What is halving and how does it affect the price of cryptocurrencies?

Halving is an event in the cryptocurrency world that reduces the amount of new coins generated and awarded to miners for mining a new block in the blockchain.

This event occurs at regular intervals and is a built-in deflation mechanism for many cryptocurrencies, including Bitcoin.

Halving directly impacts the price of cryptocurrencies because it reduces the rate at which the supply of coins increases, which, given stable demand, can cause the price to rise.

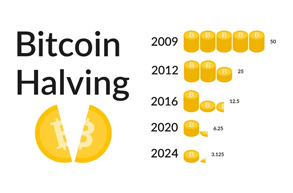

If we talk about the most popular cryptocurrency, Bitcoin, Bitcoin halvings occur every 210,000 blocks, that is, approximately once every four years.

- The first halving occurred in 2012, when the block reward dropped from 50 to 25 BTC.

- The second halving occurred in 2016, reducing the reward to 12.5 BTC.

- The third halving took place in 2020, and the block reward was reduced to 6.25 BTC.

- The fourth is planned for April 18-21, 2024, and will be reduced to 1.125

Each of these halvings was accompanied by significant interest from investors and speculators, as well as discussion of the potential impact on the price of Bitcoin and other cryptocurrencies. While historical data shows a tendency for prices to rise after halvings, it is important to remember that the cryptocurrency market is subject to a multitude of factors that can influence prices.

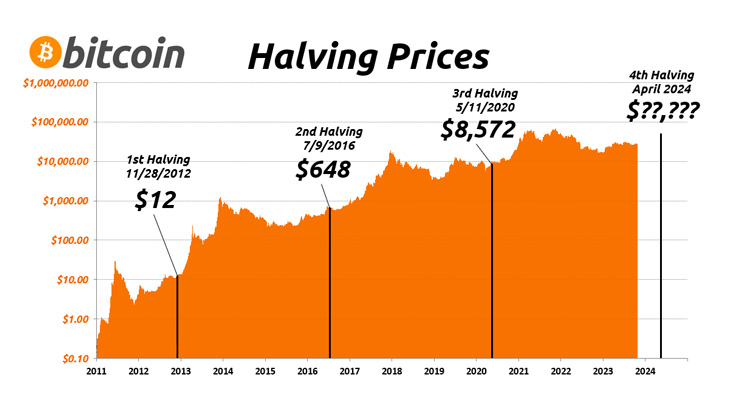

Analysis of past halvings shows that this event can have a significant impact on market value.

Let's look at Bitcoin as the most famous example:

- After the first halving in 2012, the price of Bitcoin increased from $12 to $1,000 within a year.

- The second halving in 2016 also triggered a significant price increase, with Bitcoin soaring to $20,000 in 2017.

- The third halving took place in May 2020 and was again marked by an increase in the price of the leading cryptocurrency. At the end of 2020, Bitcoin reached new all-time highs of $28,000 per coin.

However, it's important to understand that halvings aren't the only factor influencing cryptocurrency prices. Market value also depends on a variety of other factors, including regulatory news, technological advances, market demand, and macroeconomic trends.

An interesting feature is that the price begins to rise long before the halving begins; all investors know that there will be growth after the event and are actively buying coins.

A few days before the event, demand falls, and with it the cryptocurrency's price. However, if you didn't manage to sell your coins at the highest price, don't worry. As past statistics show, the price will resume its rise and generate profits.

Besides Bitcoin, halving is also happening for other cryptocurrencies, which is also a great opportunity to earn money:

Litecoin (LTC): Halving occurs every 840,000 blocks, which is approximately 4 years.

Bitcoin Cash (BCH): Halving occurs every 630,000 blocks, which is approximately 4 years.

Ethereum (ETH): difficulty bomb, increasing mining complexity, occurs at the request of the developers.

Investors and analysts have varying expectations regarding future halvings, but many agree that these events could drive price increases. This is due to the limited supply of new coins, while demand remains stable.

However, predicting exact numbers or market reactions is difficult, and investors should always exercise caution and not rely solely on halvings as a guaranteed growth trigger.

Cryptocurrency brokers - https://time-forex.com/kriptovaluty/brokery-kriptovalut