Using Fundamental Analysis in Practical Forex Trading

Forex trading is based on two methods of market analysis: technical and fundamental analysis. While the latter seems simpler to apply, it raises many questions.

At first glance, it seems simpler to simply open a trade in the direction of the trend after a news release. However, in reality, the market doesn't always behave correctly, and prices move irrationally.

Therefore, if you want to trade forex most effectively, you should follow a few simple rules for opening and closing trades, taking into account fundamental factors.

Market entry and fundamental analysis

The key to Forex trading has always been entering the market, but this requires not only choosing the right trade direction but also taking into account the risk of a trend reversal.

There is no point in closing a position just before the release of important news, since if this news causes a trend reversal, the trade will close with a loss.

If it contains events that are predicted to cause trend reversal It's better to postpone your entry and wait for the news to be released. However, an exception might be when the indicator in the forecast column corresponds to the chosen trade direction.

For example, you're trading the EUR/USD currency pair, which is trending upward, and a US GDP report is due in a few minutes. The "Forecast" column shows (-0.5%), meaning this report will further weaken the US dollar. In this situation, you can safely open a buy trade, but keep an eye on the news release and, if the experts' forecast is not confirmed, close the trade.

Closing positions.

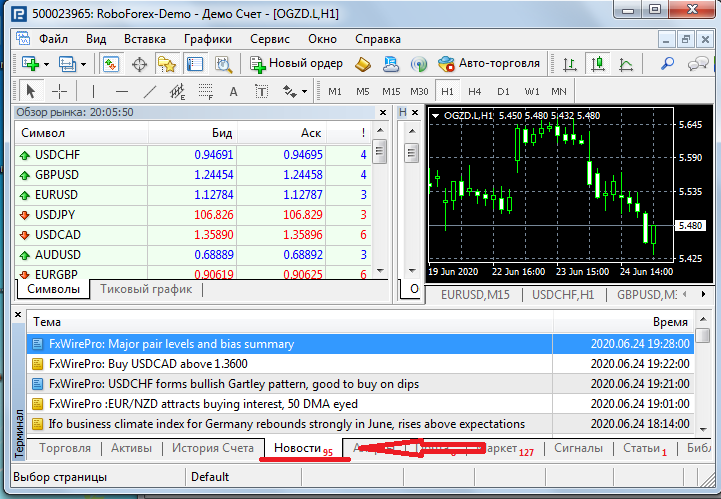

News can also serve as a signal to end a trade if it increases the risk of a trend reversal. Information about the release of important news can be obtained on financial news websites or through the Forex broker's news feed directly on the trading platform:

This method is quite effective because it allows you to track news directly in the trading platform. This allows you to immediately determine how the trend has reacted to an event and quickly open a new position.

news indicator can be an alternative signal source ; it also broadcasts the most significant events. It's best to compare both options and choose the one that's most relevant to you.

For example, if you opened a buy trade on EURUSD, and unfavorable news about the European Union appears in the news feed, it's better to close the order yourself rather than wait for the stop loss to be triggered.

Similarly, you can develop an entire news trading strategy using the principles outlined in this article.