Consumer Price Index: Impact of the News Release on the GBP/USD Currency Pair

Every novice trader who decides to trade using fundamental analysis on Forex faces the problem of simply not knowing how a particular piece of news can impact the market, how far the price moves on average after the news is released, and why the market sometimes doesn't react to it.

faces the problem of simply not knowing how a particular piece of news can impact the market, how far the price moves on average after the news is released, and why the market sometimes doesn't react to it.

Many websites write on their pages about the importance of fundamental indicators and that they can be traded, but unfortunately, practical information on how to apply a particular piece of news is almost impossible to find.

I had to face this problem too, so I decided to conduct my own analysis and some mathematical calculations.

If you've ever traded the news, you've noticed that the same news item affects each currency pair differently. This effect stems from the fact that each currency has its own economy, and if the economy is strong and stable, and there's been good news beforehand, a new indicator for its counterpart may have no effect at all.

One of the most popular news items traded by traders is the Consumer Price Index. For those unfamiliar, the CPI measures price changes for goods and services used by ordinary consumers.

If the index rises, it signals rising sales, which directly translates into economic growth, lower inflation, and a healthy economic climate. This seemingly insignificant index has a significant impact on the market at the time of its release.

As I mentioned earlier, to understand the true impact of the Consumer Price Index on price movements, I decided to conduct some research using historical data. I chose to focus on the GBP/USD because it is one of the most popular pairs traded by traders.

For our observations, we selected only the GBP CPI, which will give us an objective picture of the news's impact on the GBP/USD currency pair. The GBP Consumer Price Index is released monthly, so we decided to analyze the past five months and calculate the average price change after the news release, the duration of the news, and information about possible reversals.

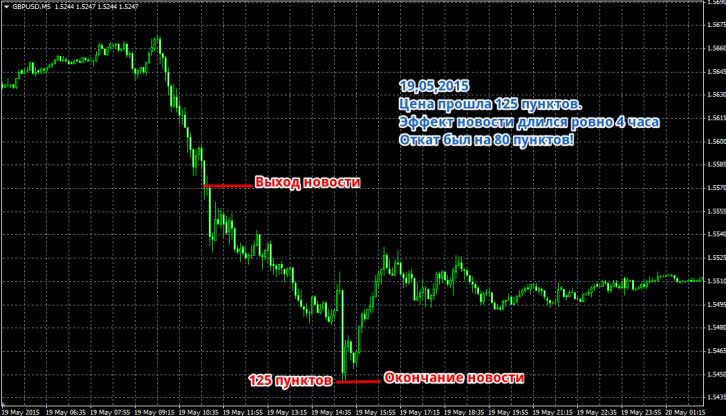

The first CPI data for the pound was released on May 19, 2015, and was lower than the previous reading, suggesting the pound will begin a downward spiral. You can see the actual situation at the time of the news release and its conclusion in the image below:

At the moment the news was released, the market plunged sharply, falling 120 points, with minor pullbacks observed, as weak resistance and support levels formed. It's crucial to note that the impact of the Consumer Price Index release lasted for four hours.

One common mistake traders make when using news is believing that the price only completes its main move at the moment of its release. In reality, however, news can move the price in a given direction for a very long time, so there's no need to rush into exiting a position after grabbing a few pips. It's also worth noting that after the news ended, the price began to pull back and move sideways for 80 pips.

The second Consumer Price Index release date fell on June 16, 2015, and was higher than the previous one. This suggests that the price should move higher at all points. In reality, the price initially moved lower, defying most expectations. However, after 15 minutes, the news began to take effect and moved 85 points. Its impact on price movement lasted for a full 10 hours, after which the price began to move sideways. You can see this in more detail in the image below:

The third news release was on July 14, 2015. It was a negative figure, which should have pushed the pound down significantly. However, just a couple of minutes later, news about the dollar was released, which was extremely negative. Therefore, the news simply didn't work out, and the market simply surged higher due to the negative dollar data. An example is shown in the image below:

On August 18, 2015, the CPI data came out higher than expected, causing the market to surge higher. The news's impact lasted only an hour and a half, but during that time, the price climbed 115 points. Another big mistake for beginners is exiting when the market is weak, but in this case, it was a buildup that led to a new surge. The rebound after the news was realized was 70 points. An example is shown in the image below:

On September 15, 2015, the CPI data remained unchanged, so the price continued its downward trend. The news's impact lasted four hours, and the profit from the trade could have been as much as 120 pips.

Now let's sum it up. If we were trading with a stable stop loss and a take profit equal to the minimum profit in history, which is 85 points, we would get the following figures: 85 + 85 + 85 + 85 - 85 = 255 points of profit.

This is a rough calculation, because as you can see, on average, news moves 110-120 points per day. I'd also like to debunk the myth that the main price movement only occurs in the first few minutes after the news release, as our calculations show that the effect can last from an hour to 10 hours.

In conclusion, I'd like to say that trading the Consumer Price Index is quite profitable, but you need to be patient and not jump out of the market at the first opportunity. Remember, your minimum target should be 85 points after the news release, but keep in mind that the price could easily break 120 points.