Carry trade (carry trade).

You can make money on Forex not only by predicting the direction of exchange rates, but also by simply exploiting the difference in interest rates between the currencies included in a currency pair.

Carry trade is a trading strategy in which the main profit driver is the difference between deposit and loan rates in different countries. Depending on the direction of the trade, this trading option can yield a considerable profit.

Basic concept of Carry trade.

When buying or selling a currency pair, a trader borrows one of the currencies in the pair and maintains control of the other. When trading intraday , no interest is paid for the use of funds or deposit remuneration, but if the trade is carried over to the next day, a forex swap is charged.

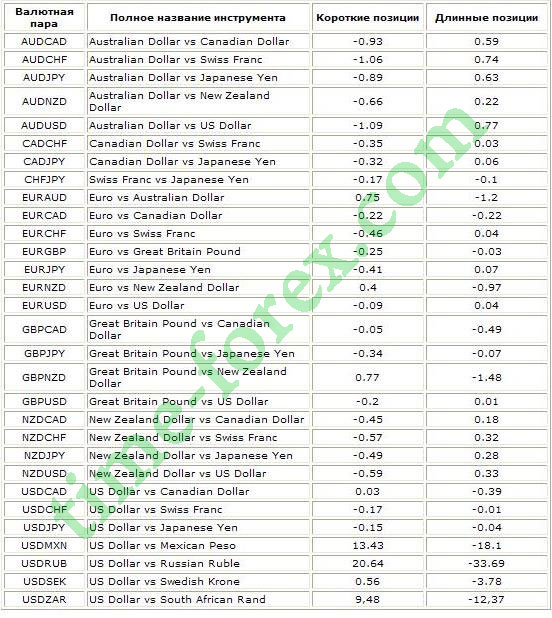

A swap can be negative or positive, depending on which is greater: the interest paid for using the loan or the remuneration accrued for the deposit.

For example, if the EURAUD currency pair is used for trading, the swap commission is

+0.75% per annum for a sell and -1.2% per annum for a buy. This means that if you open a buy trade and roll it over to the next day, regardless of the exchange rate movement, you will be charged +0.75% per annum.

It might seem possible to make money with such paltry interest rates, but it's important to remember that Forex trading uses leverage, and if it's 1:100, the interest will increase 100-fold, reaching 75%, or 6.5% per month, or 0.2% per day. With a $10,000 deposit, that's about $200.

Moreover, there are more favorable currency pairs, where positive swaps can reach up to +5%.

For example, by choosing a currency with the lowest interest rate for a loan, you can invest in a more profitable instrument, but in another country's currency. In practice, this operation looks like this: you take out a loan in euros at 9% per annum, convert the proceeds into rubles, and deposit them at 20% per annum. If the exchange rate remains unchanged for a year, you will earn an 11% profit minus the bank's exchange fee. The low profit percentage is offset by the fact that you are working exclusively with someone else's money. This is the simplest example of how this strategy can be applied in real life.

Carry trade strategy on Forex.

The main components of this trading strategy are:

1. Selecting a suitable trading instrument – the primary requirement for using this strategy is choosing an appropriate currency pair with a positive swap level.

2. The presence of a favorable trend direction, or its complete absence, so that exchange rate changes do not cause losses on the currency pair.

3. A low spread will increase the potential profit.

This strategy is not often used in Forex trading due to the high level of currency risk, but it does exist.