The cost of 1 lot in Forex trading, a simple cost calculation

When trading on Forex, there are many different parameters that need to be calculated before opening a trade, one of which is the cost of 1 lot.

is the cost of 1 lot.

The lot value is the amount of funds in the deposit currency that must be paid when opening a one-lot trade. This parameter depends on the currency pair being traded.

Calculating the lot value is fairly simple, but it's important to keep in mind that in addition to the trader's own funds, leverage also plays a role. The higher the leverage, the less equity is required to support the transaction.

The standard lot size is 100,000 units of the base currency in the currency pair. So, if a trade is being conducted on EURUSD, the base currency would be the euro.

That is, to open a deal of one lot on EURUSD we will need 110510 dollars, this is where the leverageIf its size is 1:100, then we divide the resulting amount by 100; now, to open a transaction with a volume of 1 lot, only $1,105 will be required.

This is taking into account that you have a dollar deposit, otherwise the amount is simply transferred at the current exchange rate.

Using this approach, you can calculate the cost of a lot for almost any currency pair; the easiest way to do this is if base currency The US dollar is used. In this case, one contract would be equal to $100,000.

Forex trading is not only done with whole contracts; most brokers allow their clients to open trades in 0.1 or even 0.01.

Cent brokers They even offer the opportunity to trade from as little as 0.001 contracts, which is equivalent to just 100 units of the base currency. This amount becomes a mere pittance when using leverage. This approach allows you to get acquainted with trading without incurring large expenses.

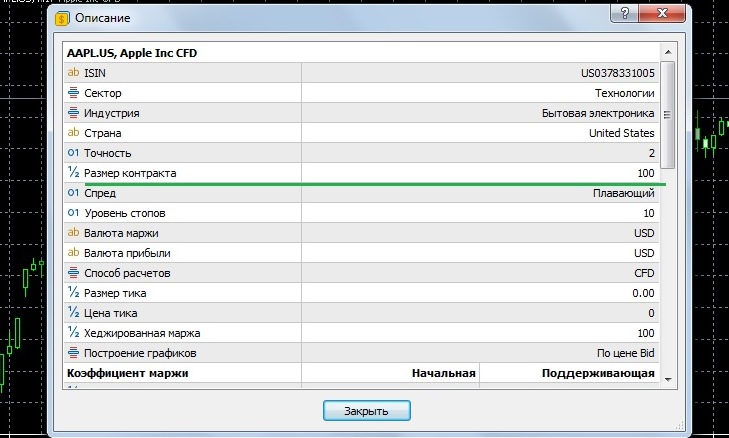

Price of shares lots

When trading on the stock exchange, there is a different approach to the cost of 1 lot of shares, where a standard contract contains 100 shares:

While the quote shows the price per share, that is, to calculate the cost of 1 lot of shares, you just need to multiply the current quote by 100.

For example, shares of Apple Inc. are currently trading at $159, which means the price of one share of Apple Inc. at the moment will be $159,000.