US Consumer Confidence Index: Impact on USDCHF

The people's confidence in the stable growth of the state's economy and satisfaction with the current situation within the country is a good sign of confident growth and stability for any economy in the world.

with the current situation within the country is a good sign of confident growth and stability for any economy in the world.

There are many myths surrounding the US Consumer Confidence Index, the main one being that the release of this index has no impact whatsoever on the US dollar exchange rate.

The US Consumer Confidence Index is measured through a standard survey of 5,000 households, who express their opinions on the current state of the economy and share their thoughts on the future.

Simply put, the confidence index allows us to see how much the average consumer trusts and believes in the stability of their country's economy. Therefore, it's important to keep this in mind when conducting fundamental analysis on Forex.

As you can imagine, because the index is based on a standard citizen survey, its results may not reflect the true picture of economic developments. However, because the questions also address the future of consumers, it has an interesting leading effect, allowing investors and traders to draw conclusions about the country's economy.

If the average citizen doesn't trust or believe in their own country's growth prospects, can an investor really invest their money there? This is the thinking of every trader trading the dollar on the Forex market. Therefore, when a negative indicator comes out, we can see a weakening of the dollar, while when a positive indicator comes out, we can see its rapid growth.

Because the index is based on a simple citizen survey, the market generally does not react very strongly to the news release, but denying that there is no impact is equally foolish.

To understand how to trade this news, let's look at the price behavior after its release, calculate how far the price moves and over what period of time, and whether we can profit from it. For this calculation, I chose the USD/CHF currency pair because it is a popular pair. Given Switzerland's stable economy, US news releases can have a noticeable effect in the form of price surges.

Application of the trust index in Forex.

On May 26, 2015, the US Consumer Confidence Index was released monthly. While the previous reading was 94.3, the actual reading was 95.4. This suggests rising consumer confidence, and as a result, a possible rally in the USD/CHF currency pair. The price action after the positive reading can be seen in the image below:

Judging by the chart, the price had a sharp momentum in our favor, but within 20 minutes, a pullback occurred. The pullback wasn't massive and was purely speculative, so by the time the news ended, the price had successfully overcome 45 pips. Regarding the effect of the news release, it lasted for seven hours, after which the market gradually moved sideways.

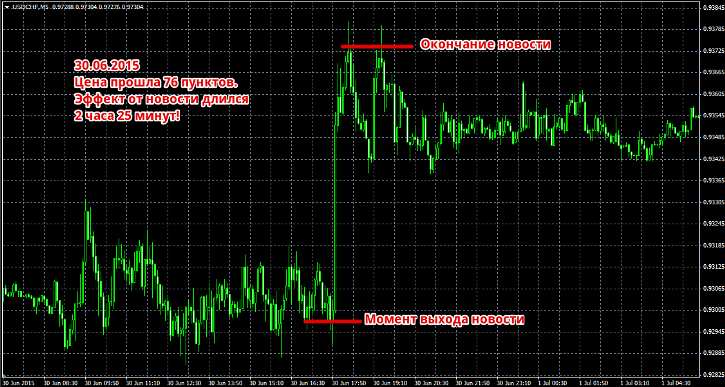

The US Foreign Exchange Report on June 30, 2015, was also positive. Analysts predicted the indicator would rise to 97.3, but the actual reading was 101.4. This suggests the dollar is strengthening against the franc, which should translate into a rise in the currency pair's chart. You can see the chart's performance after the news release in the image below:

Judging by the chart, you can see that the price rose for two and a half hours, gaining 76 points. As in the previous example, the price initially pulled back and remained sideways, but then quickly surged.

It should be noted that after the news ended, the price went into a calm sideways movement without a rapid return to the point of growth.

On July 28, 2015, the IDP reading was lower than the previous one, reaching only 90.9, compared to a revised 99.8. This indicates a decline in consumer confidence, leading to a weakening dollar, so the currency pair chart should show a sharp decline. You can see how this actually played out in the image below:

Conversely, as in the previous scenarios, the price initially formed a pullback, moving against the price. However, an hour later, the news began to take full effect and moved 35 points. The news's effect lasted approximately 11 hours, and the price moved toward its target in small candlesticks.

On August 25, 2015, the IDP data was higher than previous data, as well as higher than expected, reaching 101.5 versus the previous 91.

This indicates increased confidence and a strengthening dollar, which should be reflected in a rising USD/CHF pair. The actual picture can be seen in the image below:

The news performed well, covering a distance of 60 points in an hour and twenty minutes. After the news played out, a small sideways movement formed, leading to a reversal of the current trend.

Now let's summarize the results of the study. If we take the minimum profit from all four months, which was 35 pips, and set a stop order of the same size, we get: 35 + 35 + 35 + 35 = 140 pips. You'll agree, this is a pretty good profit for four trades, and this is taken from the minimum, without using a trailing , which could have squeezed more out of the market.

Regarding the impact of a news release, as you might have noticed, on average, the price takes at least an hour to recover, and in some cases, even longer. Therefore, try to avoid the typical mistake of jumping out of the market and taking a few pips on a small impulse. The news is truly powerful, so be patient and wait for it to fully unfold.