Futures trading on the exchange, necessary programs and transaction examples

Many newcomers, as well as experienced forex market players, lack the courage to try other instruments, limiting themselves to a narrow range of currency pairs. A number of myths have developed around futures trading, including that it's very complicated, difficult to predict prices, and quite difficult to understand.

other instruments, limiting themselves to a narrow range of currency pairs. A number of myths have developed around futures trading, including that it's very complicated, difficult to predict prices, and quite difficult to understand.

Of course, the first thing that puts off a newbie from futures is the name of the symbol, which often carries no associations with a commodity or stock, unlike a currency pair, where everything becomes perfectly clear after looking at the name.

However, you don’t even think about how much you limit yourself and prevent yourself from realizing your potential by actually working on difficult to predict currency pairs like the euro/dollar and pound/dollar.

There are hundreds of such stories, and every trader who reaches a professional level tries to switch to futures trading, given that it is more liquid and predictable.

Key points of futures trading on the exchange

A futures contract is a special type of exchange contract between a buyer and seller of a commodity, based on the principle of an agreement to buy the commodity on a specific date and for a specific amount. To illustrate, imagine you've grown a ton of grain and your harvest reaches...

You can harvest grain at the end of the season and sell it at the market price, or you can enter into a contract with a buyer to buy the grain back exactly one month later at the current price, rather than the market price the following month. This way, you protect yourself from the risk of a price drop, and the buyer, anticipating a price increase by the start of the season, saves on the purchase.

This is roughly what a futures contract on the exchange looks like. When you buy it, you simply own the commodity, and if by the end of the transaction's expiration, the price rises, and you entered into the transaction at a lower price, the difference will be your net profit.

You should understand that there are cash-settled and deliverable futures. Cash-settled futures are simple—they allow you to speculate on your favorite exchange without the obligation to take delivery. Deliverable futures, on the other hand, are traded on commodity exchanges, and at the contract's expiration date, your goods will be delivered to you.

There is simply a huge number of futures, but they can be divided into conditional groups.

The first and one of the largest groups are currency futures. They work very simply: you enter into a contract to buy a specific currency at the current price, and your profit will be visible at the contract's expiration.

When analyzing currency futures, many traders make forecasts for the movement of currency pairs, since a strong trend correction .

The second group of futures are stock indices. For those unfamiliar, indices are constructed based on the growth of shares of the country's major companies.

The third major group is Energy. Here you can trade contracts for oil, gas, fuel oil, gasoline, and various energy products.

The fourth oldest group is designated as grains. This group offers contracts on key agricultural commodities, including futures on corn, soybeans, wheat, rice, soybean meal, oats, and soybean oil. A notable feature of trading this asset category is that its participants are large industrialists rather than speculators, which makes prices more stable.

To analyze possible price movements, various reports on the export volumes of the main exporting countries, data on weather conditions, and crop yields are used.

The fifth major group is metals. You can enter into contracts for gold, silver, platinum, copper, and other precious metals.

Although futures trading on the exchange occurs on special futures platforms, brokers have introduced the so-called CFD tool, which allows you to try trading various assets through your Meta Trader 4 trading platform.

Examples of futures trading

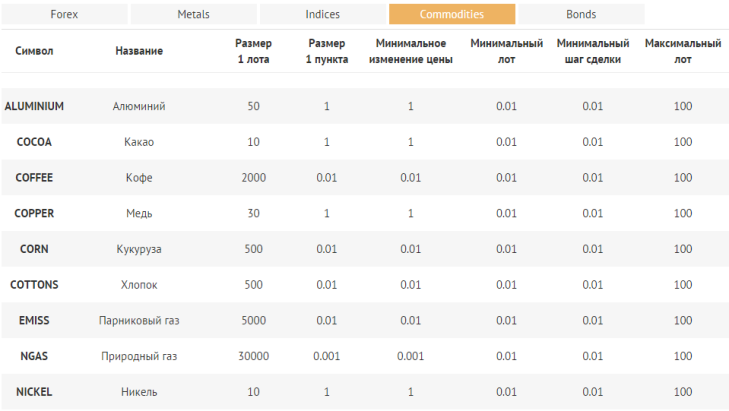

For example, the broker Amarkets offers the ability to trade 21 futures contracts, including key ones like soybeans, corn, oil, aluminum, gasoline, and other popular contracts. Brokers often organize these into subgroups in the MT4 trading terminal, so they're always readily available.

