Cryptocurrency hedging strategy: two options to eliminate exchange rate risks

One of the strategies for hedging currency pairs is a strategy based on the inverse correlation of these assets.

upward at the same time, while the other is trending downward.

For example, currency pairs such as EURUSD and GBPUSD have an opposite correlation, which means that when the price of EURUSD rises, the value of the GBPUSD pair will fall. By making two transactions in the same direction, you can practically hedge your position.

Moreover, if you choose currency pairs wisely , to earn on positive swaps without worrying about exchange rate changes.

Cryptocurrency hedging will provide the opportunity to earn guaranteed profits through staking , receiving interest for locking assets.

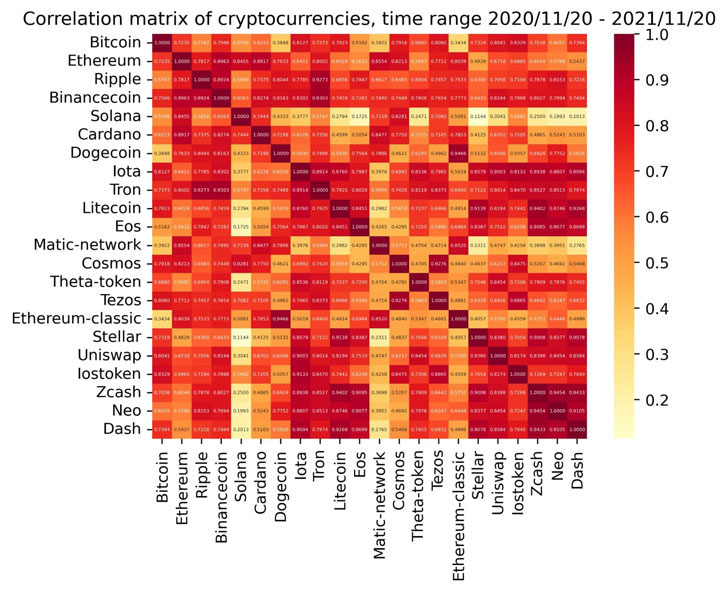

All you need to do is find assets with an inverse correlation. For this purpose, you can use a special table:

As you can see, the lowest correlation coefficient in the table is 0.2, meaning all assets are moving in the same direction. You can also use the correlation indicator , but it's unlikely to yield any positive results.

The crux of the matter is that virtually all cryptocurrencies are directly correlated; they rise and fall in price simultaneously. Some move faster, others a little slower.

Therefore, unfortunately, it is not possible to use a hedging strategy on cryptocurrencies in the same way as on regular currencies.

How do you hedge cryptocurrencies?

It turns out that hedging cryptocurrencies is impossible, but fortunately this is not entirely true; it just requires a slightly different approach.

That is, use a third-party asset for hedging that has an inverse correlation with the cryptocurrency market. For example, the USDJPY currency pair, i.e., buy the US dollar for the Japanese yen:

You lead when the price of Bitcoin falls and the US dollar begins to strengthen against the Japanese yen.

You may be able to find an asset that has an even stronger correlation to cryptocurrencies.

Ultimately, it's possible to hedge cryptocurrencies, but in a slightly different way than we're used to with traditional currencies. Ultimately, you offset cryptocurrency losses with gains from another asset.

The second option is "Lock cryptocurrencies"

If you want to protect yourself when staking, you can also use locking , which is when you stake cryptocurrency on an exchange or in your wallet and simultaneously open a sell transaction for the same cryptocurrency with a cryptocurrency broker - https://time-forex.com/kriptovaluty/brokery-kriptovalut

In this case, you completely eliminate exchange rate risks, since the transaction will be opened for one asset, and you will only have to wait for the accrual of staking interest.