How to fund a Forex account: profitable and fast deposit options

One of the most common questions when trading on the foreign exchange market is "how to fund a forex account?" This seemingly simple step can sometimes cause a host of complications.

It should be taken into account that some brokers practice an approach in which withdrawals are only possible using the same method by which they were deposited.

There are several simple ways to fund a forex trader's account: with electronic money, bank transfer, from a card account, cryptocurrency, or cash at a dealing center office.

When making your choice, be sure to pay attention to the size of the commission charged, the transfer period, and the ability to choose the payment currency.

Some brokers charge withdrawal fees as high as 5%, while other brokerage companies allow you to withdraw funds without any fees.

Each of the listed options has its own advantages and disadvantages, which should be taken into account when choosing it.

Currently, you can top up your Forex trader account:

1. From a card account – one of the easiest and fastest ways to deposit and withdraw funds. To do this, you need a debit or credit card; the salary card you receive your salary from is also suitable.

First, you need to top up your card account if there aren't enough funds on it, and then go to the broker's website to make the transfer. All that's required for this action is the card number and a special three-digit code, which is usually indicated on the back of the card (not to be confused with the ATM PIN code).

Funds crediting depends on the bank's processing speed and can take anywhere from a few seconds to an hour, depending on your bank and brokerage company.

5. Cryptocurrency is the best option. Some brokers allow you to fund your Forex or other trading account with digital currencies. This approach allows you to maintain anonymity when trading and withdrawing funds without disclosing your profits.

Alpari and RoboForex offer the widest range of options and the fastest deposits to traders' accounts (deposits and withdrawals are commission-free).

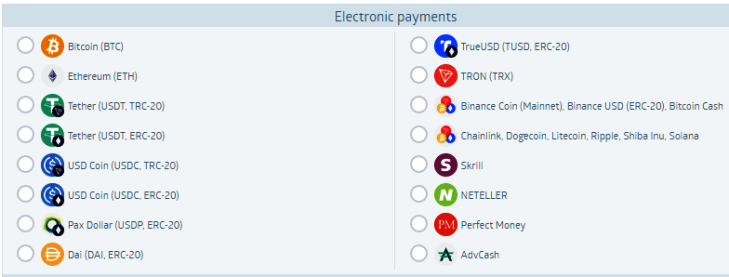

The most popular option is stablecoins such as Tether (USDT), USD Coin (USDC), Binance USD (BUSD)

Funds are credited instantly, and most brokerage companies conduct cryptocurrency transactions with virtually zero commission.

3. Bank transfer – the third most popular option for funding a Forex account. It's not very practical, but it's suitable for those who have trouble funding their account with a bank card.

To do this, first copy the payment information from the website of the dealing center where the funds should be transferred, then go to the nearest bank branch and make the transfer.

Or simply log into online banking and enter the required details found in your trader's personal account.

On average, a transfer takes from 2-3 hours to several days, depending on the speed of your bank.

1. Electronic payment systems – currently there is a fairly large selection of electronic systems – Webmoney, Yumani, Perfect Money, Neteller, FasaPay.

To get started, you need to register with one of the selected payment systems, then go through the verification process and top up your account.

Recently, electronic systems have been losing popularity, giving way to cryptocurrency wallets due to the high cost of transfers and the complex process of identity verification.

4. Cash – funds are deposited directly in cash at the brokerage company's office. This option is no longer widely used.

When choosing a method to fund your Forex trading account, remember that many brokers require you to use the same channel for withdrawing profits as you used to fund your account.

Therefore, if you plan to withdraw funds in cryptocurrency, it is advisable to top up your account with digital money.