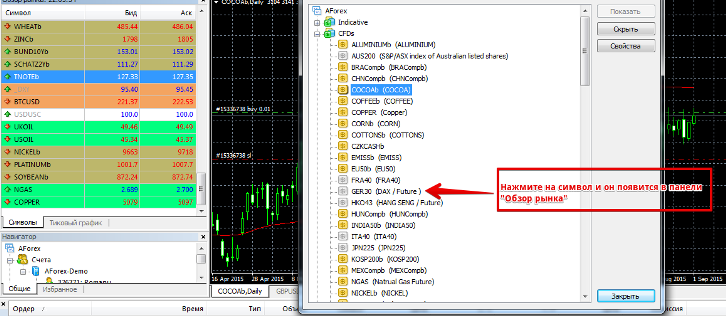

To see the symbol for which company or commodity futures you're trading, right-click on the currency list and open the symbol menu. Subgroups with currency pairs will then appear, so open the CFD group.

Each symbol's meaning will be explained in brackets next to it. You can also add missing instruments to the work panel by clicking on the contract you're interested in. An example of the symbol definition can be seen in the image below:

Trading futures on the commodity exchange is no different from your usual currency trading. You can actively use technical analysis, manage orders by setting stop orders and take-profits, apply trailing stops , and utilize various indicators and expert advisors, as well as all the additional features available on the MT4 trading platform.

Trading futures on the commodity exchange is no different from your usual currency trading. You can actively use technical analysis, manage orders by setting stop orders and take-profits, apply trailing stops , and utilize various indicators and expert advisors, as well as all the additional features available on the MT4 trading platform.

Also, to properly manage your money and understand the cost of any given transaction, I recommend visiting the Amarkets instrument specifications page, where you can find more specific information on the lot size and instrument features.

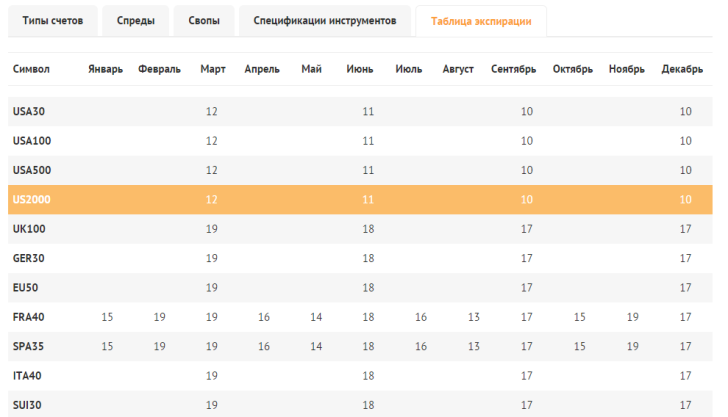

It is important to remember that futures, like options, have a contract expiration time.

To help you stay informed about the expiration date for all instruments, AMarkets has created a separate contract expiration table, where you can see the day and month a futures contract expires. You can find this table in the "Trading Conditions" section.

In conclusion, I'd like to say that trading futures on the exchange isn't as complicated as it first appears. Forecasting potential exchange rate changes for some commodities is much easier than for popular currency pairs, as the factors influencing the corn exchange rate are clearly an order of magnitude fewer than for the euro or the dollar.

For more information on this topic, visit the AMarkets website . Thank you for your attention, and good luck in exploring new horizons!