Trading on bad news

Fundamental market analysis generally produces the best results when it is aimed at identifying a downward trend.

Bad news related to various terrorist attacks, natural disasters or the outbreak of military action in a particular region has always had an impact on the exchange rate of the national currency.

The harbinger for writing this article was the terrible terrorist attack that took place in France, where, according to official figures, 128 people were killed and over 250 people were injured to varying degrees of severity.

According to preliminary data, the terrorist attack was carried out by representatives of the Islamic State, against which the entire international community has declared war.

This event in the center of a European capital provoked a very strong public reaction, since one of the explosions occurred right before the eyes of the French President during a football match between the national teams.

As bitter as it may sound, it's precisely these kinds of events that allow traders to profit from the market. There's no shame in trading on blood, and most famous traders became rich precisely by reacting promptly to such events.

Many analysts claimed that a similar terrorist attack in Paris would be practically analogous to the Twin Towers attack in the United States, and that the financial markets would react in a similar manner. However, the reaction was muted, so I propose analyzing the market reaction on various euro-based currency pairs.

How the currency reacts to bad news.

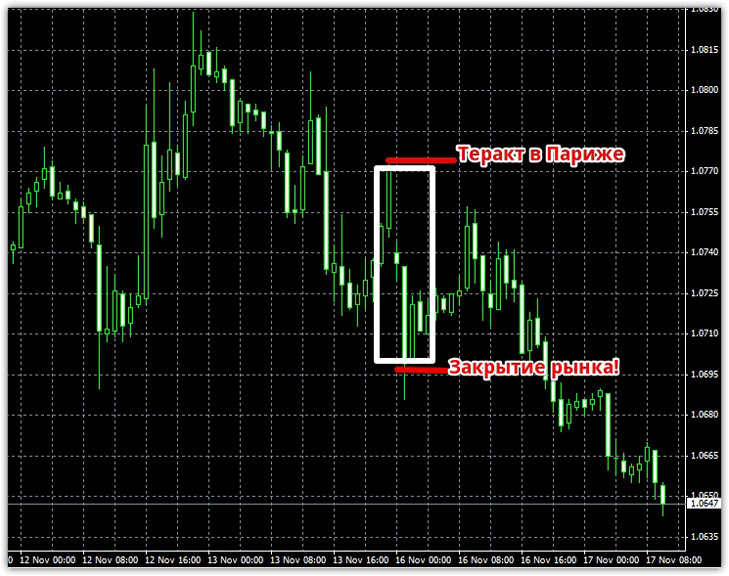

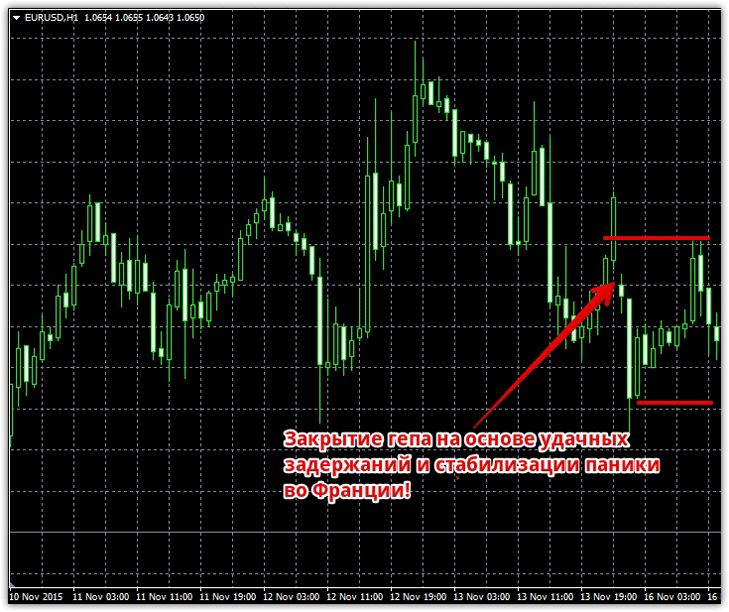

The first currency pair to reflect the incident was EUR/USD. Before the terrorist attack, the euro had reached a strong level and then successfully rebounded. The market was gaining momentum upward, but then the first explosion occurred at the stadium. The reaction was immediate, with gap , followed by a further downward movement to 1.0699, for a total of 76 points.

