Which timeframe is better?

Timeframe is a time interval that characterizes the movement of the exchange rate over a certain period of time.

The effectiveness of opening positions and many other nuances will depend on how accurately you determine which time frame is best for you.

Each option has its own characteristics and requirements for leverage, deposit size, and the applied forex trading strategy.

There are several options for dividing the timeframe depending on the chosen strategy for working on the Forex currency market. Each option is based on the amount of funds at the trader's disposal, the availability of free time for trading, and experience in the currency market.

Choosing a timeframe is a rather complex process; when doing so, you should carefully analyze your trading strategy and all its tactical aspects.

You should first decide whether you will work exclusively during the day or carry over positions to the next day.

1. Which time frame is better for intraday trading and which for long-term trading?

Intraday trading involves opening and closing a trade within one business day. In this case, you don't need to conduct a complex analysis of long-term trends; simply monitor key news for your chosen currency and rely on technical indicators.

When calculating trade profitability, only the broker's commission spread, which is charged when opening a position, is taken into account; there's no need to include the size of the credit interest rate. This is the most suitable and simple option for a novice trader.

Long-term trading implies that an open trade will remain open for at least several days. When a position is rolled over to the next day, a special swap fee is charged to the account, based on the difference in interest rates between the currencies in the currency pair.

The main advantage of trading on long timeframes is high profitability and low time investment. This trading approach is especially beneficial during a prolonged trend movement in one direction.

The disadvantages include increased deposit requirements, as price reversals may occur during trading, leading to the loss of an unsecured trade. This option is typically used by more experienced traders who are able to make long-term forecasts for currency pair movements.

When determining which time frame is best, one should not forget about the time division, as many strategies are built on this basis.

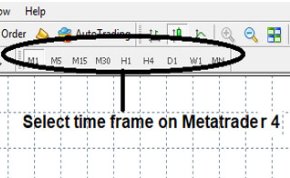

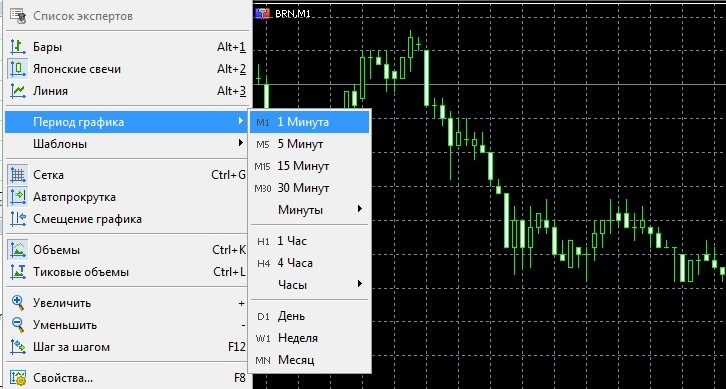

2. Timeframe duration

Super short – ticks or M1 – uses a scalping strategy based on short-term trades, lasting from a few seconds to several minutes. Increased profits are achieved through large trading volumes and the maximum number of trades executed in a single day.

Often, trading is conducted simply on intuition or using special indicators; the main thing is to catch short-term movements and then close the trade in time.

At the same time, maximum requirements are imposed on order execution speed and spread size. It is not recommended for beginner traders, as it may seem simple at first glance, but in reality, it is scalpers who most often lose their deposits.

Choosing this timeframe allows you to earn even with a small deposit using the so-called " Deposit Acceleration " strategy, the highest recorded return for which was 10,000% per annum.

Short time frames—M5, M15, M30—are a bit easier to trade than the previous option; trading no longer puts as much pressure on the psyche and can be used as a signal to open positions based on forex news.

Averages – H1, H4 – choosing this option requires market analysis, at least during the current session or over the previous 24 hours. This determines which factor caused the current trend and the likelihood of it reversing in the near future.

Long-term positions – D, W, and MN – are not suitable for every instrument, as you need to be absolutely certain that the price will continue moving in that direction over the entire timeframe. Typically, trading is conducted on currency pairs with low volatility but good predictability.

Examples of strategies for trading on various timeframes can be found at the link - http://time-forex.com/strategy

To make sure you've made your choice, try opening trades of varying durations on a demo account. Then, compare their success rates. Based on the results, you can then decide which timeframe is best for you.

You should also not forget about the asset you are trading; for stocks, long time frames are more interesting.

In currencies, many prefer intraday trading, and the time for holding futures trades is often limited by the contract expiration time.