Timeframe in Forex trading

Trading on the Forex currency exchange takes place using a special trader terminal, with price movements displayed on currency pair charts, each of which has two lines.

A vertical one, which displays the price value, and a horizontal one, divided into time intervals (time frames).

Timeframe – a time period characterizing price movement. It is designed to simplify and standardize data display across various trading terminals.

Very often, novice traders mistakenly assume that the name of the time frame in trading characterizes the duration of the time interval, but in fact, it is the period of one candle.

In other words, we can say that H1 characterizes a trend section lasting almost two days, and even longer if you zoom out on the chart. Each candlestick, however, is exactly one hour long:

Therefore, you should not confuse the name of the timeframe and the duration of the trend segment that opens on the currency pair chart.

Therefore, you should not confuse the name of the timeframe and the duration of the trend segment that opens on the currency pair chart.

Basic Forex timeframes

Short-term – this category includes the first three timeframes, ranging from 1 to 15 minutes.

M1 – suitable for scalping and forex scalping ; it's the best way to maximize profits with a small deposit, taking full advantage of leverage. A one-minute trading chart perfectly captures all price changes that occurred within an hour:

M5 and M15 are used for short-term trading, but if desired, trades can last several hours. High leverage is also possible, but trading is more relaxed than on M1.

M5 and M15 are used for short-term trading, but if desired, trades can last several hours. High leverage is also possible, but trading is more relaxed than on M1.

Medium -term timeframes cover timeframes from M30 to H4.

M30 is the best timeframe for intraday trading , allowing you to apply most available Forex trading strategies. It offers one of the most optimal options in terms of profitability and risk.

H1 is also convenient for intraday trading, but allows you to compare price behavior over two days.

H4 allows you to evaluate trend dynamics over the course of a week, is suitable for swing trading , or can be used as a data source for technical analysis.

Long-term timeframes : Most brokers now claim they do not limit the duration of trades, meaning an open position can last for a year or two. This trading option is more suitable for investments, where profit can be realized only in the long term.

True, there are some limitations imposed by the exchanges themselves, for example, when trading futures.

D1 is a daily timeframe, where each candle or bar represents a day, essentially allowing you to assess price movements over the course of a month.

W1 – this trading timeframe corresponds to one week, while the chart displays a six-month period; it is also used exclusively for technical analysis.

MN – one month; this chart allows you to look back several years and assess forex market patterns , depending on seasonal fluctuations or other factors.

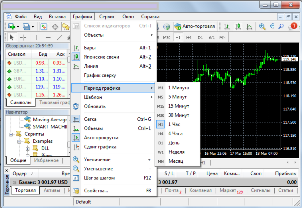

In addition to the above-mentioned timeframes, you can also create your own timeframe of a specified duration, for example, 7 minutes. For instructions, see https://time-forex.com/sovet/nestandart-taymfreym

Choosing a Forex Timeframe for Trading can help you with this .