After the market closed, a series of political statements followed, declaring that France would not be intimidated, and declaring a state of emergency in the country to search for Islamists. Successful special operations to detain Islamic State members instilled confidence in some major investors, leading to an upward movement and a classic gap fill on Monday.

After the market closed, a series of political statements followed, declaring that France would not be intimidated, and declaring a state of emergency in the country to search for Islamists. Successful special operations to detain Islamic State members instilled confidence in some major investors, leading to an upward movement and a classic gap fill on Monday.

At the same time, various media sources are reporting that the European economy has confidently withstood this blow, and the financial market has reacted to this terrible event with extreme restraint and without panic.

However, the tragic consequences were followed by very bellicose statements related to the intensification of French air strikes against Islamic State positions. Such rhetoric has never satisfied investors, and the release of a video declaring war on the people of France and threats of further terrorist attacks had a chilling effect on market participants.

However, the tragic consequences were followed by very bellicose statements related to the intensification of French air strikes against Islamic State positions. Such rhetoric has never satisfied investors, and the release of a video declaring war on the people of France and threats of further terrorist attacks had a chilling effect on market participants.

Perhaps the panic would have subsided after successful arrests, but all investors understand that the enormous influx of refugees from Syria has brought Islamists to all European countries, who are ready at a moment's notice to continue terrorizing civilians and undermining infrastructure.

Understanding that France is under serious threat and that terrorist attacks could continue in other European countries, market participants began actively selling the euro, so the chart reached new lows and continued its downward movement:

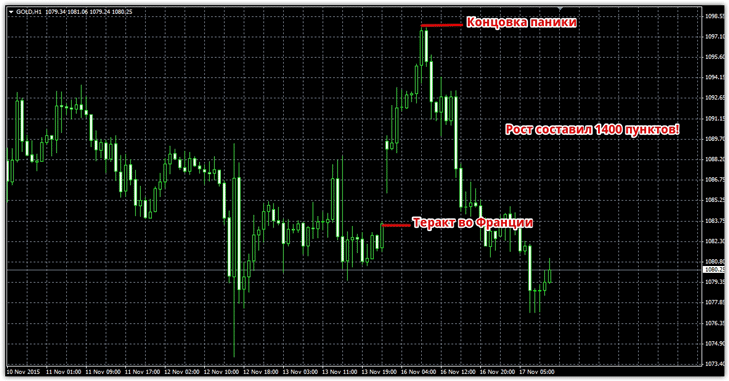

While chasing the euro's exchange rate, very few people paid attention to gold. However, gold is the most likely to react to various events, as it is considered a safe haven for panicked investors. The panic that erupted in Europe immediately pushed gold prices higher, as frightened investors began buying it aggressively. The gold chart's reaction to the terrorist attack in France can be seen in the image below:

While chasing the euro's exchange rate, very few people paid attention to gold. However, gold is the most likely to react to various events, as it is considered a safe haven for panicked investors. The panic that erupted in Europe immediately pushed gold prices higher, as frightened investors began buying it aggressively. The gold chart's reaction to the terrorist attack in France can be seen in the image below:

In summary, it's safe to say that trading on bad news is a profitable strategy, as while the market can react ambiguously to good news, terrorist attacks and military actions that cause panic almost always trigger a counter-reaction.

In summary, it's safe to say that trading on bad news is a profitable strategy, as while the market can react ambiguously to good news, terrorist attacks and military actions that cause panic almost always trigger a counter-reaction.

It's also worth adding that when dealing with bad news, you shouldn't just look for a decline in the national currency where the news occurred, since gold, as a safe haven, always responds with growth to such events.