What can be seen in the account history of a trader's trading terminal?

A trading platform is a multifunctional tool for conducting financial transactions on exchange and over-the-counter markets.

Despite the diversity of software, all terminals can be roughly divided into two categories:

- Trading.

- Analytical.

Few beginning traders have heard of the second group of terminals for making money in financial markets.

They differ from the more well-known ones by their variety of integrated analytical tools, which are not provided by trading platform developers.

Analytical terminals are used by traders solely to assess the current market situation.

The vast majority of this category of traders ignore theory, and the educational stage is reduced to searching for an effective strategy online and testing its effectiveness on demo account.

For these purposes, the most popular trading terminal, MetaTrader4, is installed. It can be downloaded either from the developer's official website or from the broker's page after creating an account and logging in.

Of all the functional capabilities of this trading platform, account history is worth highlighting.

This tool can be invaluable for new traders, helping them understand their own mistakes and avoid them in the future.

What is the role of account history and how can it be used in trading?

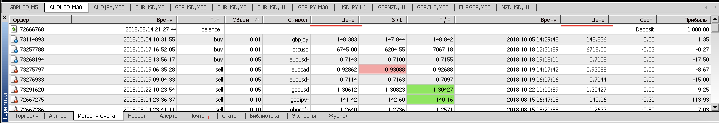

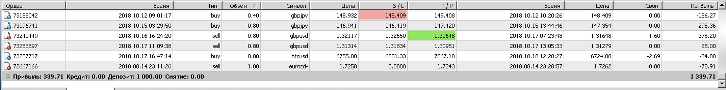

The MT4 platform's account history stores all important information about trades over the past period. This information is displayed in the additional menu at the bottom of the terminal.

The trading account history is displayed as a table and contains the following information about previously opened orders:

- Time of placing a trade order.

- Order type.

- Transaction volume.

- Currency pair.

- Order opening price.

- The meaning of stop loss and take profit safety orders.

- Time of deal closing.

- The fixed price of an asset at the time the order is closed.

- The swap value is the fee for carrying a trade over to the next day. It can be either positive or negative.

- Financial result of the order (profit/loss).

In addition, the bottom of the table shows the total profit the trader has received, as well as the withdrawal and deposit amounts.

This data is essential for effective error correction. The MT4 account history table displays the opening and closing prices of trading positions, as well as the values of safety orders.

This information allows you to identify market entry points on the chart and re-analyze the situation. Beginner traders should perform this analysis at least once a week if trading is unprofitable.

Important! Correcting your mistakes is an essential part of a successful trading career. This will allow you to make appropriate adjustments to your trading strategy , which will significantly impact your future profitability.

Never underestimate the importance of correcting your mistakes!

Conclusion:

The account history in the trading platform is an effective tool for any trader.

Thanks to the detailed information on trades presented in the table, the user can effectively correct mistakes and make appropriate adjustments to their strategy.

Potential investors also pay attention to the account history when assessing the investment potential of your trading.

You can find other useful tips here - http://time-forex.com/sovet