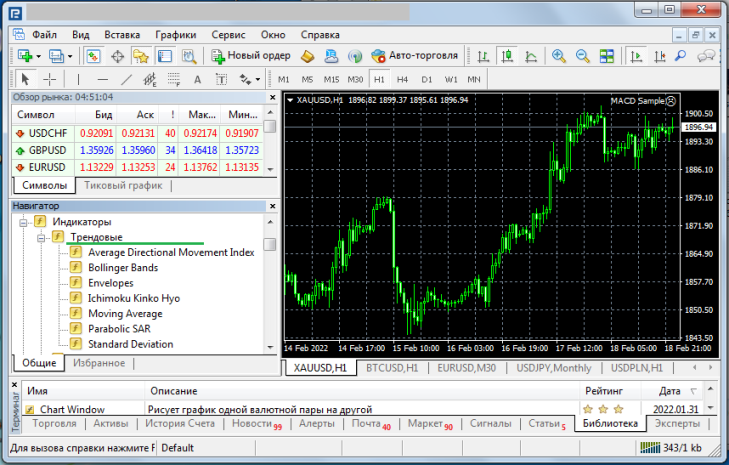

An additional tool for determining an upward trend are special indicators - https://time-forex.com/tehanaliz/indikatory-trenda the use of these tools significantly speeds up the analysis of the existing trend.

In addition, the trading platform itself has its own selection of indicators for determining trends:

Trading on an Uptrend in Forex

If you're a trend-following strategy enthusiast, then when there's an uptrend in the Forex market, you should only open buy trades, with a few exceptions.

The best entry points are price lows or so-called pullbacks, where the price corrects and then begins to rise again. However, you should ensure that this is a correction and not a trend reversal. You can do this by checking the latest news in your news feed and assessing the magnitude of the pullback.

A second, simpler trading option is so-called news trading, which occurs when an upward market trend begins to form after a positive news release. The key here is to not miss the news release and open a trade as early as possible.

A second, simpler trading option is so-called news trading, which occurs when an upward market trend begins to form after a positive news release. The key here is to not miss the news release and open a trade as early as possible.

When opening trades, don't rely solely on a single timeframe ; it's also a good idea to evaluate the situation over longer timeframes. Ideally, an upward trend should also be observed on these timeframes.